Boab Metals Limited (ASX:BML) is an Australian listed company currently developing the Sorby Hills Lead-Silver-Zinc Project in Western Australia.

About Boab Metals Limited

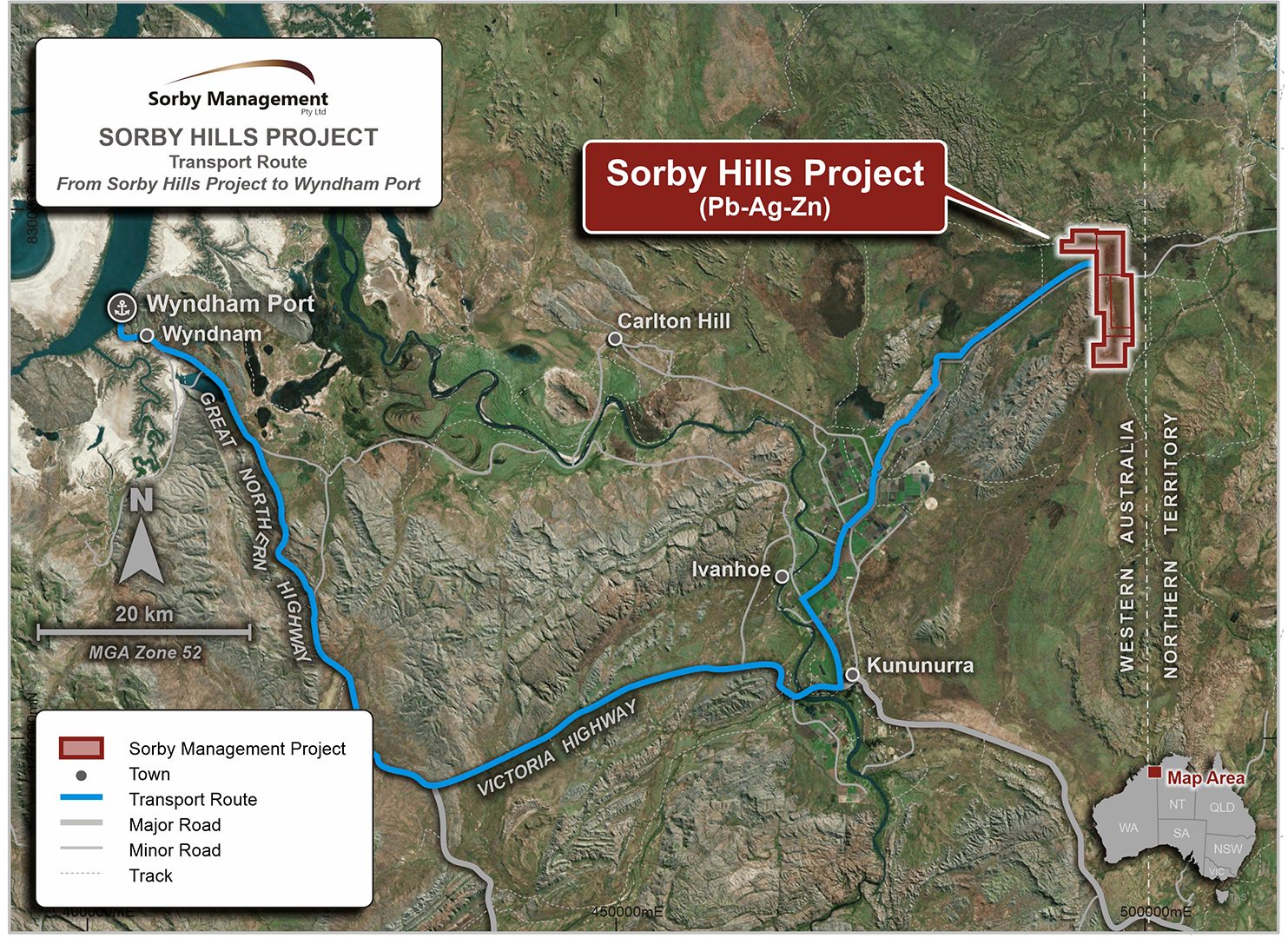

Boab Metals is an established ASX-listed company currently developing the Sorby Hills Project, 50km northeast of Kununurra in the East Kimberley of Western Australia.

Australia is one of the most attractive regions in the world for mining investment. According to the Fraser Institute 2022 Annual Survey of Companies, Western Australia remains Australia’s highest-ranked jurisdiction when considering investment attractiveness due to its quality mineral potential and economy.

