Chariot has made the first hard rock lithium discovery by drilling in Wyoming, US.

Chariot corporation limited (Chariot) recently announced the first discovery of hard rock lithium in Wyoming, US. The initial results from the Company’s first three drill holes at its flagship Black Mountain project had assays returning individual lithium (Li) and tantalum (Ta) values of up to 3.79% Li2O and 230 ppm Ta2O5. These are strong early results from Chariot’s Phase 1 drill programme, which will be completed by March 2024, and indicate the presence of hard rock lithium with further drilling focused on determining the scope of the resource.

The United States is rapidly accelerating the exploration and development of American lithium resources to meet the anticipated demand from over 224 GWh of expected battery manufacturing capacity due to be online by 2025¹ (and significantly more thereafter). The US Government has also taken significant first steps to incentivise and encourage local investment across the lithium-battery supply chain, including $3.5bn to expand domestic advanced battery and battery materials manufacturing capacity from the Bipartisan Infrastructure Law.

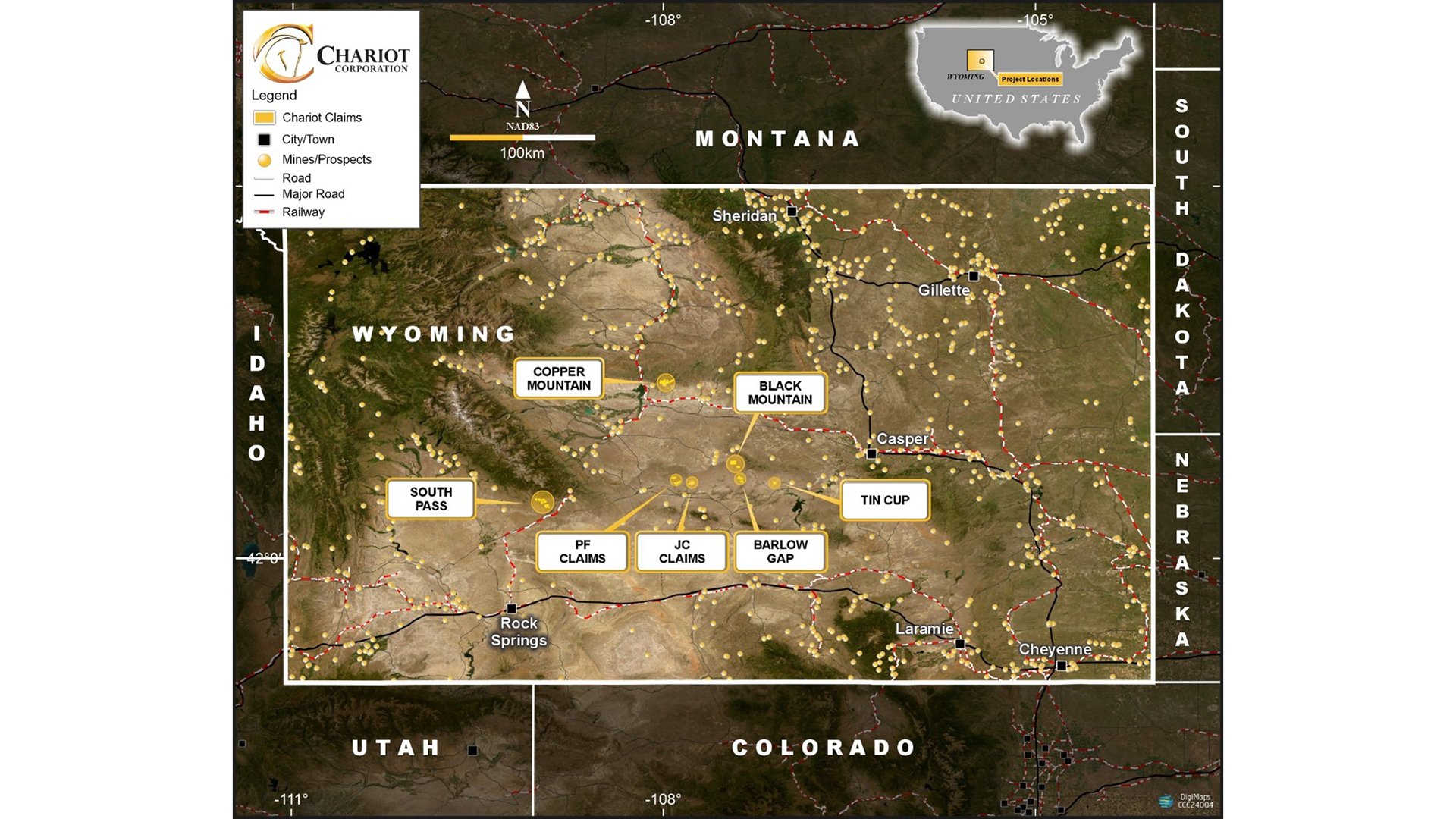

Chariot appears uniquely positioned to benefit from these efforts by being one of the largest landholders of lithium assets in the US. The company has a diversified strategy of holding both hard rock and claystone exploration claims focused in the US. The Black Mountain project (hard rock) and the Resurgent project (claystone) form the company’s core projects. Chariot also holds a dominant land position in Wyoming, with six additional hard rock lithium projects featuring extensive outcropping pegmatite swarms in geological settings similar to the Black Mountain project.

Why Wyoming?

The exceptional assay results from the first three holes of the Black Mountain project show the asset’s potential and, together with the company’s six additional Wyoming projects, position Wyoming to become an important source of critical minerals for the US electric vehicle market (see Fig. 1).

Wyoming is a tier 1 mining jurisdiction with a long history of mining gold, uranium, coal, and industrial minerals, accounting for 21% of the state’s GDP. In 2020, Wyoming was ranked second on the Fraser Institute’s policy perception index, demonstrating strong government policy support for ongoing mining exploration and development. Moreover, the state’s infrastructure is well-developed, with extensive experience transporting minerals within and out of state.

Chariot’s Wyoming lithium portfolio is entirely located in areas with no known land use encumbrance. It is hosted in metasedimentary rocks in Archean-aged geological systems, ideal conditions for LCT pegmatite discovery.

Black Mountain project

Chariot’s core project, the Black Mountain project (Black Mountain), is located in Natrona County, Wyoming, US and comprises 134 unpatented lode mining claims. Chariot has intersected significant zones of strong lithium-tantalum mineralisation in the first three holes of the maiden drill programme at Black Mountain.

These drill results confirm the potential of the Black Mountain lithium caesium tantalum (LCT) pegmatite swarms with notable results, including:

