With exciting new projects on the horizon and a plethora of promising results firmly under their belt, Brazilian Rare Earths is a forerunner in the Australian rare earths industry.

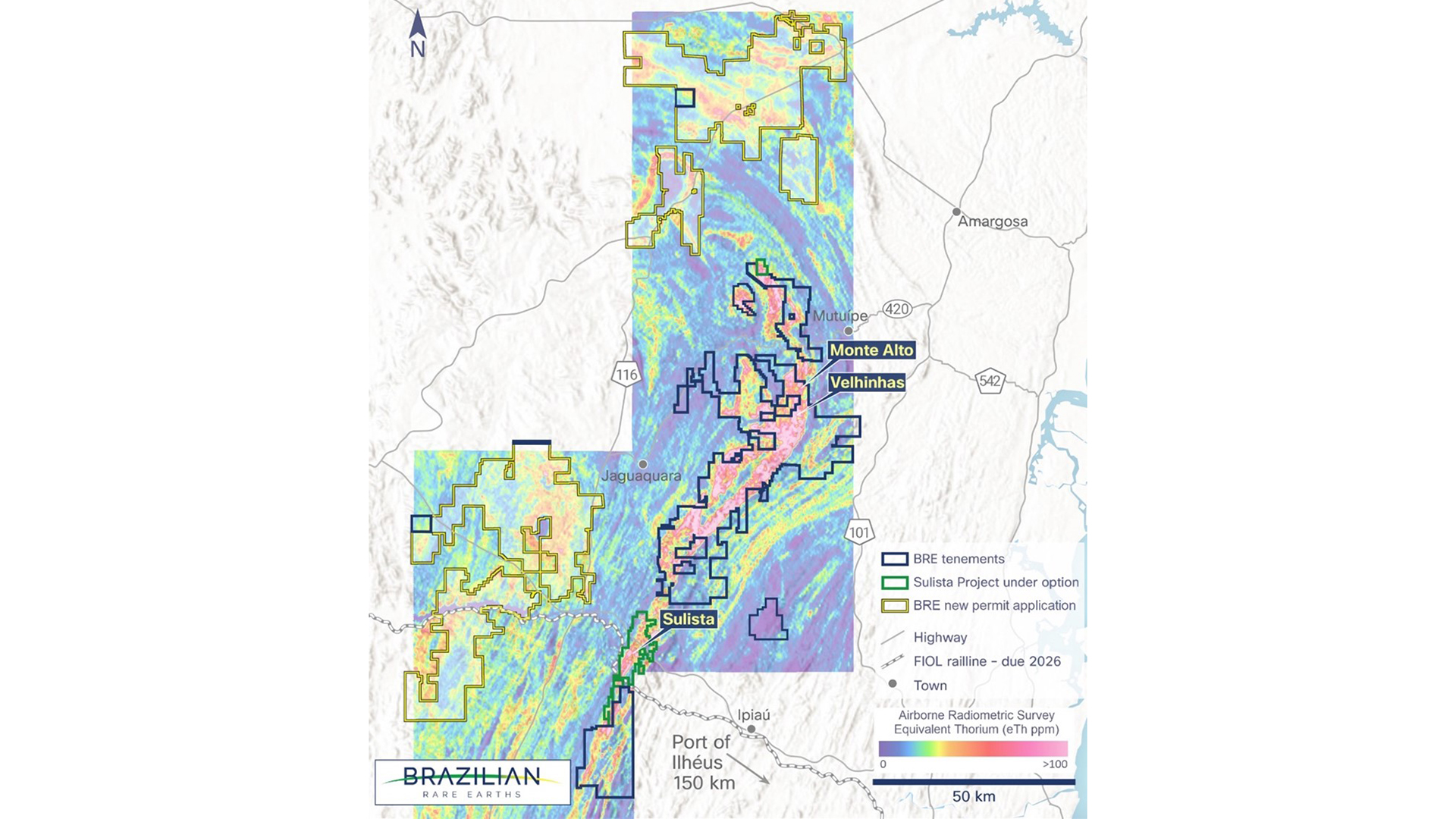

After making a significant impact as the largest resources IPO on the Australian Securities Exchange (ASX) in 2023, Brazilian Rare Earths (BRE) has rapidly solidified its position as the most prospective and potentially high-grade rare earths project globally, with all the necessary elements in place for the company’s project to become the preeminent rare earths province worldwide. Brazilian Rare Earths is situated in a tier-one mining jurisdiction. It controls an extensive portfolio of mining tenements spanning over 4,000km², covering almost the entirety of the Rocha da Rocha Critical Minerals Province. The project enjoys close proximity to excellent infrastructure with access to hydroelectric energy, sealed roads and nearby ports.

