In this new eBook, Four Corners Helium explores the intricate geology, economic forces, and geopolitical nuances shaping the helium industry, illuminating the path forward for North American helium exploration.

Helium is a vital element required across a range of sectors. It is used in MRIs in hospitals, hard drives, smartphones, supercomputers, and space exploration.

The demand for this indispensable gas is poised for continuous growth, with the Four Corners region of Arizona, New Mexico, Utah, and Colorado in North America emerging as focal points for potential helium prosperity.

The Four Corners region’s Colorado Plateau hosts extensive helium source rocks dating back over 1.6 billion years.

These source rocks are overlaid by thousands of feet of sedimentary deposits spanning the past 480 million years, offering numerous reservoir possibilities for economically viable helium accumulation.

With 400 years of combined experience and expertise committed to finding and producing helium reservoirs, Four Corners Helium is poised to advance helium reservoirs in one of the most prospective regions on Earth for helium exploration.

The importance of helium exploration

What does the helium subject mean to you? Are you a casual observer and want to know if little Jimmy, depending on your location, can justify the expense of the annual birthday balloon euphoria?

Do you trade on the ASX, TSX, or AIM markets, looking for the next (or 1st) ‘winner’? Are you a doctor, nurse, astronaut, welder, nuclear physicist, or chip manufacturer, or merely an avid reader?

Let’s just say most of you use a smartphone, and living without planes, trains, and automobiles has not crossed your mind.

Yes, this itsy-bitsy, non-toxic, non-flammable, and (mostly) irreplaceable helium molecule should have your attention. The United States’ once mighty Federal Helium Reserve will soon be owned by (Germany-based) Messer Group. Unknowns abound, notwithstanding the reserve is ~90% depleted.

Are there supply-side silver bullets waiting in the wings to offset the dissipating reserve? Where is the most promising sector in the US?

Let’s dive deeper.

Conventional versus non-conventional helium exploration

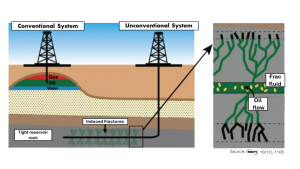

From ~1984 to ~2000, Mitchell Energy utilised blue zone persistence to perfect a safe technology to create permeability pathways in otherwise tight, hydrocarbon-bearing rock.

By creating artificially induced microfractures (aka fracture stimulation), George Mitchell revolutionised the world’s energy business and propelled the United States into its present position of being the largest oil producer in the world (Fig. 1).

Fast forwarding, hydraulic fracturing (fracking) has become a Godsend for the United States in terms of significantly reducing its dependence on OPEC oil and dramatically reducing CO2 emissions by replacing coal-fired energy generation plants with natural gas-fired plants.

As for the latter, the Oil and Gas Industry has known for decades that the utilisation of natural gas was the natural transition away from fossil fuels, but unfortunately, disinformation campaigns have prevented this concept from migrating into the mainstream.

But pendulum swings are not without consequences. The ‘art’ of discovering conventional gas deposits – permeability-prone sandstone and carbonate reservoirs which can include helium – has been replaced by engineering-driven oil and gas ‘farming’.

Scores of old-school, proven hydrocarbon explorationists have either moved into the unconventional realm or retired due to the inability to find drilling capital. The talent pool for efficient conventional helium exploration has dropped precipitously – investors beware.

The fundamentals

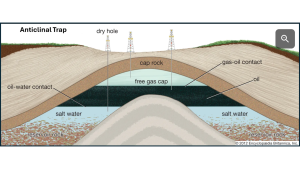

More than three decades before George Mitchell was born, the Anticlinal (drill on a hill) theory ruled the day (Fig. 2), followed by explorationists utilising gravity and magnetic surveys, followed by ten decades of amazing breakthroughs in seismic technology.

More recently, advancing petrophysics (quantifying the rock fabric and fluids), applied geochemistry, and reservoir modelling utilising geo-mechanical software and machine learning have become keys to success.

Chasing helium via the drill bit is like exploring natural gas, although the source and seal are more important.

Helium’s relative minuteness compared to a methane molecule requires helium host rocks (sandstones/carbonates) to be capped by a formation with negligible permeability. Nothing in the subsurface strata prevents it from eventually finding a home in the heavens, but certain rock layers slow it down better than others, including unfractured granites, evaporites, dense limestones, hard shales, and hard clays – and their metamorphic counterparts.

Helium generation involves the radioactive decay of Thorium and Uranium-rich buried granites or minerals in Cambrian-Devonian clastics.

Compared to the relatively rapid expulsion of C1-C4 molecules from buried organic-rich shales and mudstones, alpha decay requires hundreds of millions of years.