The Sorby Hills Project

Sorby Hills is Australia’s largest undeveloped, near surface lead-silver-zinc deposit and sits just 150km from the Wyndham Port. Wyndham Port is Australia’s closest port to Asia and can be accessed via an existing sealed highway. With granted mining leases, and West Australian Environmental Protection Authority (EPA) approval for open-pit mining and associated infrastructure, Boab has an excellent opportunity to fast track production.

A Definitive Feasibility Study (DFS) completed by the company in early 2023 highlighted a robust and low-risk project with low operating cash costs. Boab is currently advancing towards a Final Investment Decision, with first lead-silver concentrate potentially being produced as early as 2025.

The proposed on-site Conventional Process Plant is supported by extensive metallurgical test work and process engineering. The plant will have a feed capacity of 2.25Mtpa (a 50% increase on that proposed in the Sorby Hills PFS), producing an average of 103kt of high-quality lead-silver concentrate per annum.

Sorby Hills is situated in the Bonaparte Basin. The Bonaparte Basin is a remote and under-explored mineral province proven to be prospective for rich carbonate-hosted lead-silver-zinc mineralisation. It is known to form mineral districts hosting millions of tonnes of base and precious metals.

In 2018, Boab commenced exploration and resource delineation at its flagship Sorby Hills Project. Since then, the company has completed in excess of 390 drill holes for 32,000m over seven drilling campaigns.

Boab began its work with a deep dive into the technical parameters of the Project and identified the most value-adding opportunities. Mineralisation continuity, structurally controlled mineralisation, and discrete high-grade mineralisation zones were identified as targets.

A systematic and targeted approach to the drilling from the start paved the way to an increased and more robust resource and has allowed the company to reach several critical milestones towards development. The aggressive work schedule has served multiple technical purposes, underpinning three progressive mineral resource statements (MRE) and growing ore reserves.

Boab aims to unlock and deliver critical metals vital for a clean and sustainable future.

Ord River Hydro Power Plant will provide clean energy to Sorby Hills

A Heads of Agreement with Horizon Power in respect to future power supply from the Ord River Hydro Power Plant to the Sorby Hills Project was executed in April 2022.

The Ord River Hydro Power Plant provides electricity to the Argyle Diamond Mine and the nearby towns of Kununurra and Wyndham – and does so in an environmentally friendly way.

Indeed, the Ord River Hydro Power Plant has enabled renewable energy to become the sole source of electricity for the region.

When the hydro plant first began generating power in 1997, the Ord River Hydro Power Plant was the largest private sector renewable energy project completed in Australia. It was the recipient of an Engineering Excellence award in 1996.

The Power Plant provides base-load power delivered via its own 132 kV transmission network. It remains the largest hydroelectricity generator in Western Australia, generating over 212 GWh of emission-free energy each year which is purchased by Horizon Power and the Argyle Diamond Mine.

With the Argyle Diamond Mine recently closing and moving to its rehabilitation phase, sufficient power is available for the Sorby Hills Project.

Our metals

Silver

With a resource containing 54 million ounces of silver, Boab Metals represents a rare, low-risk exposure to an exciting silver market.

In 2023, the fluctuation of silver prices is influenced by many elements, prominent among which are industrial demand, potential supply shortages, inflation rates, and global economic uncertainty.

In the contemporary era characterised by rapid technological evolution, silver, due to its superior electrical conductivity, has become an indispensable component in manufacturing a range of devices, interconnected systems, and advanced cables. The increase in the production of these elements worldwide has resulted in a greater industrial demand for silver, like that found at the Sorby Hills Project.

China is a notable consumer of silver, the world’s leading producer of technology components, such as chips, circuits, and cables. The demand within China alone has significantly influenced the global demand for silver and, by extension, the prices. The interconnected global economy means that the ripple effects of China’s silver demand can be felt far and wide, from South America’s mines to Wall Street’s trading floors.

Additionally, the accelerating shift towards green technologies has brought silver into focus. Silver is crucial in sustainable innovations, such as electric vehicles (EVs) and solar panels, due to its excellent conductivity, thermal properties, and reflectivity. For instance, silver’s application in solar photovoltaic (PV) panels is significant. Over the next five years, the energy produced from solar panels is anticipated to double, and the consumption of silver in the solar industry could grow by 85% to 185 million ounces in a decade. Consequently, the consumption of silver in the solar industry may increase significantly.

The burgeoning EV market signals a potential increase in silver usage. Current data suggests that an electric vehicle typically uses between 25-50g of silver, compared to the 15-28g used in combustion-powered vehicles. Future usage could vary based on a host of factors, including advances in technology, regulatory changes, and more.

