Junior explorer Mink Ventures has a strategic portfolio of Canadian battery metals projects that hold great potential within the global battery metals supply chain.

Mink Ventures Corporation (TSXV:MINK) is a junior exploration Canadian battery metals company with a strategic portfolio of nickel (Ni), copper (Cu), and cobalt (Co) projects in the Timmins Nickel District, Ontario, Canada.

MINK was created to capitalise on Canadian battery metals opportunities as they arose. The team behind it has extensive experience in the mineral exploration business and deep roots and relationships in capital markets. The company began as a capital pool company (CPC) on the TSX Venture Exchange in September 2021, completed its qualifying transaction (QT) in December 2022, with the acquisition of its Montcalm Ni-Cu-Co project, and began trading under the symbol MINK in January 2023.

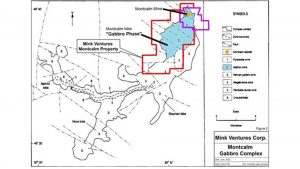

Due to the nickel rush in Timmins, this strategic 40km2 project would be near impossible to acquire at this time and would be incrementally more expensive than MINK’s acquisition costs, as it sits adjacent to Glencore’s former Montcalm Mine with 3.9 million tonnes of 1.25% Ni, 0.67% Cu and about one pound of cobalt to the tonne of historical production. The mine is currently on care and maintenance with a resource of over 1.1 million tonnes.

Meeting the demands of the energy transition

Nickel, copper, and cobalt are all central to the green energy transition. Each of MINK’s projects are multi-element, with each of these commodities. Exploration companies play a vital role in discovering the mineral deposits needed to establish a resilient source of Canadian battery metals and MINK is well positioned to play a role with its prospective Ni-Cu-Co assets in its Montcalm and Warren projects.

It takes many years from the discovery of a deposit to production. The supply and demand simply don’t match up, which suggests that, even with short-term price volatility, the long-term trend is very positive for these metals and polymetallic deposits typically offer better value per ton, especially when located in established mining camps with existing infrastructure.

Insufficient supply and projected global demand in the coming years is well documented. In many cases, demand continues to overshoot the forecasts well ahead of schedule. More mines are needed to supply the metals and they simply aren’t found and put into production in the timeline required to avoid a shortfall.

While there is additional supply coming on stream from Indonesia, there is a huge environmental carbon cost due to the significant coal power supply being used to extract and process these laterite deposits. This is further amplified by the impact of deforestation occurring to access them. Electricity in northern Ontario, where MINK’s project is located, is generated primarily with hydro-electric power, which has significantly lower carbon costs.

Canadian battery metals strategically located in Ontario

MINK’s projects are ideally situated with low geopolitical risk factors. Ontario is a top-ranked Canadian battery metals jurisdiction. The province is mineral rich, with a wide range of deposits that make a significant contribution to the economy and the local communities. Further, MINK is operating in a part of Northern Ontario where there is a clear and articulate process to build solid relationships and work side by side local communities and First Nations.

MINK’s battery metals projects fall in the traditional territory governed by the Waban Tribal Council, which has developed a straightforward process and model for discussion and negotiations, that is admired across Canada and globally. The overall intent of the process they have developed is to provide winning outcomes for all stakeholders, while providing and protecting for future generations and showing consideration for the environment from start to finish. MINK is in the process of completing a draft Memorandum of Understanding (MOU) for submission to ensure co-operation even at this early stage of exploration.

Access and infrastructure to MINK’s projects, the adjacent Montcalm Mine and the Timmins Mining Camp, is exceptional. The access to green hydro power and all-weather roads which run adjacent to MINK’s projects, mining infrastructure through a very established mining camp, and a straightforward permitting process for both of MINK’s projects add tremendous value to the equation. It provides for extremely cost-effective exploration, from the availability of drills, crews, skilled labour force, equipment, lower mobilisation costs, and, in MINK’s case, significant efficiencies in logistics to move between its two projects which are located only 35km apart along the same Montcalm Mine Road.

Both of these Canadian battery metals projects are hosted within Gabbro Intrusive Complexes, which have produced significant nickel deposits across Canada. The Warren property is hosted within the Kamiskotia Gabbro Complex (KGC), and it is thought to be broadly equivalent to the Montcalm Gabbro Complex (MGC) but separated by a granitic arch. The MGC hosts the former Montcalm Mine which produced approximately 3.93 million tonnes grading 1.25% Ni, 0.67% Cu and 0.05% Co (OGS, Atkinson, B, 2010) (Fig. 2). Gabbro complexes, such as MGC and KGC, are known to be prospective for magmatic nickel copper sulphide deposition, as demonstrated by the Montcalm Mine located within the MGC.

