Auto manufacturers warn that tariffs on electric vehicles caused by Brexit trade agreements could cost €4.3bn and impact production.

To avert substantial tariffs on electric vehicles, the European Automobile Manufacturers’ Association (ACEA) is appealing for a three-year postponement of restrictive rules on EU-UK EV trade.

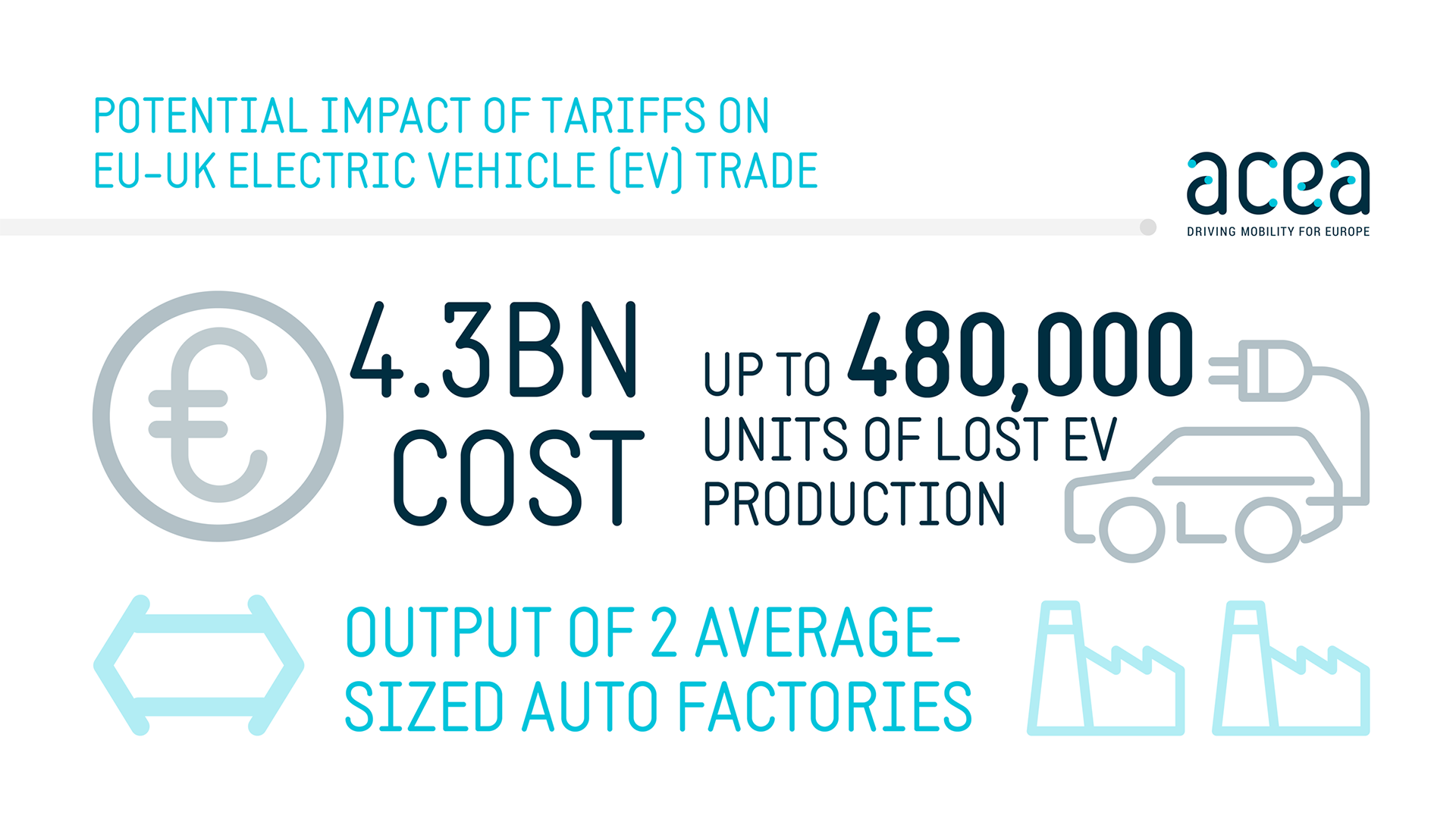

These rules are slated to take effect within the next six months, and failure to delay them could result in tariffs amounting to a staggering €4.3 billion.

Moreover, implementing these regulations could potentially lead to a decrease in EV production by an estimated 480,000 units.

Tariffs on electric vehicles could emergency stop the industry

The regulations in question concern compliance with ‘rules of origin’ for goods exported under the European Union’s free-trade agreements. These regulations dictate the necessary conditions for obtaining tariff preferences.

Under the current transitional rules outlined in the EU-UK Trade and Cooperation Agreement (TCA), batteries assembled in Europe qualify as European-origin goods.

However, these rules are set to become significantly more restricted. From 1 January 2024, all battery components and some critical battery materials will need to be produced in the EU or UK to qualify for tariff-free trade.

ACEA data suggest that between 2024 and 2026, 10% tariffs on electric vehicles would cost billions, reducing production capabilities and impacting the European economy

Europe has not yet established a secure and reliable BATTERY SUPPLY CHAIN that can cater to these more restrictive rules right now

ACEA’s Director General, Sigrid de Vries, commented: “We are asking the European Commission to extend the current phase-in period by three years.

“There has been massive investment in the European battery supply chain, but time is needed to build up the required capacity. In the meantime, vehicle manufacturers must rely on battery cells or materials imported from Asia.

“As we face increasing competitive pressures from abroad, applying these rules would have severe consequences for electric vehicle manufacturing in Europe – at the very time when we should be massively ramping up sales and production.”

Roadblock caused for EU’s largest export market

The UK is the EU’s top market for electric vehicle exports and the largest export market for EU-made battery-electric vehicles (BEVs).

In 2020, over 20% of the 6.3 million EU vehicle exports were to the UK, with 10% being BEVs. Between 2019 and 2022, the EU’s share of the UK BEV market has accelerated from 44% to 47%.

In contrast, 62% of all vehicles exported from the UK went to the EU in 2022, with the EU representing 70% of all UK vehicle imports on value.

De Vries explained that tariffs on electric vehicles will have dire consequences for this essential market, concluding: “Failure to act now will hamper our ability to remain competitive on the global electric vehicle market and lead to lost market share – which will be extremely difficult to regain.”