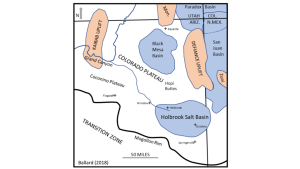

As basins subside, laterally migrating helium (and nitrogen) molecules lead the pack of expulsing gases, eventually becoming concentrated on basin margins (Brown, Cammack).

Geology matters

Today’s helium exploration can be broadly subdivided into two major categories: traps with evaporitic (salt/anhydrites) seals and traps without evaporitic seals (tight clastics and carbonates).

Non-evaporitic fields can have exceptional economics when helium accumulates at anomalously shallow depths (800-1,200’). Considering the lower bottom hole pressures at these depths, even hard shales can act as seals.

An excellent example is the prolific Pinta Dome and Navajo Springs accumulations located in Arizona’s Holbrook Basin (Fig. 3). With helium percentages ranging from 5% to 7%, these conjoined fields produced ~700 million cubic feet of helium from a rather limited area (less than seven square miles). Several operators have aggressively sought to duplicate the 1960s/70s Pinta/Navajo lucrative economics, but to date, Mother Nature has been uncooperative.

Fields with thick evaporitic seals were born from large ancient water bodies which evaporated over millions of years, forming salt layers reaching several thousand feet in thickness and extending laterally up to several thousand square miles (e.g., the Akah formation in the Paradox Basin).

A notable modern-day example is the highly saline Great Salt Lake in Utah. (But take it from me – avoid taking a dip in this lake with any recent cuts or abrasions).

Mega helium fields include Hugoton, LaBarge, and North Field in Qatar. These three monsters – representing over 75% of global helium production – all have evaporitic seals. They also have dolomitic reservoirs as a common thread.

Dolomites rock

The next time you’re snorkelling with dazzling tropical fish on a bustling reef, remember that this collection of skeletoidal organisms will eventually become a homogeneous, dense limestone.

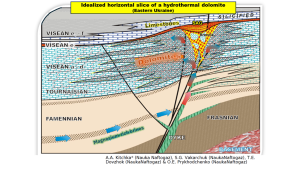

Limestones represent 10% of all sedimentary rock, but over time, approximately one-fifth of this dense substrate diagenetically alters to dolomite – an explorationist’s dream. The prevailing enhanced porosities and permeabilities from this conversion can result in production flow rates exceeding 50 million cubic feet of gas per day, leading to reservoirs becoming economical with helium concentrations well below 1%.

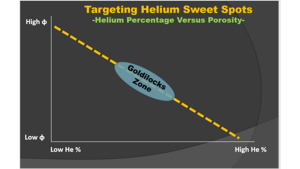

High helium percentages can be headline-grabbing, but if the gas comes forth in a trickle, the party balloon quickly deflates. Fig. 4 provides a hypothetical relationship between helium concentration and rock properties.

It’s intrinsically reasonable to conclude that tighter rock captures minuscule helium molecules more readily than porous rock.

Since drilling subsalt wells is capital-intensive, the interrelationship between rock fabric (permeability and porosity) and helium concentration is critical to success. The golden chalice is finding the perfect combination of moderate porosity/permeability, moderate helium percentage, and moderate drilling costs.

In conclusion, strategically timed paleostructures consisting of dense dolomites sealed by impermeable formations and situated near granitic rocks rich in helium sources offer optimal prospects for helium exploration.

Did someone say Paradox Basin?

The Paradox Basin

Following Colonel Edwin L Drake’s 1859 groundbreaking (pun intended) oil discovery in Titusville, Pennsylvania, it was not until 1891 that hearty oil hunters began seeking their oil and gas fortunes in the 33,000 square mile western United States Paradox Basin (Fig. 5). Similar in size to the State of Indiana, the Paradox Basin first struck crude oil in 1908, but it wasn’t until the mid-50s that SE Utah’s massive Aneth field was discovered. This super-giant oil pool has an estimated 900 million barrels of ultimate recovery.

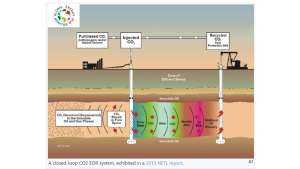

Three decades later, the next Paradox Basin super-giant discovery was made at McElmo Dome field in SW Colorado. McElmo is estimated to contain almost 18 trillion cubic feet of CO2, and since the mid-80s, has been piping the CO2 to West Texas for injection into depleting oil fields for enhanced oil recovery (EOR, Fig. 6).

It’s estimated that 3-5 billion barrels of additional crude could ultimately be recovered by way of CO2 floods. Good, bad or ugly – it’s a fact that the world’s energy transformation will not happen overnight.