The Warren Project complements MINK’s Montcalm property due to the distinctly similar prospective geological environments found in the MGC and the KGC, as well as the presence of significant Cu-Ni zones.

If MINK is fortunate to outline a deposit at either project, there are numerous advantages that improve project economics and feasibility, including an active power line running to the Montcalm Mine adjacent to MINK’s project, an all-weather access road which is maintained by Glencore, and numerous access points to both the Montcalm and Warren properties through forestry roads.

Further, the Montcalm Mine ore was processed on a customised circuit that is still in place at Kidd Creek which may hold potential for toll milling at the currently idle facility. Nickel-copper-cobalt sulphides in a gabbro host typically involve simpler metallurgy than other nickel sulphide ore. Good metal recoveries also factor into project economics.

Time is what the Canadian battery metals supply chain does not have on its side. The location and access to infrastructure of both the Warren and Montcalm projects positively impacts the feasibility with improved economics and reduced capital cost requirements if a deposit is outlined, compared with other similar projects located in more remote jurisdictions without access to mills.

Montcalm Project: Nickel-copper-cobalt

MINK has just begun the evaluation of its sizeable Montcalm project, which would be incredibly challenging and costly to assemble in the current environment. The entire Montcalm Gabbro Complex (MGC) covers ~120km2. MINK controls 39.6km2.The gabbro phase of MGC hosting the mine is approximately 15km2. From past exploration and mining, it is known that the deepest nickel lenses at the Montcalm Mine are present well beyond 300m below surface. Only recently have modern airborne geophysical systems been able to penetrate deeper than this. MINK controls 10km2 of the prospective geological unit and Glencore controls 5km2 within the mine boundary.

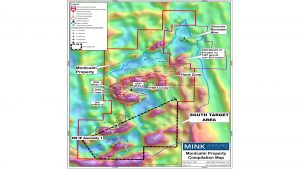

Historical exploration and drill density (48 holes over 40km2) on a project of this scale, adjacent to a high-grade nickel sulphide mine, has been a sporadic effort at best. As such, MINK has incredible hunting ground for additional lenses of mineralisation. It is often the case, especially in the Timmins Camp, that where you find one mine, there are likely to be more found in its shadow. Fortunately, with new technology in the toolkit, the odds of finding new deposits have improved greatly.

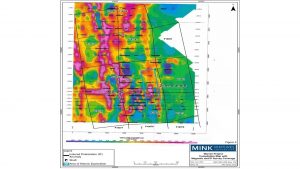

Significant advances in geophysical technology and computer power modelling have enabled deeper penetrating systems, and the data captured can now be modelled with incredible clarity.

The new borehole Induced Polarization (IP) gradient array survey allows for the production of 3D geophysical models of mineralised zones. MINK is the first to use this technology at Montcalm and believes it is the first use in the Timmins Camp. Borehole IP systems now have the capability to see a 250m radius around a borehole and significantly below the end of the drill hole, which is an extremely cost-effective way of evaluating both disseminated and more massive targets at depth.

The deepest known nickel-copper-cobalt lenses at the Montcalm Mine are known to extend from approximately 250-400m vertical depth, which is well beyond the capability of many older surface electromagnetic (EM) systems. Most Canadian battery metal mines now extend to several thousand vertical feet in depth, so the new technology really opens up the next layer of the cake.

MINK has benefitted significantly from the work of previous operators who left numerous EM targets unexplained or untested in historical holes. These holes can now be probed with the new borehole IP technology. IP can assist in locating disseminated, stringer, and massive sulphides. Certain styles of mineralisation act as a pathfinder to the other types of mineralisation, depending on where you are in the system.

Historical work at the Glencore mine site demonstrated that, in addition to the higher-grade Ni-Cu-Co lenses at the mine, there is potential for disseminated mineralisation. In some instances, this type of mineralisation is associated with a magnetic high and no coincident EM response (e.g., Hole MAC9731, see Fig. 3). Numerous magnetic targets of this nature are present on MINK’s claims both within the Hook Zone and across the South Target Area of the property, representing valid exploration targets.

In MINK’s recent exploration programme at Montcalm, the company vetted the capability of these new geophysical technologies and demonstrated that both 3D borehole IP and surface IP surveys are cost-effective target development tools; and discovered a number of previously undetected, high-priority drill targets, which may represent potential new zones of base metal mineralisation. These new targets are very captivating and the MINK team is eager to get back to the project later this summer to continue additional IP surveys and to begin drill testing its priority targets.

