The European Union witnessed a significant uptick in new car registrations in November, particularly electric cars, showcasing the growing preference for sustainable mobility options across the region.

According to recent data released by the European Automobile Manufacturers’ Association (ACEA), EVs represented over half of new car registrations in 2023. This surge signals a promising trend toward electric vehicles as a viable alternative in the automotive market.

The rise of electric vehicles

In November, new car registrations of battery-electric vehicles surged by 16.4%, reaching an impressive total of 144,378 units.

The growth was multifaceted, with several markets contributing substantially to this surge. Notably, Belgium emerged as a standout performer, boasting an impressive 150.2% increase and solidifying its position as the fifth-largest market for battery-electric cars by volume.

However, in contrast, Germany experienced a setback with a decline of 22.5% in battery-electric car sales, marking an anomaly in an otherwise upward trajectory.

Despite Germany’s downturn, the cumulative figures for the year paint a promising picture, reflecting a remarkable 48.2% increase in battery-electric car sales compared to the previous year.

This surge has propelled the year-to-date volume to nearly 1.4 million units, capturing a notable 14.2% share of the EU car market during this period.

November also saw a surge in new registrations of hybrid-electric cars by 28.7%, driven primarily by robust growth in Germany (+38.4%), France (+35.8%), and Italy (+30.2%), the three largest markets for these vehicles.

As of November, the cumulative figures for hybrid-electric cars surpassed 2.5 million units sold, representing over a quarter of the EU market share.

However, amidst the overall growth in electric vehicles, plug-in hybrid electric cars experienced a setback in November.

Sales declined by 22.1% to 72,002 units, marked by a substantial decline in Germany (-59.3%), the largest market for this power source.

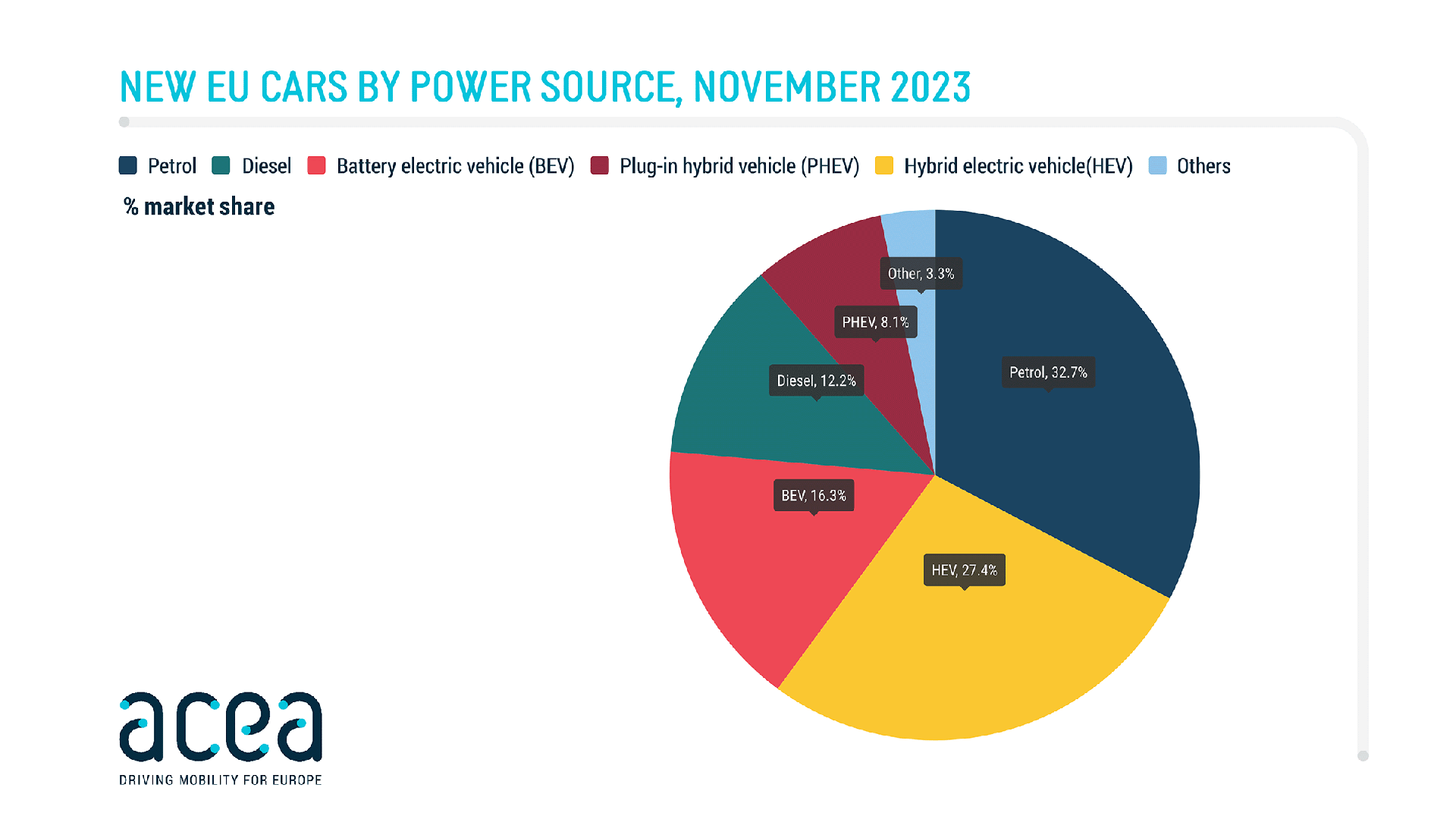

Despite notable increases in Belgium (+43.8%) and France (+17.8%), they couldn’t offset the decline in Germany, leading to a drop in market share from 11.1% last year to 8.1% in November this year.

These figures highlight the nuanced landscape of electric vehicle adoption in the EU, showcasing varying trends across different types of electric cars.

While battery-electric cars continue to surge ahead in most markets, plug-in hybrids faced challenges, primarily influenced by the German market’s downturn.

Nonetheless, the overall momentum in electric vehicle sales paints an encouraging trajectory towards a more sustainable automotive landscape in the region.

Sales of petrol cars rise as diesel declines

Despite progress made in EV adoption, the EU’s automotive sector witnessed notable changes in petrol and diesel car sales during November 2023, signalling intriguing shifts in market dynamics.

Amidst a continual decline in market share, the petrol car segment of new car registrations surprisingly surged by 4.2%, despite holding at 32.7% the previous month.

This growth was propelled by substantial sales spikes in key markets like Italy, soaring by 20.2%, and Germany, which saw a remarkable 12.5% increase.

The cumulative sales volume reached a substantial 3.5 million units, marking an impressive 11.1% uptick and claiming a commanding 35.7% market share over eleven months.

However, in contrast, the EU’s diesel car market sustained its downward trajectory, shrinking by 10.3% in November.

This decline was widespread across most of the bloc’s markets, notably impacting the four largest: France (-28.3%), Spain (-22.8%), Italy (-7.4%), and Germany (-1%).

Despite this overarching decline, certain Central and Eastern European markets, like Poland, experienced growth in diesel car sales, showing an increase of 13.8%. The market share for diesel cars in November was 12.2%, down from 14.5% during the same month the previous year.