Not to be outdone, Doe Canyon Field, 12 miles north of McElmo Dome, has established itself as the 3rd largest helium discovery in North America since SW Wyoming’s LaBarge-Shute Creek field came online in 1986. Industrial gas giant Air Products, teamed with Kinder Morgan, was quite comfortable not tooting their own horn, while quietly producing almost 10% of the United States helium production by early 2016 (~230 million cubic feet/year). Little-known Doe was also cranking out almost 5 billion cubic feet/month of CO2 at the time, utilising the first industrial-scale plant in the world capable of extracting helium from a CO2-dominated gas stream.

Proof of concept analogs are essential risk modifiers for explorationists; therefore, Doe Canyon became a catalyst for Colorado-based Four Corners Helium, LLC (FCH) to explore helium in the Paradox Basin.

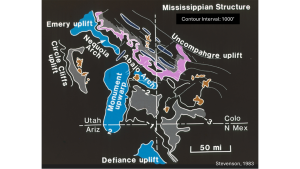

Having mapped almost nine million acres of helium-sourced reservoirs in the Southern Rockies, FCH developed a methodical procedure for exploring this prolific basin, particularly focusing on Mississippian-aged rocks (359-323 million years ago).

Why the Mississippian?

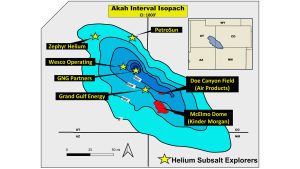

First and foremost, the Mississippian ‘Leadville’ Formationin SE Utah (equivalent to the ‘Madison Formation’ at ExxonMobil’s LaBarge Field) lies directly underneath the aforementioned uber-sealing Akah formation (Fig. 7).

In addition, whether it’s purely matrix-driven high porosity or hydrothermally enhanced porosity (rock influenced by hot, magnesium-enriched brines; Fig. 8), flow rates from Mississippian-aged dolomites can range from four to 70 million cubic feet of day, depending on your location in the basin. Now consider these same vugular, high-porosity dolomites sitting atop the uplifted Colorado Plateau, which contains thousands of square miles of shallow fractured granites rich in thorium and uranium – the pistons for radioactive decay and voluminous helium generation.

The final piece of the Paradox puzzle

Structure. Proterozoic rifting (2.5 billion to 542 million years ago), accretion, and basement fracturing precipitated enormous ‘catch’ areas for migrating gases.

The most significant paleofeatures in the Paradox Basin include the NW/SE trending Abajo Arch (east of Monticello, Utah) and the Nequoia Arch (NE of Hanksville, Utah) (Fig. 9). The Abajo Arch, the larger of the two, has an aerial extent of over 250 square miles at Mississippian and Devonian depths. Gases have been migrating into the pore spaces of this paleoclosure for over 325 million years.

The BIG picture for North America

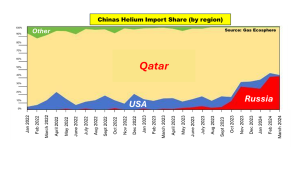

Beginning in September 2023 to the present, China’s helium imports from Russia have risen from negligible to 40% (Fig. 10). Who suffered the largest loss of China’s helium market share? Qatar.

ExxonMobil took the second-place prize. Gazprom’s Eastern Siberia $~11bn helium venture fought major delays from a January 2023 fire and explosion, but now its exports are exploding.

Befitting their China/Russian omni-alliance and aided by China’s rapid expansion of iso-container availability, the global helium supply/demand equilibrium has taken a tilt. As Phil Kornbluth of Kornbluth Helium Consulting, plus gasworld Magazine, has pointed out many times, it’s only been a matter of time before Russia flexed its muscle.

What’s next for Qatar?

Complicated answer.

Many North American helium operators could ultimately find it difficult to compete with Qatar’s off-load prices since helium is merely a by-product of their massively profitable liquified natural gas (LNG) business. This means that their finding and developing costs (F&D) for helium are negligible.

But Qatar is not without challenges. How long willthe Suez Canal be destabilised due to Houthi rebels (for that matter – potential direct attacks by Iran in the future), causing tankers to be diverted around the Cape of Africa? The incremental addition of ~3,500 miles of tanker travel amounts to a total of ~12,500 miles at sea (Fig. 11).

In addition, the value for LNG has recently dropped by over 50%, and LNG price forecasts are bearish for the next ten years: Could this possibly scale back Qatar’s LNG exports, thus potentially reducing the volume of their helium exports? Lastly, Qatar has encountered intermittent icy relations with Saudia Arabia, the United Arab Emirates (UAE), Egypt and Bahrain over the years, including a blockade of Qatar from 2017 to 2021.

Hopefully, that’s a distant memory.