It’s widely agreed that no single fuel can lead the UK to net zero. As electrification dominates discussions on decarbonising heat, Orlando Minervino, Decarbonisation Strategy Lead at Xoserve, asks: Is the UK overlooking biomethane as a potential solution?

The DNV’s 2025 UK Energy Transition Outlook warned that the UK might not meet net-zero targets by 2050 due to a lack of clear plans for decarbonising buildings.

While no final decision has been made on domestic heat decarbonisation, full electrification faces significant challenges, particularly in grid capacity.

The UK is working towards transitioning the 23 million homes that currently rely on gas heating while addressing the challenges of expanding electricity infrastructure.

In this context, and given the risk of falling short of our legally binding target, shouldn’t energy transition leaders thoroughly examine all fuel sources and maximise their potential for short and long-term solutions?

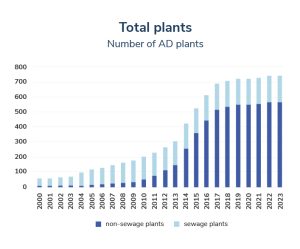

Biomethane is a rapidly growing renewable energy source, with over 700 biomethane plants in Britain alone, a figure which has doubled over the last decade. In the European Union, France is one of the leading countries in the scaling up of biomethane production, having nearly doubled its capacity since 2022.

Natural gas’s good twin

By removing impurities such as carbon dioxide, water, and hydrogen, biomethane becomes chemically identical to the methane found in natural gas. However, it’s not created from fossil fuels but from organic materials like food waste, agricultural residues or sewage that decompose in the absence of oxygen – a process called anaerobic digestion.

Biomethane has a high methane content (typically 95-99%), making it ideal for any application that uses natural gas, like heating. With significantly lower greenhouse gas emissions than fossil fuels, biomethane has the potential to play a crucial role in achieving net zero goals.

One of the advantages of biomethane is that it can be injected directly into the existing gas grid without the need for costly infrastructure upgrades. Data from the Anaerobic Digestion & Bioresources Association (ABDA) shows that the UK currently has 141 injection plants, a number that is expected to grow in the coming years. Biomethane can also be stored easily and provides a more consistent output compared to renewable sources like solar and wind power. This predictability helps to balance energy supply and demand effectively.

Moreover, this gas has the potential to be carbon-negative. If organic matter comes from food waste or manure, for example, these materials would have decomposed over time regardless, releasing methane into the atmosphere. Instead of letting this methane escape, biomethane production captures it and puts it to good use, preventing harmful gases from being released into the atmosphere.

It can also be produced from other readily available waste products, such as agricultural waste or even wastewater, creating a circular economy that complements the waste sector.

That is not to say biomethane does not release any carbon emissions at all. The production and upgrading of biomethane require energy, which may come from fossil fuels, contributing to overall carbon emissions.

Currently, this situation is similar to other energy generation processes; for instance, 38.3% of Britain’s electricity generation comes from fossil fuels. However, there is potential to use surplus renewable energy in the future for biomethane production.

Building blocks of a biomethane market

Realising biomethane’s full potential requires clear and consistent policy frameworks that foster investment and growth. The policy landscape surrounding biomethane is a mixed picture of progress and gaps. While there have been many positive developments, further clarity and more strategic direction are needed.

There are currently two government support schemes for biomethane: the Green Gas Support Scheme (GGSS) and the Green Gas Levy (GGL). The GGSS is a government scheme designed to incentivise the production of biomethane for injection into the gas grid by providing payments to biomethane producers for every unit of biomethane they inject. The GGL supports the GGSS by placing obligations on gas suppliers to fund the scheme, including quarterly levy payments.

In 2023, the GGSS was extended to March 2028. This is a significant win for the industry as it encourages production, making biomethane a more financially viable proposition. With this tariff-based support offsetting the high initial investment costs associated with anaerobic digestion plants and biogas upgrading, biomethane becomes a competitive fuel to produce.

Still, other opportunities have been missed. For instance, while the Department for Energy Security and Net Zero’s December Clean Energy Action Plan acknowledged biomethane’s potential for power generation and gas decarbonisation, it lacked concrete plans for its integration into the gas network.

By 2050, it is estimated that annual power generation will reach 692 TWh. The Government’s Biomass Strategy indicates that producing approximately 30 to 40 TWh of biomethane by 2050 would contribute to the UK’s goal of achieving net zero emissions, representing just 5% of total power generation. However, this figure may be too modest, with a biomethane target that is up to three times greater achievable.

A national biomethane strategy and roadmap could provide a long-term plan for producers, investors and developers, making clear how the fuel should be used across different sectors in the years to come. It could also establish clear production targets and outline grid integration plans.

To promote market development and further decrease emissions from heating, it is important to hold additional consultations with energy leaders. These should explore mechanisms that can encourage the blending of biomethane into the natural gas network.

To drive market development and further reduce heating emissions, additional consultations with energy leaders are essential. These discussions should explore mechanisms to encourage biomethane blending into the natural gas network, including the potential implementation of a gas-blending mandate requiring a set percentage of biomethane injection.

Equally important is streamlining planning and permitting processes for anaerobic digestion plants and biomethane upgrading facilities, enabling faster project deployment across Great Britain. This challenge, however, is not unique to biomethane but applies broadly to all renewable energy technologies.

Drawing on a resourceful pathway

Up against the UK’s ambitious emissions targets and the undeniable challenges of a full electrification strategy for heating, biomethane stands out as an integral energy source that can no longer be overlooked.

As a ‘good twin’ to natural gas, biomethane provides a resourceful pathway that uses existing infrastructure and feedstock. Its production could not only significantly reduce greenhouse gas emissions for heating buildings but also divert waste from landfills, contributing to a circular economy.

Despite the biomethane industry’s rapid growth in the UK and across Europe, its immense potential remains largely underestimated. Current government incentives are a step in the right direction, but more could be achieved. A comprehensive biomethane strategy is essential—one that includes ambitious production targets, seamless integration into the gas grid, and the establishment of a robust market through mechanisms such as gas-blending mandates and streamlined permitting processes.

To achieve a fully decarbonised energy system, the UK must pursue a diversified approach. Biomethane is more than just a complementary fuel; it is a scalable, environmentally beneficial solution that can play a key role in the future energy mix.

Maximising the potential of all viable energy sources is essential for a successful clean energy transition.