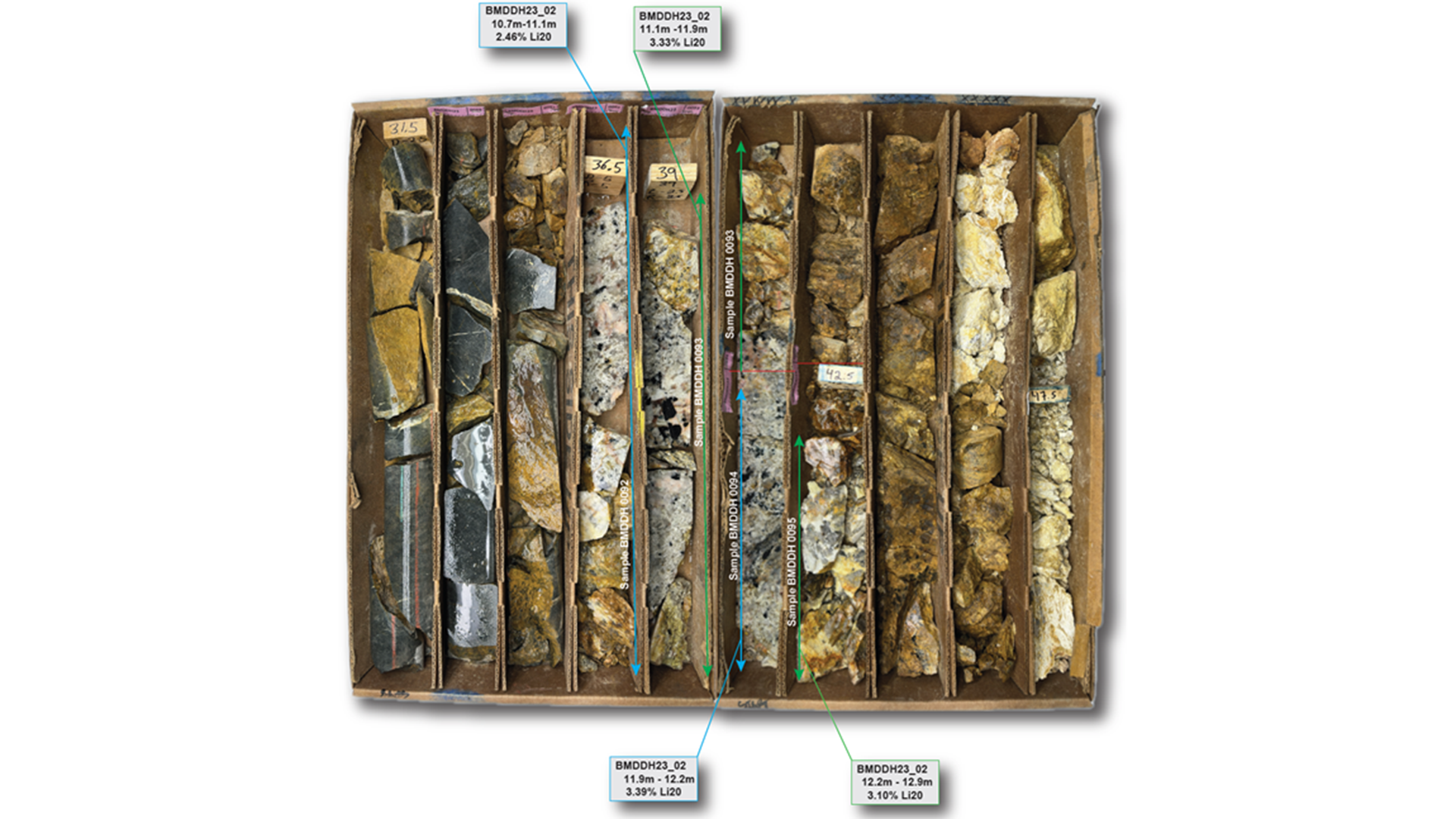

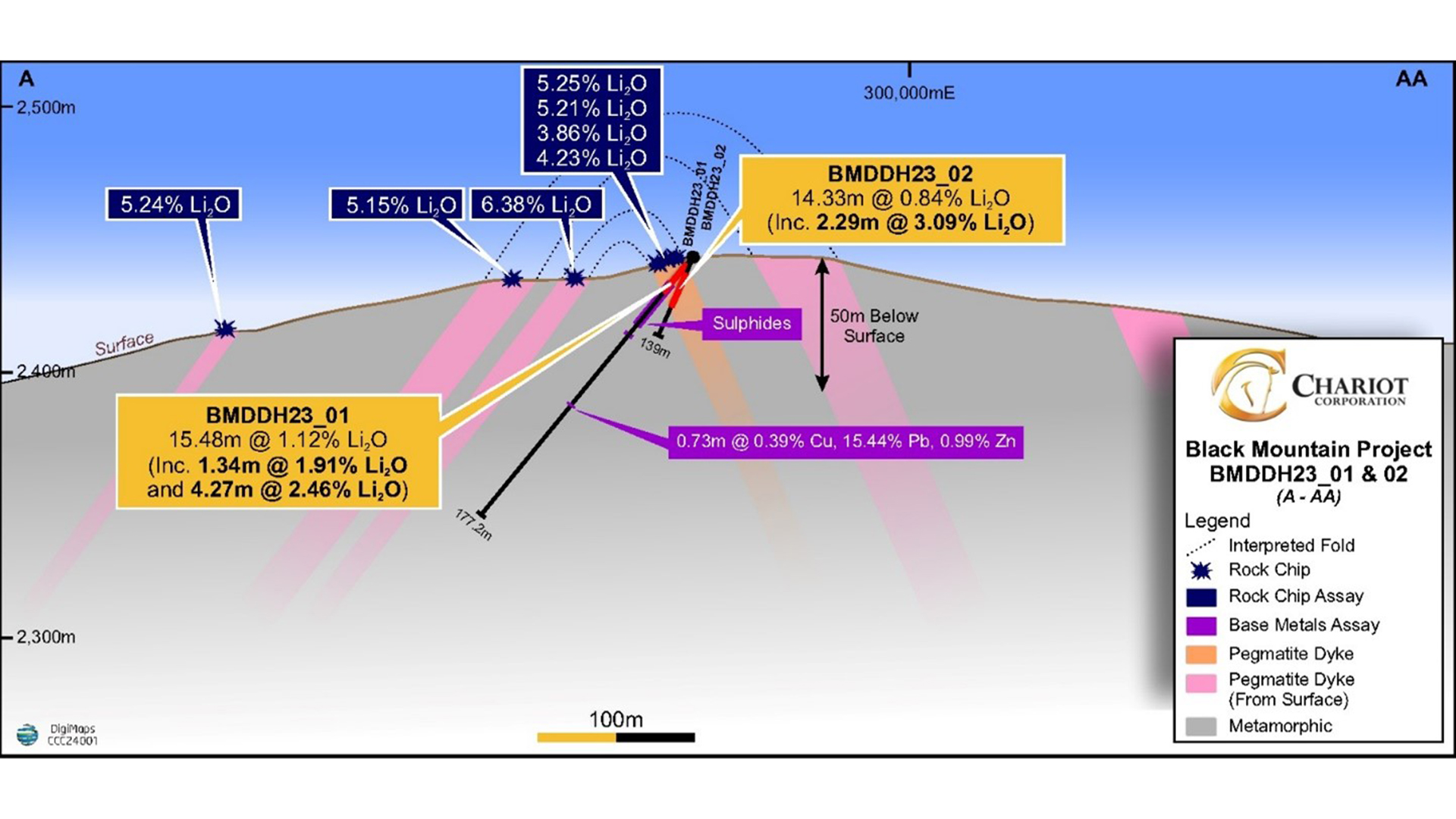

• BMDDH23_01 15.48m @ 1.12% Li2O and 79 ppm Ta2O5 from 2.74m, including 4.27m @ 2.46% Li2O and 128ppm Ta2O5 from 9.94m

• BMDDH23_02 14.33m @ 0.84% Li2O and 61 ppm Ta2O5 from 1.83m, including 2.29m @ 3.09% Li2O and 138 ppm Ta2O5 from 10.67m

