Establishing EU domestic rare earth supply chains is a fundamental requirement, argues Dr Nabeel Mancheri, Secretary General at (REIA). Here, he outlines their position paper in support of proposed updates to ETS Directives AM-353 and AM-1189.

The goal of establishing EU domestic rare earth supply chains is becoming an ever-increasing need and will be a fundamental requirement for energy-saving applications. We firmly believe these supply chains can be achieved if included in the European Union’s Innovation Fund (IF).

The IF is one of the world’s largest funding programmes to demonstrate innovative low-carbon technologies and is perfect for all energy-saving applications. REIA’s position paper in support of a proposed update to the Emissions Trading System (ETS) Directives AM-353 and AM-1189 to include the domestic production of rare earth permanent magnets in the EU is now urgent.

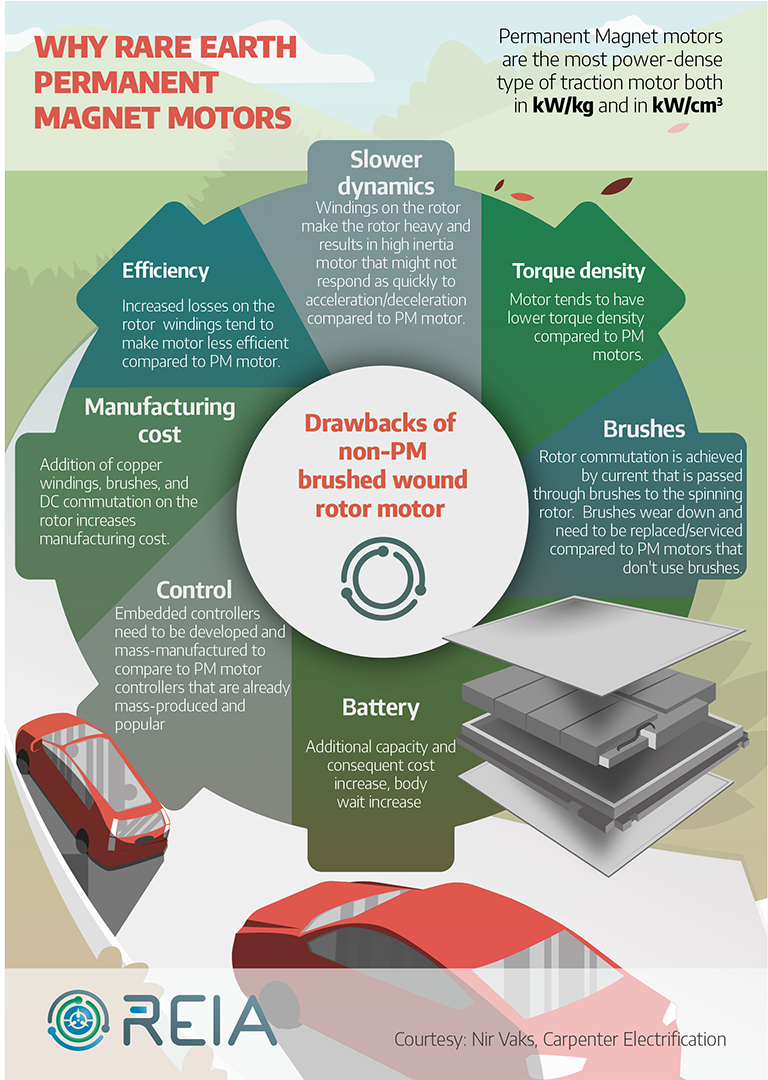

Substituting rare earths is easier said than done, as rare earth permanent magnets in the drivetrain motor of EVs yield the efficiencies that make the EV’s battery economics work.

There is no shortcut to resolving the critical minerals supply chain conundrum – it takes a holistic approach of including all minerals and heavily incentivising the processing of primary and recycled materials in the EU. If one type of critical mineral (e.g. rare earths) is not addressed appropriately, then the policy prescription for battery materials – that has been successful so far – becomes inadequate.

Why rare earth permanent magnets are practically difficult to substitute for EVs?

Rare earth permanent magnets (REPMs) provide the most energy-efficient technology solution for the drivetrain motors of EVs. For an EV to achieve a given range without using rare-earth permanent magnets in the drivetrain motor design, the energy loss will be higher. Therefore the battery will have to be around up to 30% larger.

What is the required magnitude of rare earth supply for European EVs?

