Altona Rare Earths tell us about the state of magnet metals and provides an update on their Monte Muambe project.

Rare earths are a group of 17 chemical elements. Each of these elements has its own properties, uses, and prices. Among other uses, four elements – neodymium, praseodymium, terbium, and dysprosium, collectively known as the ‘magnet metals’ – are necessary for the manufacturing of high-performance permanent magnets.

By volume, permanent magnets represent about 50% of the world’s rare earth consumption. By value, they represent more than 95%.

Ryan Castilloux, the founder of Adamas Intelligence, recently revealed that nine out of ten electric vehicles (EV) deployed during September 2023 were permanent magnet synchronous motors or magnet-assisted synchronous reluctant motors. Both types contain rare earth magnets.

The same company forecasts that the current supply deficit of neodymium-praseodymium oxide will grow from a few thousand tons currently to 90,000 tons per year by 2040.

Magnet metals are already an essential raw material for many industrial and high-technology applications. They are critical to the decarbonisation of the world’s energy sources through the production of EV drive trains and wind turbines. While alternatives exist, these have drawbacks in terms of performance and cost that make them second choices.

The share of EV and wind turbines in the consumption of magnet metals is set to grow during the next decades, driven by the green energy transition and policy changes aimed at implementing it.

Altona Rare Earths’ acquisition strategy

Altona Rare Earths is a British mineral resources exploration and development company specialised in rare earths and focussed on Africa. The company joined the Main Market of the London Stock Exchange on 9 June 2023.

Altona Rare Earths started to implement its rare earths project acquisition strategy in early 2020 and reviewed different projects in various African jurisdictions, applying its strict selection criteria.

In 2021, the company settled on the Monte Muambe carbonatite-hosted rare earths deposit, located in the Tete Province in the Northwest part of Mozambique. The project now has a maiden JORC Mineral Resource Estimate published, and a Scoping Study will soon be completed.

Taking advantage of its position in Africa, its networks, and its knowledge of the African continent’s geology, Altona Rare Earths continues to assess new potential project acquisition opportunities and expects to add at least one other rare earths project to its portfolio over the next year.

Africa’s geological history

The African continent has a long and complex geological history, which has been favourable to the development of rare earth deposits over time. The crustal abundance of rare earths is of the same order of magnitude as that of metals such as copper, vanadium, and lead.

However, economically viable concentrations are rare, and they are found in very different geological environments.

The main sources of rare earths are carbonatites, ionic clay deposits, and heavy mineral sands. The grade of rare earth deposits is expressed as total rare earth oxide (TREO), either as a percentage or in parts per million (ppm).

Ionic clay deposits typically have a low grade, usually ranging from 500 to 2,000 ppm TREO (0.05 to 0.2% TREO), which is compensated for by lower development and exploitation costs, and they can be exploited on a small scale. Carbonatite deposits such as Monte Muambe have higher grades, typically ranging from 1-10% TREO, but have higher development and exploitation costs.

Assessing a rare earths project is difficult

Rare earth projects are relatively new to the mining industry. Production currently originates mostly from a few carbonatite mines in China, one in Australia, and one in the United States, as well as a flurry of small-scale ionic clay deposits in Southeast China and neighbouring countries.

Therefore, when benchmarking a rare earths project, it is difficult to compare with existing operations, and comparisons are more easily made with advanced projects at the definitive feasibility study stage.

However, the complexity of rare earth deposits is such that every deposit is different in terms of geology, mineralogy, metallurgy, and costs. Therefore, comparisons also have their limitations.

While assessing a rare earths project, it is also important to distinguish between mineral resources, which represent the quantity of minerals contained in the ground, from ore reserves, which show the quantity of minerals viably extractable, as demonstrated in a feasibility study.

For example, mineral resource statements for carbonatite rare earth deposits can reach several hundreds of millions of tons, but the ore reserve statements for such projects rarely exceed 30 million tons.

An update on the Monte Muambe project

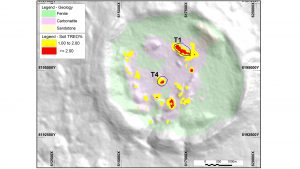

Since 2021, Altona Rare Earths has carried out several drilling campaigns at Monte Muambe, as well as soil sampling and ground geophysical surveys. Over 100 boreholes have been drilled for a total of more than 7,800m. This focused exploration work has allowed the company to discover and define two significant orebodies, referred to as Target 1 and Target 4.

