Mink Ventures Corporation (TSXV:MINK) is a Canadian mineral exploration company exploring for critical minerals (nickel, copper, cobalt) at its Warren and Montcalm projects, in the Timmins Nickel District, Ontario, Canada.

The assets are strategically located, highly prospective, polymetallic, Canadian critical minerals projects, ideally situated in a top-ranked mining jurisdiction with low geopolitical risk.

Mink’s portfolio offers significant opportunities for the discovery of critical minerals. The company’s capital structure, with only 18.8 million shares outstanding, enhances its shareholders’ potential to ride the Lasonde curve.

Location and advantages of Mink’s projects

Mink’s Montcalm Project covers 40 km2 and is adjacent to Glencore’s former Montcalm Mine. The former mine had a historical production of 3.93 million tonnes of ore grading 1.25% Ni, 0.67% Cu, and 0.051% Co (Ontario Geological Survey, Atkinson, 2010). Mink’s Warren Project is located just 35 km away.

These projects sit on the western edge of the Porcupine Camp and approximately 50km southwest of Canada Nickel’s Crawford project, which has recently attracted significant investment and attention from mining companies and battery manufacturers seeking an opportunity and a secure Canadian supply of these critical minerals.

Access and infrastructure to Mink’s projects, the adjacent Montcalm Mine, the Timmins Mining Camp, and milling facilities are exceptional. The proximity to infrastructure provides for extremely cost-effective exploration, with the availability of drills, crews, skilled labour force, equipment, and lower mobilisation costs.

All in diamond drill costs are in the range of approximately CAD$230 dollars per metre. This is extremely reasonable compared with drill programmes conducted outside of established mining areas.

Further, there is plentiful green, hydropower and all-weather road access to the projects.

Work on the Warren Project

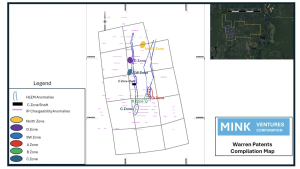

Mink is currently working on its recently acquired Warren Nickel Copper Cobalt Project. The Warren property covers 1,010 hectares of land and is located in Whitesides Township, approximately 35km west of Timmins (Fig. 1).

The Warren patented mining claims have a sporadic exploration history from the late 1920s to the present day, and yet a number of promising historical mineralised Cu Ni zones were outlined. That said, the majority of the exploration completed to date was conducted in a very minimal area of the property and completed over 60 years ago, as the patents were locked up and remained relatively untouched since.

More recent geophysical surveys from the early 1990s and 2008-2009 outlined a series of untested targets along strike from known mineralisation and/or new targets proximal to known mineralisation.

With the favourable geology, more recent geophysics, and extensive surface mineralisation, there is a significant opportunity for new Canadian critical mineral discoveries on the patents and across the expanded Warren project, which now includes additional staked claims (Warren East) and acquired claims (Warren North).

Mink’s work commitment to earn a 100% interest in the patented claims is $300,000. The company made a significant dent in that obligation with its recently completed $150,000 drill programme, half of which was funded by non-dilutive capital received through an Ontario OJEP exploration grant.

Though significant historical work exists on both the A and B zones, the bulk of the exploration efforts were limited to fairly shallow drilling and/or surface work, and the strike extents remain virtually untested. Consequently, there is a limited understanding of the geometry of these mineralised zones at depth.

Initial drill programme

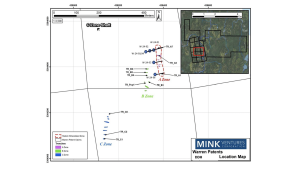

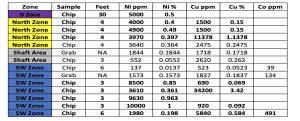

The ‘A’ Zone (Fig. 2,3,4) was the focus of Mink’s initial drill programme. It was selected as a high-priority target for drill testing as a result of a geological data review, a field examination, and a confirmation sampling programme during the summer of 2023. The ‘A’ Zone is exposed in historical trenches over a strike length of 120 metres.

Mink’s grab samples on the ‘A’ Zone returned assay values ranging from 1.075% to 2.08% Cu. Nickel values ranged from 0.313% to 0.348% Ni. Cobalt values ranged from 0.0389% to 0.0498% Co and silver values of interest ranged from 10.3 ppm to 23.8 ppm Ag. (See press releases: February 5, 2024, September 20, 2023).

The drill programme consisted of a series of short holes on the A Zone to determine the extent of the mineralisation down plunge, down dip and along strike prior to evaluating the other mineralised zones and numerous untested priority geophysical targets on the property.

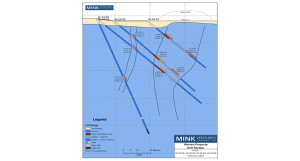

The programme consisted of six drill holes (507 metres) in the A Zone. Drilling confirmed the geophysical data and intersected broad zones of sulphide mineralisation in all six holes with anomalous nickel, copper and cobalt values associated with disseminated and net textured sulphides.