Warren Project: Nickel-copper-cobalt

In addition to MINK’s flagship Montcalm project, the company added a second polymetallic Canadian battery metals project (Warren) to its portfolio in July 2023. The project has some exceptional nickel, copper and cobalt mineralisation identified, with significant discovery potential. It is very underexplored as it was in a prospector family’s hands for nearly 70 years and saw little activity. Surface bulk samples from this project in the 1950s returned 2.83% Cu, 0.96 Ni and over two pounds of cobalt to the ton.

More recent geophysical surveys suggest that three established zones with projected strike lengths of 800-1,000m are open along strike and at depth and remain almost entirely untested. The deepest historical drill holes only tested to approximately 60m vertical depth. In the 1950s, previous operators calculated a non-compliant NI43-101 resource of 385,000 tons of 1% Cu + Ni (Fig. 4).

Warren Project: Sulphide mineralisation

MINK has the option to acquire a 100% interest in the Warren Project, which consists of 14 patented mining claims, covering 251 hectares, 35km west of Timmins, Ontario. This strategic acquisition expands MINK’s exploration portfolio and discovery opportunity with a very complementary, second gabbro-hosted copper nickel sulphide project which shares a similar geological environment with its flagship Montcalm project. The company intends to begin diamond drill testing the known zones later this year.

Highlights from the Warren Project include:

Highlights from the Warren Project include:

- The Warren Project is drill ready. MINK’s geologists have completed an in-depth study of all available historical data and recent geophysical survey data. Recent ground truthing to update Geographic Information System (GIS) data prior to selecting drill targets occurred in July. Significant zones of mineralisation were traced at surface and samples taken;

- The Warren Project complements MINK’s key Montcalm battery metals project due to the distinctly similar, prospective geological environments, as well as the presence of significant Cu-Ni zones at Warren;

- Three distinct mineralised copper-nickel zones have been identified and are designated Zones A, B, and C, outlined by both surface exploration and diamond drilling, focused mainly on Zones A and B over a strike length of ~600m;

- Historical work in the mid 1950s included two B-Zone bulk samples by Maralgo Mines Ltd. Bulk Sample 1 returned 0.21% Cu, 0.96% Ni, 0.11% Co and 0.10% Zn, and Bulk Sample 2 returned 2.83% Cu, 0.58% Ni, 0.10 Co and 0.13 Zn;

- A resource (see Note) calculation of 385,000 tons of 1% Cu + Ni was outlined by Jade Oil & Gas. They drilled 23 holes to test Zones A and B in the mid-1950s. Highlights include 2.5% Cu+Ni over 7.6m and 2.8% Cu+Ni over 8.2m;

- Geophysical data from magnetics, horizontal loop EM (HLEM) and Induced Polarization (IP) suggest a potential strike length of A and B Zones of approximately 800m; and

- Limited exploration has been conducted on the C Zone other than a historical shaft. A recent (2021) grab sample in the shaft area muck pile by W Hawkins, P. Eng returned 3.7 ppm Ag, 3940 ppm Cu, 1670 ppm Ni and 223 ppm Co. Geophysical surveys (magnetic, HLEM, and IP) support a potential strike length of C Zone of 1km.

Note: The resource calculation is historical in nature and is not NI43-101 compliant; it is not to be relied upon and is reported as a historical statement only.

Exploration companies play a vital role in discovering mineral deposits that eventually become the mines of tomorrow. New mines are needed to establish a resilient Canadian battery metals supply and to meet current and future demand to support the energy transition. Without them, the energy transition will be delayed or non-existent, and supply risk remains inherent alongside rising costs. Time is of the essence.

It is often stated that it takes numerous grassroots exploration projects to identify a few economic deposits, which in turn may lead to a single mine. With that in mind, investment in the junior explorers needs to rise dramatically in order to increase the pace of new discoveries. Ontario is a top mining jurisdiction in Canada and the Abitibi Belt is mineral rich. MINK is ideally positioned with two polymetallic, Canadian battery metals exploration projects, with great discovery potential, in the Timmins Mining Camp and benefits from all the advantages that come with that.

The company has just completed a financing placement and was also awarded an exploration grant under the Ontario Junior Exploration Program (OJEP) grant, so is well-positioned to drill its phase 1 drill programme at Warren and then continue on at Montcalm. The company anticipates a steady flow of news and results into the autumn of 2023 and looks forward to reporting its progress.

Please note, this article will also appear in the fifteenth edition of our quarterly publication.