Other than the key factors already mentioned, there are several other factors to consider in the discourse around silver prices:

- Geopolitical instability: Geopolitical events, including wars, political unrest, trade disputes, or policy changes, can create uncertainty in global markets. Precious metals like silver often function as ‘safe haven’ assets during these times, which could potentially lead to increases in price;

- Central bank policies: The monetary policies of major central banks can significantly affect silver prices. For instance, low interest rates tend to make precious metals more attractive since the opportunity cost of holding non-yielding assets decreases. Conversely, high interest rates could make silver less appealing compared to interest-bearing investments;

- Mining disruptions: Any disruption to mining activities, such as labour strikes, equipment failures, or environmental issues, could affect silver supply. These supply-side shocks can lead to price fluctuations;

- Currency values: The value of the US dollar and the Australian dollar can influence silver prices, as silver and other precious metals are typically priced in dollars. A weaker dollar could potentially make silver more affordable to foreign buyers, potentially driving up demand and price; and

- Investor sentiment and speculation: Investor behaviour and market speculation play a significant role in price fluctuations. Trends in investor sentiment, which can be influenced by factors including market news, economic indicators, and global events, can significantly affect demand and, consequently, the price of silver.

In summary, the observable increase in silver prices in 2023 has been attributed to factors like industrial demand, potential supply shortages, inflation rates, and global economic uncertainty. As the world continues to embrace technological advancements and green energy solutions, silver might retain its essential role in various industries.

As a potential near-term lead-silver mining company, Boab Metals’ Sorby Hills Project is getting ready to supply high-grade ore to the growing renewable energy market.

Lead

At Boab Metals, we are looking at adding our name to the list of lead miners who have shaped the country by developing the Sorby Hills Project. We are doing it safely and in partnership with our community.

The Sorby Hills deposit contains over 500,000 tonnes of payable lead metal. As we near production, the project could become a major player on the ASX and in international battery minerals markets.

Lead is primarily used in battery storage. Most vehicles, including electric vehicles, contain a lead-acid battery to power critical functions in the vehicle. Although lithium-ion batteries dominate technology, the reliability of lead-acid batteries will result in demand growth for telecommunication, uninterruptable power supply (UPS) and starter/lighter/ignition (SLI) batteries in both internal combustion and electric vehicles.

Boab Metals Limited is well positioned to supply high-quality lead concentrate that will find its way into lead-acid batteries for vehicles (including EVs), healthcare equipment, communications equipment, and many other industrial applications.

Milestones

Engineering and design commenced for the Sorby Hills Project, March 2023

Boab Metals announced that GR Engineering (GRES) has commenced Front End Engineering (FEED) for the process plant and associated infrastructure at the company’s flagship Sorby Hills Lead-Silver-Zinc Project. To find out more, read here.

Definitive Feasibility Study, January 2023

Boab Metals reached a major milestone and delivered the Sorby Hills Definitive Feasibility Study (DFS) with encouraging results. Read the full DFS announcement here.

EPA Approval received for site establishment and early works at Sorby Hills, July 2022

Boab received to commence site establishment and Early Works at the Sorby Hills Lead-Silver Project. Read the full details of the announcement here.

Agreement executed with Horizon Power, April 2022

A Heads of Agreement with Horizon Power concerning a future Power Purchase Agreement was executed in April 2022. The agreement will allow cleaner and cheaper energy to be delivered to the Sorby Hills Project. To find out more, read here.

Port access agreement executed, March 2022

An Access and Stevedoring Services agreement was executed with Cambridge Gulf concerning the Wyndham Port. The term extends to 2034 with an automatic rollover on a 12-month basis after that. The agreement is a critical element of the path to market for the concentrates that will be produced at Sorby Hills and shipped to customers. To find out more, read here.

Strategic acquisitions

Boab has also acquired a 100% interest in the Manbarrum Zinc-Lead-Silver Project, which is strategically located 25km east of the Sorby Hills Project. The company also has a 100% interest in the Eight Mile Creek Exploration Licence E80/5317 which sits just to the south of the Sorby Hills Project.

The Manbarrum Project has 175km2 of prospective tenements (including two granted mining leases) covering geology genetically related to that of Sorby Hills, which allows for an effective transfer of technical knowledge.

Initial drilling at the Eight Mile Creek Project has confirmed a favourable stratigraphic setting that may host mineralisation, similar to Sorby Hills.

To keep up to date on our latest news and subscribe to our mailing list, visit our website: www.boabmetals.com

Please note, this article will also appear in the fifteenth edition of our quarterly publication.