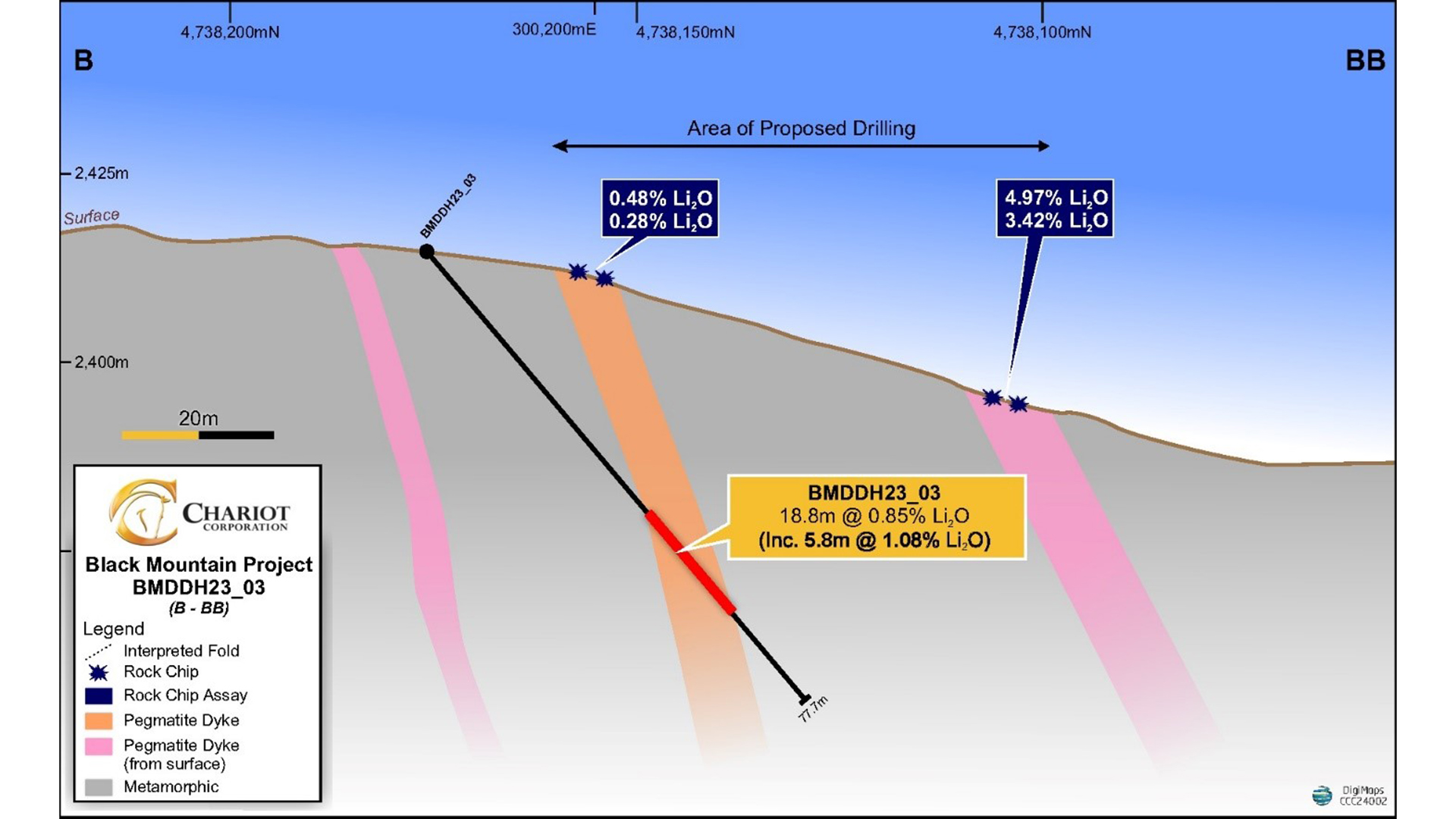

• BMDDH23_03 18.81m @ 0.85% Li2O and 98ppm Ta2O5 from 45.26m, including 5.79m @ 1.08% Li2O and 105 ppm Ta2O5 from 47.55m

• High-grade potential with individual grades downhole of up to 3.79% Li2O and 230 ppm Ta2O5

This is the first hard rock lithium discovery, through drilling, in Wyoming, US.

Dr Edward Max Baker, Chariot’s Chief Geologist,³ said: “We’ve got stunning initial results amid the North American winter. The targeted hard rock lithium system has been intersected in multiple holes. Still, we need to come back in the North American summer for a 5,000 – 10,000m drill programme to better handle the resource potential. The base metals’ sulphide mineralisation is also very promising and indicates the potential for base metals and/or gold mineralisation, separate from the lithium mineralisation.”