The Board and Senior management team comprises a group of highly experienced executives with substantial in-country experience and a stellar track record in creating shareholder value and operating mining assets. With founders and the Board still holding around 60% of the company’s shares, most of which are locked up for two years, it is clear that management is entirely aligned with shareholders and committed to the long haul.

Furthermore, BRE is well-funded, having successfully completed a significantly oversubscribed Initial Public Offering (IPO) of AU$50m at AU$1.47 per share on the ASX. The IPO attracted exceptionally high-quality investors, including Gina Reinhardt’s Hancock Prospecting, coal giant Whitehaven Coal, top institutional funds, and several large family offices.

Promising results

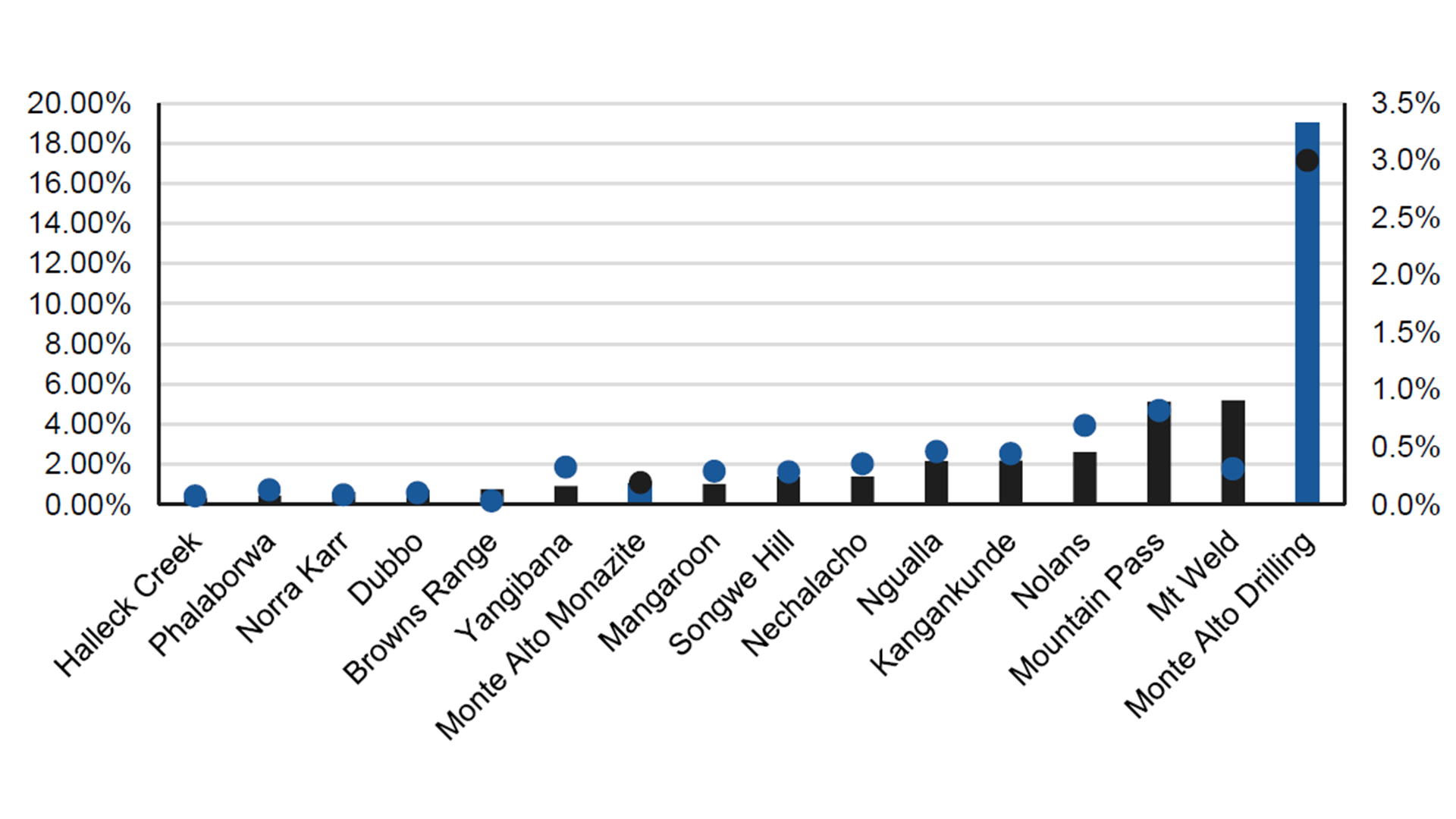

It is no surprise that Brazilian Rare Earths attracted such a star-studded register! While many listed companies boast projects with grades measured in parts per million (ppm),¹ and the very best projects in operation today, such as Lynas’ Mt. Weld and MP Materials’ Mountain Pass, have grades ranging from approximately 6-8% Total Rare Earths Oxides (TREO),² BRE has recently announced significant intercepts as high as 34% TREO and as they say ‘grade is king!’ In fact, the weighted average of BRE’s recently published diamond drilling results in their ultra-high-grade Monte Alto Project was 18.8% TREO. Fig. 2 below illustrates how these average intercepted grades compare to the JORC Reserve grades of the major rare earth deposits globally.

