Mink’s drilling and exploration for battery metals nickel, copper, and cobalt, in Ontario, continues with compelling projects in the emerging Timmins Nickel District, an area currently attracting global interest.

Mink Ventures Corporation (TSXV:MINK) is a Canadian mineral exploration company exploring for battery metals (nickel, copper, cobalt) at its Warren and Montcalm projects in the Timmins Nickel District, Ontario, Canada.

Mink’s flagship Montcalm project covers 40km² adjacent to Glencore’s former Montcalm Mine, which had historical production of 3.93 million tonnes of ore grading 1.25% Ni, 0.67% Cu and 0.051% Co (Ontario Geological Survey, Atkinson, 2010). Its Warren project is located just 35km away.

These projects sit on the western edge of the Porcupine Camp and approximately 50km southwest of Canada Nickel’s Crawford project, which has attracted significant investment and attention recently by major mining companies and battery manufacturers seeking opportunity and a secure Canadian supply of these battery metals.

Both of Mink’s polymetallic critical minerals projects are ideally situated with low geopolitical risk factors. Ontario is a top-ranking Canadian mining jurisdiction. The province is mineral-rich, with a wide range of deposits that significantly contribute to the economy and the local communities.

Polymetallic deposits typically offer better value per ton, especially when located in established mining camps with existing infrastructure. Access and infrastructure to Mink’s projects are exceptional. Plentiful green hydropower and all-weather roads run adjacent to Mink’s projects, as well as mining infrastructure in the long-established Timmins Mining Camp.

Further, a straightforward permitting process for both of Mink’s projects adds tremendous value to the equation and provides for highly cost-effective exploration due to the availability of drills, crews, skilled labour force, equipment, and lower mobilisation costs. In Mink’s case, there are significant efficiencies in logistics to move between its two projects, located only 35km apart along the same Montcalm Mine Road.

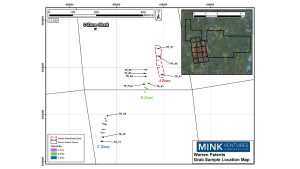

This article is focused on the Warren nickel-copper-cobalt project, as Mink is initiating a 500m drill programme on the A Zone at Warren. The Warren property covers 1,010 hectares of land in the Whitesides Township, approximately 35km west of Timmins, Ontario. (See Fig. 1) The first phase of drilling will consist of a series of short holes on the A Zone to determine the extent of the mineralisation down plunge, down dip, and along strike before evaluating the other mineralised zones and numerous untested priority geophysical targets on the property.

The A Zone (See Fig. 2) was selected as a high-priority target for drill testing as a result of an extensive geological review of data, a field examination, and a confirmation sampling programme conducted in summer 2023 by company geologists.

In July 2023, Mink acquired these underexplored patented mining claims. The Warren patents have had a sporadic exploration history from the late 1920s to the present, and several promising historical mineralised Cu Ni zones were outlined. The majority of the battery metals exploration completed on the property to date is in an area representing a very minimal portion of the property, and was completed well over 60 years ago as the patents were locked up and relatively untouched.

With the favourable geology, recent geophysics, and extensive surface mineralisation observed, there is a significant opportunity for new discoveries on the patents and across the expanded Warren project, including additional staked claims (Warren East) and acquired claims (Warren North). Mink’s work commitment to earn a 100% interest in the patents is $300,000. The company will make a significant dent in that obligation with this initial drill programme, which is expected to last two to three weeks. Mink has been fortunate to receive exploration grants through Ontario’s OJEP programme, and as such, half of this initial drill programme will be offset with the non-dilutive capital provided.

