Lithium Springs Limited’s maiden MRE for the Brazil Lake lithium project signals a promising lithium reserve, coupled with an excellent location, making for an excellent lithium resource.

Lithium Springs Limited (LS1) is proud to announce our maiden Mineral Resource Estimate (MRE) for the Brazil Lake lithium (Li) project of 10.01 million tonnes @ 1.20% Li2O at a cutoff grade of 0.33% Li2O, reported under JORC (2012) guidelines. This highly encouraging outcome results from an extensive and well-executed drill programme that started in October 2022, and involved the drilling of 97 diamond core holes for over 26,700m and the use of 70 historic drill holes for approximately 6,600m.

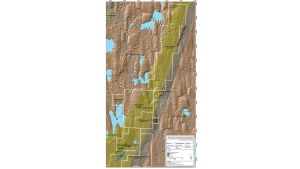

Location of the Brazil Lake lithium project

The Brazil Lake lithium project is located in southern Nova Scotia, Canada, approximately 25km north-east of Yarmouth and approximately 300km south-west of the city of Halifax (Fig. 1).

The region can be accessed via highways 101 and 103, and the project area is easily accessible via Route 340 (bitumen road) and then along secondary gravel roads.

Geology and mineralisation

The highly evolved, spodumene-bearing pegmatites within the Brazil Lake lithium project that are the focus of Lithium Springs Limited’s exploration are hosted by meta-sedimentary and meta-volcanic rocks of the White Rock Formation sequence, which locally include quartzite, amphibolite, tuff, psammite and pelitic schist and strikes northeast/southwest and locally dips steeply to both north-west and south-east. These rocks are part of the south-western part of the Meguma terrane of the Canadian Appalachian Orogen. The favourable geology of the host sub-unit, the Government Brook Member, bounded on the east by a major regional shear zone, extends greater than nine kilometres NE of the drilling to date.

Exploration and drilling

The most recent exploration and drilling on the Brazil Lake lithium project was completed by Lithium Springs Limited, in conjunction with our project partners Champlain Mineral Ventures Ltd. (a GOLDFIELDS Group Company). Before LS1’s involvement in the project, all previous exploration of the Brazil Lake lithium project and the surrounding areas was completed by Champlain Mineral Ventures Ltd; other than some early-stage exploration completed by the Nova Scotia Department of Natural Resources and Renewables (NSDNRR) between 1960-1993, which included five drill holes for a total of 577m.

Champlain completed 16 diamond drill holes for a total of 1,325m in 2002; 16 diamond drill holes for a total of 801m in 2003; 28 drill holes for a total of 2,666m in 2010; five drill holes for a total of 505m in 2019; and six drill holes for a total of 1018m in 2020, as well as field mapping and sampling (including pits), soil surveys, trenching, and geophysics.

This sample was then subjected to metallurgical test work, which produced a spodumene concentrate with highly encouraging Li2O grade and recoveries utilising heavy liquid separation. Lithium Springs is currently in the process of verifying the historical metallurgical test work through independently verified test work to be completed by SGS Lakefield, Canada.

Mineral resource estimate

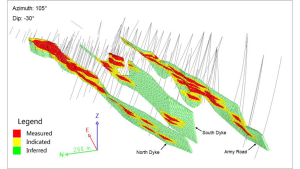

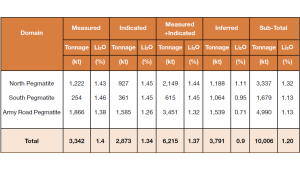

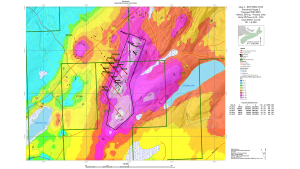

The Brazil Lake lithium project mineral resource estimate (MRE) as of 6 August 2023 is 10.01MT @ 1.20% Li2O at a cutoff grade of 0.33% Li2O and is reported in accordance with JORC (2012) guidelines by the independent mining consultants, JP Geoconsulting Services. This MRE results from a combination of three spodumene-bearing pegmatites: the Army Road Pegmatite, North Pegmatite and South Pegmatite (Figs. 2 and 3).