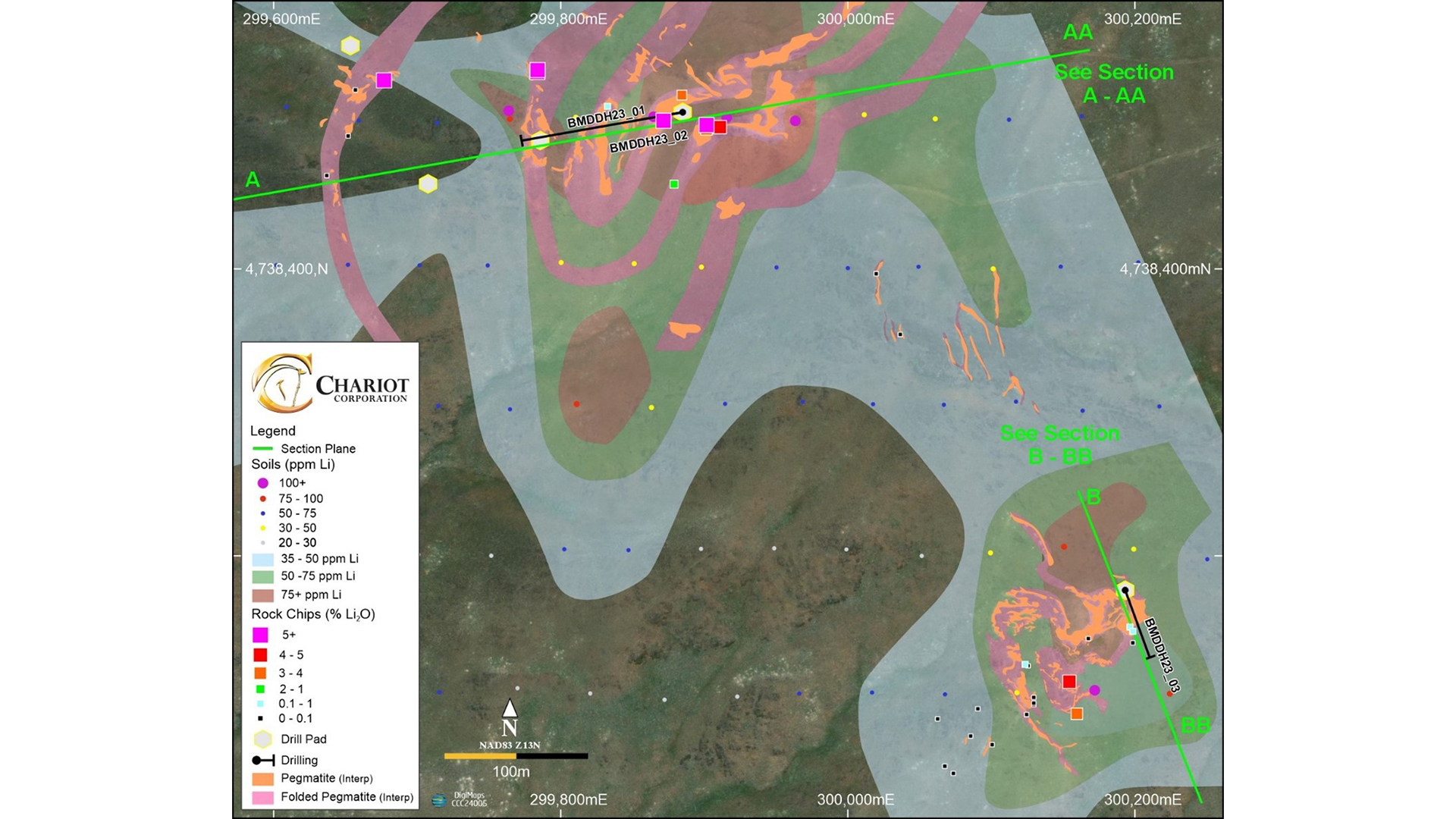

The drill intercepts reported from the first three holes confirm the lithium potential of the Black Mountain LCT pegmatite (see Fig. 2 and Fig. 3), as indicated by the Chariot’s earlier surface rock chip sampling results.⁴ In addition, Chariot is optimistic it may have intersected the peripheral portion of a potentially larger base metal mineral system, with selected intervals grading up to 0.6% (6,012 ppm) copper (Cu), 1.0% (9,931 ppm) zinc (Zn), and 15.4% (154,412 ppm) lead (Pb).