Property highlights

- Prospecting, sampling, and a geological evaluation of known mineralised zones A, B, and C was completed in the summer of 2023 to locate the most prospective zones of mineralisation for drill testing. A total of 20 reference grab samples were taken;

- Sampling efforts confirmed the presence of extensive zones of mineralisation; recent sampling demonstrated excellent copper grades and significant nickel, cobalt and silver grades associated with some of the best copper grades;

- The sampling efforts confirmed that the highest priority target is the A Zone, where approximately 120m of the zone is exposed in a series of trenches in outcrop. The A Zone trenches noted excellent copper values ranging from 1.075% to 2.08%. Nickel values from the A Zone ranged from 0.313% to 0.348% Ni, and cobalt values ranged from 0.0389% to 0.0498% Co. Some interesting silver values ranging from 10.3ppm to 23.8ppm were also associated with some of the better copper values on the A Zone;

- To date, the Warren patents host three known zones with copper, nickel, and cobalt mineralisation; these have been designated A, B, and C. Two historical bulk samples were completed on the Warren patents; the first bulk sample returned 0.21% Cu, 0.96% Ni, 0.11% Co and 0.10% Zn, and a second bulk sample returned 2.83% Cu, 0.58% Ni, 0.10% Co and 0.13% Zn. The combined A-B zones and the C zone have projected strike lengths of 800 and 1,000 metres respectively, from geophysical data;

- In the 1950s, a resource calculation of 385,000 tons of 1% Cu + Ni was outlined by Jade Oil & Gas on the Warren patents. Jade Oil and Gas drilled 23 holes to test Zones A and B in the mid-1950s. Highlights include 2.5% Cu+Ni over 7.6m and 2.8% Cu+Ni over 8.2m (Please be aware that the resource calculation is historical in nature and is not NI43-101 compliant; it is not to be relied upon and is reported as a historical statement only. Note: The methods and parameters used to prepare this estimate and the category of the estimate are unknown. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and the company is not treating the historical estimate as current mineral resources or reserves. References: Technical Report for Western Troy Capital Resources on the Warren Property (W. Hawkins P. Eng, 2021) and Maxmin, Magnetometer and VLF Surveys Evaluation Report, Whitesides and Massey Twp. Claims (C. Mackenzie Consulting Geologist, 1990); and

- Despite fairly significant historical work on both the A and B zones in the past, the bulk of the battery metals exploration efforts were limited to relatively shallow drilling and/or surface work. Consequently, there is limited understanding of the geometry of these mineralised zones at depth. The first phase of drilling by MINK will consist of a series of short holes on the A Zone to determine the extent of the mineralisation down plunge, down dip, and along strike prior to evaluating the other mineralised zones and numerous untested priority geophysical targets in a second phase programme.

Warren property geological discussion

Mink’s expanded Warren project is hosted within the Kamiskotia Gabbro Complex (KGC), and it is thought to be broadly equivalent to the Montcalm Gabbro Complex (MGC) but separated by a granitic arch. The MGC hosts the former Montcalm Mine, which produced approximately 3.93 million tonnes grading 1.25% Ni, 0.67% Cu and 0.05% Co (OGS, Atkinson, B., 2010).

Gabbro complexes such as MGC and KGC are known to be prospective for magmatic nickel-copper sulfide deposition, as demonstrated by the Montcalm Mine located within the MGC. The Warren property complements Mink’s Montcalm property due to the distinctly similar prospective geological environments found in the MGC and the KGC, as well as the presence of significant Cu Ni zones on the Warren property.

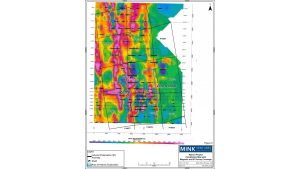

As highlighted above, the Warren patents have had a sporadic exploration history from the late 1920s to the present day, and several promising historical mineralised Cu Ni zones were outlined. The majority of the battery metals exploration on the property was completed in an area representing a very minimal portion of the property and completed well over 60 years ago. More recent geophysical surveys from the early 1990s and 2008-2009 outlined a series of untested targets along strike from known mineralisation and/or new targets proximal to known mineralisation. These targets are particularly evident in the accompanying magnetic and IP compilation map shown in Fig. 3.

