Xcite Resources Inc. offers insights into the future prospects of the uranium market and highlights the potential for significant uranium discoveries at its Athabasca Basin projects.

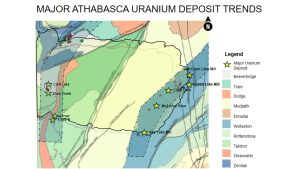

Xcite Resources Inc. secured six projects in the Athabasca Basin, Canada, in December 2023: the Lorado, Gulch, Black Bay and Smitty Projects in the Beaverlodge District. The district historically produced over 70 million pounds of uranium from 1950 to 1982, which included production of Xcite’s projects. The historical production targeted shallow-depth low-hanging fruit mineralisation. With today’s basin geological understanding, the larger deposits were discovered at much lower horizons (circa 350 to 90m vertical versus the 10-70m vertical of historical production).

This leaves an untouched exploration potential for uranium discoveries while Xcite is embarking on launching its first campaign this summer.

Xcite projects

The two other prospects are the Don Lake and Beaver River Projects. They demonstrated multiple evidence of uranium-rich mineralisation right at the surface. High-grade uranium samples and trenches reported grades from 10-36% U3O8. Those surface results are world-leading grades for uranium and reinforce the unique features of Xcite’s properties.

The Don Lake Project also has 42 historical shallow drillings with positive uranium mineralisation and a small surface historical resource.

All projects are served by road infrastructure and are located within proximity of Uranium City, where contractors, lodging facilities, and an airport are available to support exploration logistics.

The projects are also aligned on the proven major Clearwater geological trend and the Black Bay fault, which has produced world-class uranium discoveries. The Trend is hosting the Tripple R deposit from Fission Uranium Corp. (circa $1bn market cap) and the Arrow deposit from Nexgen Energy Ltd. (circa $5bn market cap). This trend generated the most exciting discoveries since the Cameco Cigar Lake and McArthur River deposits.

When aligning all these key features of uranium past production, favourable geology, and uranium surface showings, the context is right for a potential major discovery. Reinforcing the adage that the best place to find a mine is right next to a mine, Xcite has four of them in the district.

The Athabasca Basin, located in northern Saskatchewan, Canada, is unique by providing 25% of the world’s uranium supply. Its unique geology made some of the largest and richest uranium deposits in the world and counted uranium production since the 1950s.

Focus on uranium potential

Xcite’s management is committed to uranium discoveries and aligned with the shareholders, owning close to 50% of the shares. In past ventures, the team combined success from discovery holes with project feasibility and asset monetisation.

Xcite CEO Jean-Francois Meilleur sees many resemblances between the lithium and uranium markets, where he worked from 2010 to 2018, with even greater coming torque for the uranium commodity price.

He said: “We structured Xcite to be the perfect vehicle to advance a critical mineral venture, and uranium was the commodity of choice for our vision. When I started in the lithium business in 2010, we were making projections about lithium prices and coming demand, and most people in the capital markets industry were highly sceptical about our forecasts. Looking back, I realise that I was completely wrong. The demand and price of lithium far exceeded our forecasts. Today, the uranium market dynamics speak for themselves. With the constantly growing demand for clean energy and the global commitments to build nuclear power plants, we are entering a 20-year uranium bull market.”

Here is why

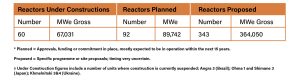

In 2022, the construction completion and grid connection of six new nuclear power plants initiated the movement of the uranium price from $25 a pound to peak at $100. Also, in 2022, the construction commencement of 60 new nuclear power plants will be connected in the coming four to seven to ten years. Considering an average construction period of 89 months, we see a robust and sustained demand for uranium as the plants get connected to the grid generating new demand.

Since no significant uranium development capital has been invested to bring more production shortly, the lead time to build a uranium complex takes an average of seven years. The timing to bring additional supply will not match the new demand.

This is the same reactive scenario that happened to the battery supply chain when they built the giga factories.

From top to bottom, the industry is proven to be reactive rather than proactive, and the lack of capital investment in discoveries and developments over the last decade will trigger a rising uranium price environment.

Furthermore, the supply chain for nuclear power projects has received more attention in recent years, and the World Nuclear Association’s Supply Chain report released in January 2015 documents the situation through to 2030. Over this period, it is anticipated that nuclear power plant construction and refurbishment projects for long-term operation could be worth $30bn per year. Its Reference Scenario envisages the start-up of 266 new reactors by 2030, with an investment of some $1,200bn, and the closure of 118 reactors, mostly in Europe and Japan.

So, clearly, the top decisions and investments are made, but not at the bottom level from the resource and mining perspective. We will need multiple new uranium active mining resource developments commencing production to maintain a balanced supply chain.

Rising demand

The proof in the pudding is: How much gross uranium is needed to generate 1GWe per year?

The ‘Uranium 2022: Resources, Production and Demand’ (‘Red Book’) from the OECD NEA & IAEA said that efficiencies in power plant operation and lower enrichment tails assays meant that uranium demand per unit capacity was falling, and the report’s generic reactor fuel consumption was reduced from 175 tU per GWe per year at 0.30% tails assay (2012 report) to 163 tU per GWe per year at 0.25% tails assay. The corresponding U3O8 figures are 206 tonnes and 192 tonnes per GWe per year.

On average, we can say 200 tonnes per year for 1GWe, now let’s look at this table from the World Nuclear Association: Plans For New Reactors Worldwide – World Nuclear Association (world-nuclear.org)

We are looking at 520,823 MWe or 520.82 GWe. At 200 tons per GWe we are looking at a new uranium demand of 104,166 (or 229 million pounds) uranium tons per year of additional demand coming in the next 20 years. This means we need to double the current world uranium production in the next 15 years.

So, for the uranium bull market, it is only the beginning…

References

- https://world-nuclear.org/

Please note, this article will also appear in the 19th edition of our quarterly publication.