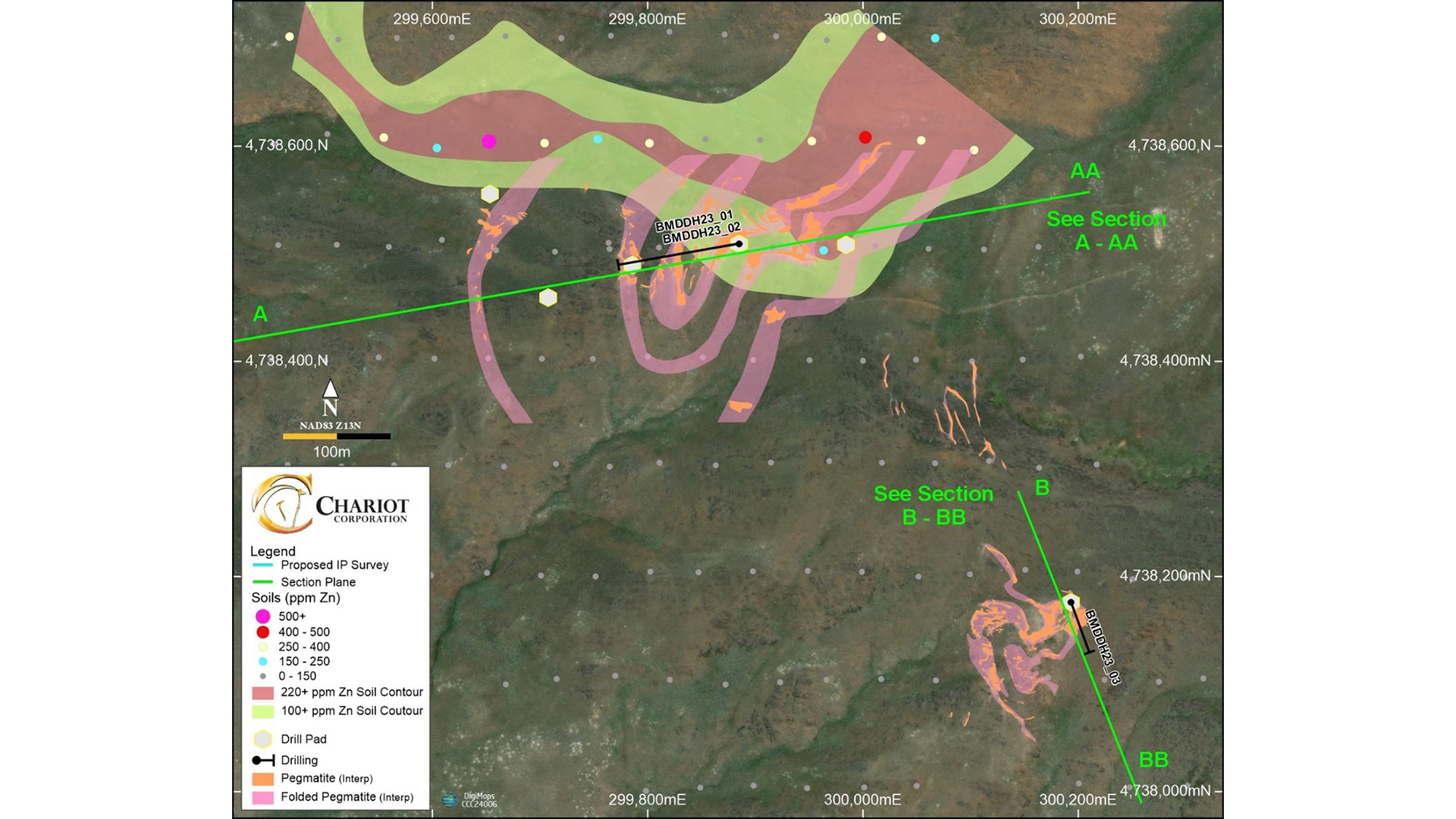

Two diamond core drill holes (BMDDH23_01 and BMDDH23_02) were drilled to test the outcropping pegmatites in the central Northwest swarm area (Northwest Area), whilst a third diamond drill hole (BMDDH23_03) was drilled in to test outcropping pegmatites in the central southeast swarm area (the Southeast Area)(see Fig. 4).

The Northwest Area comprise steeply dipping limbs of a tightly folded package of dikes, where the fold is now interpreted to be more open than initially anticipated before drilling. The dikes to the west of BMDDH23_01 and BMDDH23_02 are expected to dip westward at a dip approximately parallel to the pegmatite intercepted by BMDDH23_01. BMDDH23_01 and BMDDH23_02 both intersected the same pegmatite (see Fig. 5).

The pegmatite dike swarms in the Southeast Area comprise a complex fold-hinge, which, based on the location of the intercept of pegmatite in BMDDH23_03, appears to dip moderately steeply to the southeast (see Fig. 6).

Chariot also engaged ERM Australia Consultants Pty Ltd (previously CSA Global) and ERM Sustainable Mining Services (CSA Global) to provide technical guidance for the development of the Black Mountain exploration plan and have completed an independent review of the data, geological interpretations and exploration results to date. CSA Global’s scientific and technical disclosures review confirms Chariot’s drilling results.

Phase 1 drill programme

The Phase 1 maiden drilling programme consisting of 10-15 holes was designed to test under outcropping pegmatite dike swarms with anomalous Li rock chip values to determine the geometry of the dikes and to confirm the hard rock lithium potential ahead of a comprehensive resource drill-out in Q3 2024.