Q&A:

How does Mink Ventures plan to use historical data and advanced technologies to identify and validate drill targets specifically for the Warren project?

Company geologists have re-evaluated the very limited available historical drill data. A property visit was made to examine the surface exposure of the zone, which is exposed over 120m of strike length in a series of trenches. Re-sampling of the zones confirmed excellent base metal values. With a geological evaluation of the surface exposure and some strike and dip measurements, a series of short drill holes have been proposed to confirm the dip and plunge of the zone and tenure of the mineralised zone.

Once an understanding of the zone geometry is confirmed, deeper holes will be considered in a subsequent phase. Mink may consider using the new 3D Borehole IP geophysics system it used at Montcalm, which can seek both disseminated and massive sulfide mineralisation for a 250m radius around boreholes and further at depth to map any

zones in 3D.

What steps will Mink take to validate and expand upon the historical resource calculation in the Warren project, ensuring accuracy and compliance?

A series of drill holes in multiple phases of drilling will be required to establish the size and dimension of the zone. Canadian geologists comply with NI43-101 professional standards, which will ensure the accurate representation of all field data collected.

How will Mink prioritise community engagement and address environmental considerations?

Mink is operating in a part of Northern Ontario, where there is a clear and articulate process to build solid relationships and work side by side with local communities and First Nations. MINK’s projects fall in the traditional territory governed by the Waban Tribal Council, which has developed a straightforward process and model for discussion and negotiations that is now being replicated across Canada and admired globally.

The overall intent of the process they have developed to use with mining companies is to provide winning outcomes for all stakeholders while providing for and protecting future generations and showing consideration for the environment from start to finish. Mink is in the process of completing a draft Memorandum of Understanding (MOU) for submission to ensure co-operation even at this early stage of battery metals exploration.

Further, Mink complies with all the environmental and permitting requirements of the province. The mineralised zones at Warren that are currently being evaluated are present on patented mining claims, which means the company controls surface rights and mineral rights. Early-stage battery metals exploration efforts like diamond drilling do not require permitting when working on patented claims.

However, the same standard of care concerning the environment is taken as if we were working on regular claims, and all activities adhere to the same permit guidelines.

How does Mink plan to optimise existing advantages for cost-effective exploration at the Warren project, and what are the anticipated challenges?

The Warren project is located in the Timmins camp with proximity to infrastructure, mills, workforce, and experienced exploration contractors, including diamond drillers. All-in diamond drill costs are in the range of approximately CAD$230 per metre. This is exceptionally reasonable when compared with drill programmes conducted outside of established mining areas, such as the Canadian Arctic, where costs may be three to four times higher per metre. Access to the Warren Project is reasonable from established roads, but winter access for the Warren Project is best due to the ground conditions.

How does Mink intend to address historical gaps and explore untested targets along strike from known mineralisation?

The company will conduct several days of prospecting and sampling to evaluate the numerous mineralised occurrences across the property. Recent sample data, a relatively recently induced polarisation survey, and the information from this current drill programme compiled into the geological database will allow for prioritising the best targets for the next round of drill testing.

What are the primary exploration goals that Mink Ventures aims to achieve with the drilling programmes at the Warren project, and how do these align with the company’s broader objectives?

The primary goal of the current programme is to confirm the orientation and tenure of mineralisation in known historical zones of mineralisation to build an NI43-101 compliant resource that can be grown and eventually attract a JV partner with mining capability. Mink Ventures is an exploration company aiming to secure the best projects as cost-effectively as possible while providing significant opportunities to make new discoveries and enabling our shareholders to ride the Lassonde curve. Mink has two strategically located, highly prospective, polymetallic critical minerals projects in a well-built company with a very attractive share capital structure. This combination is set up to deliver value to our shareholders.

Please note, this article will also appear in the seventeenth edition of our quarterly publication.