However, a closer examination of these numbers reveals that these results are even more exceptional than they initially appear. It’s important for readers to understand that rare earths consist of 17 chemical elements with vastly different uses and values. For example, cerium (Ce) trades for only a few dollars per kilo, while terbium (Tb) trades for over US$1,000 per kg. With the global shift towards sustainable energy, rare earth elements (REE) are increasingly vital, especially in manufacturing high-strength permanent magnets for electric vehicles and wind turbines.

The BRE approach to grades

The so-called ‘light magnet rare earths’ neodymium (Nd) and praseodymium (Pr), as well as the ‘heavy magnet rare earths’ dysprosium (Dy) and terbium, are expected to be in high demand going forward, with many specialists predicting significant supply deficits and material price appreciation. Rather than being focused on head grades (TREO), what’s important is to examine the underlying grades of the individual rare earth elements that make up the TREO. For example, a project with a very high TREO count composed entirely of Ce may be far less valuable than a project with a lower grade consisting entirely of Tb, given that Tb tends to trade at roughly 1,000 times the price of cerium currently.

To put this in context, the average Nd+Pr grades intersected by BRE stand at an eye-watering 3.0%, higher than most developers’ total grade! Meanwhile, the average Dy+Tb grade stands at 0.15%. By comparison, Northern Minerals Limited (ASX: NTU) has the highest DyTb grades in Australia at 0.073%.

On the other hand, BRE not only has incredibly high levels of NdPr and DyTb but also significant levels of other extremely valuable elements such as Scandium (Sc) at 193 ppm and Niobium (Nb) at 0.6%, making the BRE-controlled Rocha da Rocha Critical Minerals Province one of the most exciting geological discoveries globally!

Priority exploration programmes

Additionally, BRE recently announced the acquisition of the Sulista Rare Earths Project, some 80km southwest of Monte Alto, see Fig. 1. On-site reconnaissance sampling of the hard rock outcrops and corestones/boulders recorded gamma spectrometry readings at three distinct sites within the same range as those obtained for the ultra-high grade REE-Nb-Sc mineralisation near the Monte Alto Project, suggesting the Sulista Project has the potential to host several ultra-high-grade deposits like Monte Alto.

BRE’s exploration team believes that this unique high-grade REE-Nb-Sc mineralisation is provincial in scale and that there is outstanding potential for new high-grade rare earth discoveries along the entire geophysical trendline that runs down the extensive spine of this world-class province.

BRE recently commenced a diamond drill programme at the Velinhas target, located seven kilometres to the south of Monte Alto (see Fig. 1), and has mobilised diamond drill rigs to target high-grade REE-Nb-Sc mineralisation at the Sulista Project, where three distinct high-grade targets have been identified. These priority exploration programmes will be followed by an increasing number of highly prospective regional drill targets.

Geopolitical Significance

Currently, both the European Union, through its European Green Deal and recently enacted Critical Raw Materials Act, and the United States, through the Inflation Reduction Act, are moving in the same direction, aligning their strategies and priorities. A significant focus of these superpowers is to end China’s dominance of the world’s critical minerals industry and to promote Western sources of these important elements.

BRE holds strategic significance for Western end users due to the absence of current production sources for heavy rare earths outside China and Myanmar. This situation is a cause for concern among several Western governments, as many crucial military applications rely on technologies dependent on heavy rare earths. Moreover, the fact that the primary source of these materials is China amplifies the anxiety surrounding supply chain security. BRE has the scale to solve much of the Western world’s need for these critical elements, the right team to execute the strategy, and the investors to get there!

References

- 10,000ppm=1%

- TREO = La2O3 + CeO2 + Pr6O11+ Nd2O3 + Sm2O3 + Eu2O3 + Gd2O3 + Tb4O7 + Dy2O3 + Ho2O3 + Er2O3 + Tm2O3 + Yb2O3 + Y2O3 + Lu2O3

Please note, this article will also appear in the seventeenth edition of our quarterly publication.