Major Drilling Group International Inc. (Major Drilling) has been contracted to drill oriented triple tube HQ-sized diamond drill core (drill core) using a Boart Longyear LF90 Surface Diamond Core Drill Rig (the drill rig) (see Fig. 7). Drill core from Black Mountain is transported to Chariot’s core handling and storage facility in Jeffrey City, Wyoming, where each drill core is photographed, logged, and measured for density and recovery (see Fig. 8). Drill core samples are being assayed by American Assay Labs in Reno, Nevada.

drill core

The Phase 1 programme was limited to the currently permitted seven drill pads due to the five-acre limit on disturbance under the Notice of Intent, which applies to both access roads and the drill pads.

Chariot plans to apply for an Exploration Plan of Operations (EPO) to increase the area of disturbance from five acres under the Notice of Intent to up to 2,500 acres for the Phase 2 resource drill programme commencing in Q3 2024.

The Phase 1 drill programme was limited to testing the two central pegmatite swarms (of the four pegmatite swarms identified at Black Mountain) in the Northwest and Southeast areas.

Base metal mineralisation potential

The upper section of BMDDH23_01 intersected pyrite-pyrrhotite mineralisation, occurring as veinlets and dissemination within the biotite schist throughout approximately 100m. At this early stage, only several select intervals of this mineralisation were sampled and assayed with selected intervals grading up to 0.6% (6,012 ppm) Cu, 1.0% 9,931 ppm Zn and 15.4% 154,412 ppm Pb.

Based on the location of this drill hole relative to an 800m long by 150m wide zone of anomalous zinc-in-soils, the Company is optimistic that it has intersected the peripheral portion of a potentially larger base metal mineral system (see Fig. 9). The zinc and lead anomalies are situated on the contact between metabasalt to the south and metasediments to the north coincident with a two-meter-wide zone of black massive chert outcrops along the southern margin of the soil anomaly. Based on the anomalous drill intercepts, the geological setting and the extent of the zinc and lead soil anomaly, the company plans to further investigate this base metal mineralisation by extending the soil sampling programme and conducting a preliminary induced polarisation survey (IP) lines across the anomaly in Q3 2024.

2024 Black Mountain exploration plans

The Phase 1 programme at Black Mountain is scheduled to continue until 1 March 2024, to determine the three-dimensional shape and near-surface grades, down to 100m, within the three major pegmatite dike zones, as shown in Fig. 1. In addition to the eight holes already drilled, another seven holes are planned for the remainder of the Phase 1 programme, which will conclude on 1 March 2024.

This information will be used to design a more extensive 5,000 to 10,000m initial resource definition drill programme expected to commence in Q3 2024 (the Phase 2 (resource drilling) programme).

Phase 2 (resource drilling) programme to commence in Q3 2024

In anticipation of the Phase 2 resource drill programme, the initial focus will consist of detailed re-logging of the Phase 1 programme drill core and a detailed petrographic study of the mineralisation, selection, and submittal of samples for initial metallurgical testing. At the same time, the existing rock chip and soil sampling programme will be extended to the north and east to close off the open lithium and base metal anomalies.

In addition, the company plans to run a preliminary IP/resistivity survey over the area of anomalous Zn-Pb soil geochemistry to assist in siting several holes to test the nature of this base metal mineralisation in Q3-Q4 2024.

The Company is currently lodging an application for an EPO (to drill) to expand the area of disturbance and increase the number of drill pads in preparation for a maiden resource drill-out. The Phase 2 (resource drill) programme is expected to commence in the North American summer in Q3 2024 or when the BLM approves the EPO.

Forging a lithium future in Wyoming

Chariot is well-positioned to take advantage of the future demand for lithium resources and the need for an American supply. Over the next twelve months, the company will report additional drill results and launch a more comprehensive drilling programme at Black Mountain. In addition, the company will continue to advance its other assets prudently. Each of these activities has the potential to be a significant catalyst for value creation at Chariot and to drive shareholder value.

References

- Source: National Blueprint for Lithium Batteries 2021-2030.

- The Prospectus can be downloaded from the Company website:

www.chariotcorporation.com - Dr Baker holds 7,926,860 ordinary shares in Chariot (equal to a 5.3% interest in the undiluted shares on the issue of Chariot). Dr Baker is also engaged as a consultant by Chariot.

- Refer to Chariot’s initial public offering prospectus and the Company’s announcement dated 9 November 2023 for the full set of surface rock chip sampling results.

Please note, this article will also appear in the seventeenth edition of our quarterly publication.