Experts from price reporting agency Fastmarkets identify the greatest risks and the impacts to critical raw materials supply chains.

Critical minerals play a pivotal role in shaping the modern world, particularly in the context of decarbonisation. These minerals, including rare earth elements like neodymium and dysprosium, as well as lithium, cobalt and nickel, are essential components in various high-tech and green technologies. Rare earth magnets are used in wind turbines, while lithium-ion batteries are used to power electric vehicles (EVs). Steel and base metals, such as aluminium and copper, have strategic importance because of their use in infrastructure.

As demand for these raw materials is expected to soar, they have been deemed ‘critical’ by the U.S. Department of Energy. Here, we look at the risks of supply chain disruption to these raw materials, including political, regulatory and social factors as well as supply and production availability.

What are the greatest risks to critical minerals supply chains?

Supply shortages

Copper is critical to the global energy transition. One major use of copper is in winding wire, used in electric motors, as well as in cabling, used to transmit electricity. Copper consumption growth will be underpinned by rising demand from energy-transition-linked sectors, such as wind power generation, solar arrays and, particularly, EVs and the associated charging infrastructure.

At the same time, copper is also likely to face supply constraints, due to ore depletion at major mines and recent closures. As a result, the copper market is likely to face periods of tightness, requiring investment in new capacity.

Nickel is another metal that is being increasingly used in energy transition applications, particularly in EV batteries. The picture here is different to copper: Indonesia’s emergence as a significant producer of mined, refined, and intermediate nickel products – backed by Chinese know-how, capital, and producers – has resulted in an oversupplied market. This has caused a fall in prices that has forced some producers to curtail capacity. As a result, supply is being increasingly concentrated within Indonesia and China.

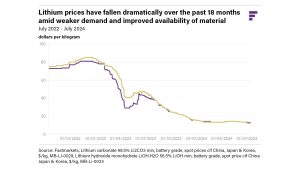

However, in the lithium market, there has been a huge increase in lithium production in China. China’s lithium carbonate equivalent (LCE) production from lepidolite increased by 126% year-on-year in April, with spodumene increasing 109%. Inventory accumulation suggests no shortage of supply, with time needed for demand to absorb surplus. In saying this, when developing our lithium long-term forecast, experience tells us that, even though we have allowed for delays and disruption, more issues are likely to affect the delivery of new material into the market, especially considering the current price environment.

Geopolitical tensions and instability

In recent years, geopolitical tensions have significantly impacted critical mineral supply chains. The war in Ukraine has led to scrutiny and regulation of Russian exports, impacting the availability of some critical materials sourced from the region. Additionally, global sanctions on Russia have created logistical challenges, further complicating the supply chain for raw materials including copper and aluminium. Russia’s war in Ukraine has also meant a boost in copper demand, due to the millions of copper-containing shells being used.

Cobalt, a key component in EV batteries, sees around 70% of annual supply sourced from the Democratic Republic of the Congo (DRC). Cobalt is primarily a by-product found during copper and nickel mining. A rise in copper prices throughout 2024 has seen a knock-on effect on the cobalt market with a rapid increase in supply causing cobalt prices to fall. With China owning seven out of the ten largest cobalt mines in the DRC, both the US and EU have stepped up efforts to create a domestic supply chain and reduce reliance on China.

The strained relationship between the US and China creates instability for commodity markets including graphite and rare earths. China’s dominance in graphite production – used for battery anodes and other industrial applications – means any trade restrictions or tariffs can lead to significant disruptions and increased costs for manufacturers. With 90% of global rare earth production also coming out of China, supply security is also a concern.

Lack of investment

In our recent lithium long-term forecast, Fastmarkets’ analysts spoke of how the current lithium price environment will see some projects struggle to access necessary funding to progress development. We’ve already seen the impact of low prices and a bearish outlook causing some closures and delays.

Changing environmental regulations and policies

The most significant policy to affect the lithium market in the near term is the US Inflation Reduction Act (IRA). The IRA has earmarked more than $80bn of funding for battery-related investments, including $7.5bn for EV tax credits and $30bn for manufacturing production credit for battery cells. We expect these investments to spur EV adoption and battery manufacturing over the short and longer term, posing an upside to lithium demand.

In an interview last year with Andrea Hotter, Albemarle’s president, Eric Norris, said that the IRA had de-risked the battery supply chain, catalysed investment into the US and provided a key differentiator to Europe.

“Several years ago, we were often being asked whether we would supply more lithium to the US, but at the time, there was little economic rationale to build a lithium plant here when all the demand was in Asia. What the IRA created was an incentive to build a supply chain here [in the US], generating local demand for lithium and derisking that problem,” Norris told Fastmarkets.

In Europe, the EU’s Critical Raw Materials Act (CRMA) officially came into effect in May 2024. The policy aims to secure the single market’s critical raw material supply chains, including measures to streamline regulatory hurdles for new projects. The CRMA also proposes a framework by which member states coordinate the establishment of strategic stockpiles.

A legal and regulatory analyst at the International Energy Agency (IEA) said: “There are still many parts of the law that need to be ironed out. This is something to watch out for, like the Commission needing to establish rules for environmental footprint of critical raw materials, which haven’t come out yet.

“Besides the CRMA, what’s been really important to different industry groups is the EU Battery Passport.”

Introduced as part of the new EU regulatory frameworks for eco-design and batteries, the digital product passport (DPP) supports the collection and sharing of product-related data among supply chain actors.

In line with the European Green Deal’s circularity ambitions, the Batteries Regulation entered into force in August 2023.