Drill hole W-24-01 was drilled to a depth of 60 metres and intersected 0.48% Nickel (Ni), 0.12% Copper (Cu), and 0.07% Cobalt (Co) over 0.9 metres in semi-massive sulphides typical of those found in the ‘A’ Zone surface trenches.

Assisting future drill programmes

Further, in several holes, Mink fortuitously clipped a sulphide zone in the upper portion of the holes which is interpreted to be the extension of the ‘B’ Zone. This valuable information provided some detail of how the A&B zones sit relative to one another which will assist in future drill programmes.

‘B’ Zone mineralisation is now known to extend approximately 75 metres beyond the historical trenches, for a total interpreted strike length of 200 metres. The ‘B’ Zone intercepts support the continuity of mineralisation along strike in general, as interpreted by geophysical surveys.

The geophysical signature for both the ‘A’ and ‘B’ Zones have a projected strike length of approximately 700 metres. Minimal drilling has been conducted on the ‘B’ Zone.

Two historical bulk samples on the ‘B’ Zone returned 0.21% Cu, 0.96% Ni, 0.11% Co and 0.10% Zinc (Zn), and a second bulk sample returned 2.83% Cu, 0.58% Ni, 0.10 Co and 0.13 Zn. Reference: Technical Report for Western Troy Capital Resources on the Warren Property (W. Hawkins P. Eng, 2021).

Surface sampling on the ‘A’ Zone and the recent drill programme have shown that the best values to date are associated with massive to semi-massive sulphides.

The current interpretation is that the initial ‘A’ Zone massive sulphide may have formed as a typical sulphide lens and then been broken apart by a later pulse of gabbro. This is based on a number of features seen in the drill core, the extent of massive and semi-massive sulphides, and Ni Cu Co values seen in the ‘A’ Zone trenches.

Further drilling is required to ascertain the extent of potential massive sulphide zones down the plunge and along the strike, as the ‘A’ Zone has only been tested by very shallow drilling (65 metres vertical) over a short strike length. The ‘A’ Zone geophysics suggests a strike length of approximately 700 metres.

Reference: Ontario Resident Geologists Office Timmins Ontario; Maxmin, Magnetometer and VLF Surveys Evaluation Report, Whitesides and Massey Twp. Claims (C Mackenzie Consulting Geologist, 1990)

Evaluating high-priority zones

The Warren project contains numerous historical, trenched surface zones, with significant Cu and Ni values which are associated with coincident geophysical responses including magnetics, electromagnetic (EM) and induced polarisation (IP) anomalies over long strike lengths. The majority of these occurrences have had little or no drilling.

At this time, it is thought that the ‘Shaft Area’, along with the ‘D’ Zone, and ‘SW’ Zone are extensions of the ‘C’ Zone. This system has had very minimal exploration along a strike length of approximately 1.5 km from geophysical data.

Mink plans to evaluate a number of these high-priority zones in order to outline a follow-up drill programme. The initial prospecting work will be conducted in the early spring/summer in order to prioritise targets for future drill testing in 2024.

The project has only gotten more compelling with the results of this programme. Given the extent of surface mineralisation on the property over seven historical mineralised zones, with significant untested strike lengths, the data is captivating and more drilling is warranted. The team looks forward to reporting its progress as the geological puzzle unfolds.

Warren property geology

The Warren property, one of Mink’s Canadian critical minerals projects, is hosted within the Kamiskotia Gabbro Complex (KGC) and is thought to be broadly equivalent to the Montcalm Gabbro Complex (MGC) but separated by a granitic arch.

The MGC hosts the former Montcalm Mine, which produced approximately 3.93 million tonnes grading 1.25% Ni, 0.67% Cu and 0.05% Co (OGS, Atkinson, B, 2010).

According to an estimate in the Ontario Mineral Inventory Record MD 142B09NE00007, dated January 2009, the mine hosted Mineral Reserves of 2,800,000 tonnes grading 1.26% Ni, 0.59 Cu, and 0.05% Co. *The reserve calculation is historical in nature and is not NI43-101 compliant; it is not to be relied upon and is reported as a historical statement only.

Gabbro complexes such as MGC and KGC are known to be prospective for magmatic nickel copper sulphide deposition, as demonstrated by the Montcalm Mine located within the MGC. The Warren property complements Mink’s Montcalm property due to the distinctly similar prospective geological environments found in the MGC and the KGC, as well as the presence of significant Cu Ni zones on the Warren Property.

Adhering to ESG measures

Environment

Mink complies with all environmental and permitting requirements of the province. The mineralised zones at Warren are present on patented mining claims which means that the company controls the surface rights and mineral rights. Early-stage exploration efforts such as diamond drilling do not require permitting when working on patented claims.

However, the same standard of care with respect to the environment is taken on Mink’s patented claims, and all activities conducted adhere to or supersede the permit guidelines.

Social

Mink is led by a female CEO, and the company has nearly equal representation. Additionally, the company is operating in a part of Northern Ontario, where there is a clear and articulate process to build solid relationships and work side by side with local communities and First Nations.

Governance

The company operates with high standards and conduct and has excellent governance due to the experienced directors and officers with track records of success in the industry.