On 25 September 2023, Altona Rare Earths announced its maiden JORC Mineral Resource Estimate for the Monte Muambe project, totalling 13.6 million tons at 2.42% TREO. This includes 45,000 tons of Magnet Metals oxides. This result provides a solid base for a mining project, and the tonnage is expected to increase through additional drilling during the pre-feasibility study without reducing the grade.

Importantly, about 58% of the resource’s tonnage belongs to the Indicated category (the rest being inferred), which demonstrates a high level of confidence in the resource figures. This is in line with the company’s strategy to avoid ‘drilling for numbers’ and rather to focus on defining the mineral resources that can be converted into an ore reserve and ultimately into a mining operation, from the onset.

So far, the Monte Muambe project ticks all the boxes of a low strip ratio open-pit mining operation.

Altona Rare Earths is now about to publish a scoping study, which will give a first pass test of economic viability for the project. The completion of this important milestone will allow Altona Rare Earths to increase its holding of the project to 51%, thus further de-risking the project for its shareholders.

The new challenges of the supply chain

While about 40% of rare earths mining is done outside of China, this country clearly dominates the supply chain, with over 90% of the separation, refining, and conversion of oxide to metal and magnet manufacturing being done in China. The country has heavily invested over the past 30 years, both domestically and abroad, to create this dominance. This has created a situation of dependence on China for other nations, not just for the supply of permanent magnets and EVs but also for critical high-technology applications such as within the communications and defence industries.

Western countries have recently started to recognise this situation and its associated risks, and are reacting by putting in place policies to develop domestic, or at least China-independent, supply chains for rare earths and other critical minerals. Rare earth processing facilities are starting to appear outside of China and will reduce the reliance on China. These changes will take time but will happen. They will, in our opinion, ultimately lead to the integration of Chinese and non-Chinese supply chains rather than their separation and to a more balanced market with more stable rare earths prices.

However, developing rare earth mines in the West, such as Europe, is proving to be a lot more difficult. This is because there are not many mineable rare earth deposits in Europe and also because the regulatory and social environment in Europe has, over time, become very adverse to mining.

The role of African, Asian, and South American countries hosting rare earths and other critical mineral resources will become essential to ensuring supplies of rare earths to both Chinese and non-Chinese markets. Africa has a long history of producing raw minerals, which have been exported to be processed and transformed in other countries. There is a strong sentiment in Africa that this must stop. Several countries have put in place bans on raw mineral products exports.

It is essential for mineral project developers to take this changing environment into consideration and integrate in-country value addition as much as possible. This is best done by starting to assess opportunities for value addition at an early stage in the life of projects rather than when reaching the final stages of the feasibility studies.

However, ultimately, the viability of a project depends on whether it can be economically implemented or not. African Governments therefore have a duty to put in place favourable conditions and lift obstacles to such value addition projects.

Another important angle in the developing rare earths supply chains is that of responsible sourcing. Western supply chains typically want to be able to guarantee to their customers, especially the end consumers, that the raw materials used to manufacture products have been extracted with no harm to people or the environment.

Responsible sourcing systems have previously been put in place, with more-or-less success, for minerals such as diamond or columbo-tantalite. Responsible sourcing is bound to become a topic of major importance in the development of critical minerals supply chains. Large and well-managed rare earth projects such as Monte Muambe can be certified and audited by responsible sourcing organisations, contrary to Southeast China artisan ionic clay operations, which are very environmentally destructive.

The outlook for 2024 at Monte Muambe

Buoyed by a rare earths market with solid long-term fundamentals and highly encouraging exploration results at Monte Muambe, including the recently published mineral resource estimate, Altona Rare Earths looks forward to a busy 2024 with the preparation of a pre-feasibility study for Monte Muambe.

A lot of emphasis will be put on the metallurgy part of the project and fine-tuning the process flow chart.

The increase of the company’s holding in the project to 51%, as well as securing a mining concession, are also important milestones that will happen during this time frame and will contribute greatly to de-risking Monte Muambe.

Please note, this article will also appear in the sixteenth edition of our quarterly publication.