The analyst also pointed to import-export bans as significant regulatory risks in critical mineral supply chains. These have added strain, notably China’s restrictions on graphite, gallium and germanium from 2023 and Indonesia’s recent export ban on bauxite.

According to European traders, they’re not yet seeing business affected by the CRMA. Fastmarkets has received stronger reactions to the EU’s Carbon Border Adjustment Mechanism (CBAM) – a system that accounts for the carbon cost of producing imported goods to reduce greenhouse gas emissions in line with net zero goals. The mechanism aims to treat domestic and imported goods equally by applying a charge to carbon emissions – but mainly concerns carbon-intensive industries such as steel, iron, and aluminium.

A trader commented: “CBAM affects the whole market. It’s a big headache for some companies [in terms of] how to report properly. It’s so expensive to comply with everything. It’s just a mess… so much legislation.”

How do these risks impact the markets these commodities are traded in, and used for?

Price volatility from resource scarcity and market unpredictability make it difficult to plan ahead

Copper prices have reached record highs in recent months, while treatment and refining charges (TC/RCs) have plunged to their lowest levels on record. This leaves smelters facing serious challenges, particularly as copper concentrates are expected to remain in a deficit for the next few years.

As well as the price volatility we’ve seen in the copper market, in a recent interview for Fast Forward podcast, Freeport-McMoRan’s Kathleen Quirk also noted the impact resource scarcity is having on M&A.

Quirk said: “If companies could invest, make discoveries, go forward with project development, they would be doing that all over the place. It just shows the scarcity of copper and it’s leading people to say ‘if I do want exposure, I may have to buy it rather than build it’ because building is very long term and uncertain.”

Lower prices create headwinds for new investment and exploration

Oversupply in the lithium market has meant prices have fallen dramatically over the past 18 months.

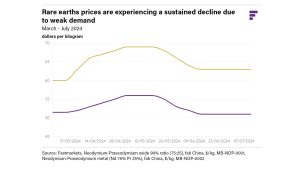

Prices for rare earths have fallen in recent months in line with continued weak demand from the downstream magnet sector. Fastmarkets’ weekly price assessment for the neodymium-praseodymium oxide 99% ratio (75:25), fob China price fell to $50-52 per kg on 11 July, from $54-56 per kg in late April.

Neodymium-praseodymium is the largest rare earth component of neodymium iron boron (NdFeB) magnets and makes up around a third of a finished magnet.

Prices also fell for Fastmarkets’ neodymium-praseodymium metal (Nd 75% Pr 25%), fob China to $62-64 per kg on 11 July, from $67-69 per kg in late April.

Heavy rare earth elements markets, including dysprosium and terbium, have also fallen due to a lack of demand. Dysprosium and terbium are added in trace amounts to NdFeB magnets to improve performance at higher temperatures.

Increased operational costs result in higher prices for the end consumer

In Europe, in particular, EVs are expensive and this limits widespread adoption. Original equipment manufacturers (OEMs) need to offer more affordable models and may follow suit with Tesla by adopting LFP batteries. Our EV sales forecast for Europe shows that we expect LFP/LMFP to have a 34% market share by 2034.

How can market participants build more resilient supply chains?

Investment into critical mineral recycling

It has been a challenging 12 months for battery recyclers, particularly for major Western entrants into the sector who faced financial issues. Despite these short-term challenges, the market looks set for strong growth in the longer term. Robust competition means the stronger companies will ultimately hold an advantage and survive the downturn.

These advantages include things like:

- Offtake agreements to secure feedstock

- Competitive technology

- The know-how to produce downstream products

- Strategic partnerships

- Access to financing

Strengthen strategic partnerships to drive innovation

At our recent Lithium Supply and Battery Raw Materials event in Las Vegas, Li-Cycle’s Tim Johnston said that recycling companies must “stay close” to customers such as OEMs and iron out technological issues to thrive. In our recent Battery Recycling Outlook, we go into more detail about how strategic partnerships are becoming increasingly important in the emerging recycling markets of Europe and the US.

Because US and European value chains are made up of a larger number of smaller-sized companies, this makes strategic partnerships increasingly important. They can provide access to funding, access to a new region or market and access to a wider network of the value chain. Small-scale companies are looking to larger companies for investment and to leverage their networks, which helps prevent the smaller companies from being pushed out of the market. In terms of critical mineral recycling, some non-recycling companies are looking for where they should try to enter the recycling value chain and when is best to do so.

Policy actions to provide financing to develop new supply sources

One difference seen between the CRMA and the IRA is in access to funding to help projects and stimulate critical mineral supply chain growth and security.

In the US, the Office for Manufacturing and Energy Supply Chains (MESC) which operates in the Department of Energy (DoE) aims to ‘eliminate vulnerabilities in US clean energy supply chains’. Together with the Bipartisan Infrastructure Law and the IRA, almost $500bn has been catalysed for investment into US energy, according to Ashley Zumwalt-Forbes, US Deputy Director for Batteries and Critical Materials (MESC).

In the opening address at Fastmarkets’ 16th Lithium Supply and Battery Raw Materials conference in June, Zumwalt-Forbes said: “Our grants figure out how the US can be competitive and where the US can be competitive.”

The CRMA legislation does not directly provide funding for strategic projects but instead looks to streamline projects by providing ‘efficient permitting and improved access to finance’, whilst advising that funding is available through existing mechanisms. Individual European member states are encouraged to provide public investment into domestic strategic projects to encourage supply chain growth.

“The guidelines set out by the CRMA are quite strict with not too much time left to get things in place, it will be interesting to see how the supply chain adapts,” a market participant said.

Please note, this article will also appear in the 19th edition of our quarterly publication.