A breakdown of the mineral resource estimate by Li2O% cutoff grade and resource confidence classification from these three pegmatites is shown in Table 1.

The Brazil Lake Lithium Project is comprised of three ore bodies – North Pegmatite, South Pegmatite, and the Army Road Pegmatite, all aligned in parallel, dipping steeply and at a downward plunge of 20° to the SSW. The North Peg and South Peg outcrop at the surface, while the Army Road Pegmatite is covered at the closest point to the surface of five metres of cover.

The combination of 6,500m of historic drilling and the Lithium Springs fully-funded 28,000m of diamond drilling has produced an outstanding maiden JORC resource of 10.01Mt @ 1.20% Li2O at 0.33% Li2O cutoff grade. The Brazil Lake project has real mine development potential located in a Tier 1 mining jurisdiction with significant Canadian federal and Nova Scotian provincial government incentives that match the funds available under the US federal government’s Inflation Reduction Act, and development grants from the US Departments of Defense and Energy. These present further funding opportunities for critical mineral development, especially given Canada’s classification as a US domestic supply source.

The Debert Lake Heavy Rare Earth deposit

Magnum Resources Inc (a GOLDFIELDS Group company) owns a 100% interest in the property. The property is located in northern Nova Scotia, 25km NW of Truro. It is on forestry land and is serviced by a logging road within eight kilometres of a sealed highway and the power grid.

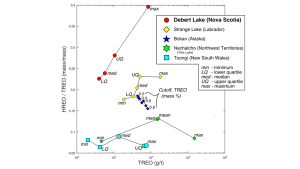

Assays from 235 samples of outcrop and drill core show that key elements by value (>80%) include: Europium, Erbium, Thulium and Ytterbium.

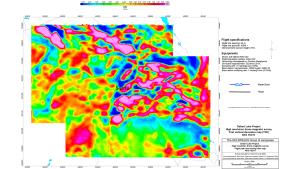

High-resolution (25m line spacing) magnetic drone surveys have identified new drill targets on the heavy REE deposit at Debert Lake, owned by Magnum Resources Inc. (a GOLDFIELDS Group company). The deposit features the highest ratio (~75%) of heavy to light of any REE deposit in North America. REEs have been designated as a critical mineral by both Nova Scotia and Canada, as well as the EU.

The Frenchvale Flake Graphite deposit

Mt. Cameron Minerals Inc. (a GOLDFIELDS Group company) owns 100% interest in the property. It is under option to Argyle Resources Corp., which is committed to spending $4.4m over four years to earn a 60% interest.

The Frenchvale Flake Graphite deposit is located 25km west of Sydney, Cape Breton Island, Nova Scotia, Canada. The deposit is hosted in Grenville Age marbles and has a strike length of eight kilometres. Sealed highways service it, and it is on the power grid.

Flake Graphite has been designated as a critical mineral by both Nova Scotia and Canada.

Deep drilling is planned on geophysical (TDEM CH13) targets as above.

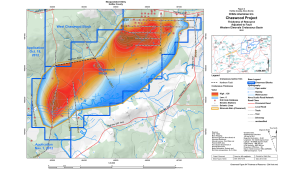

The Chaswood Aluminium (Kaolin) deposit

AlNova Mining Inc. (a GOLDFIELDS Group company) owns 100% interest in the deposit.

The deposit is hosted in unconsolidated cretaceous secondary deposits of kaolin and high-purity quartz sand lenses. The deposit is found at the surface under glacial till. It is considered one of Canada’s largest aluminium deposits, with >600 million tonnes of kaolin at a grade of >30% Al2O3. It is located in central Nova Scotia, 50km NE of the port of Halifax. It is on forest land within three kilometres of a sealed highway and power grid. It is suitable for mining by dragline with a very low strip ratio and is within eight kilometres of a gas pipeline.

The estimated resource was calculated from diamond drilling and seismic profile surveys. The kaolin and sand are suitable as additives for the production of cement. Designated as a critical mineral by Canada, the kaolin can be initially refined to SGA alumina or further for electronic applications.

Please note, this article will also appear in the seventeenth edition of our quarterly publication.