For the average passenger EV to be competitive enough in terms of performance compared to the average passenger internal combustion engine (ICE) vehicle, it would require 2kg of rare earth permanent magnets used in its drivetrain motor. In effect, to satisfy the EU’s target of 30 million EVs manufactured and used by 2030, there is a demand of approximately 60,000mt cumulatively for rare earth magnets (60,000mt x 31.5% = ~19,000mt of which is rare earth material) only for European EV manufacturers.

What prevents the private sector from proceeding with large-scale rare earth projects?

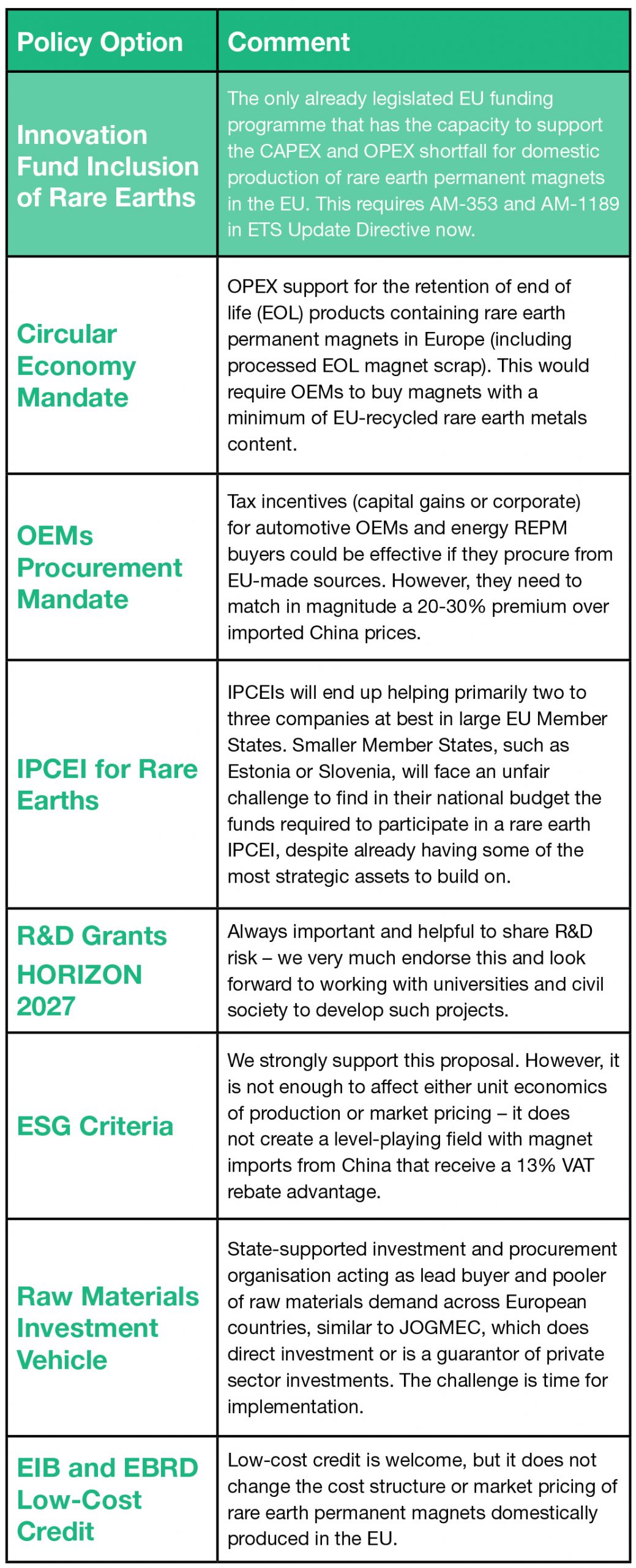

In short, the lack of the correct type and magnitude of EU funding options for both CAPEX and OPEX to create a meaningful level playing field will prevent the private sector from proceeding further.

When it comes to developing policy that shapes supply chains and mobilises the required private capital for establishing local production of rare earths, three risks require management:

1 Market risk management: Addressed by the European Green Deal, setting expectations for industry to converge to the EU’s 2050 climate targets;

2 Technology risk management: Addressed by the EU HORIZON funding programmes incentivising innovation and R&D collaboration; and

3 Financial risk management: Not addressed adequately yet for rare earths. For the European automotive manufacturing transition from ICE to EVs to be successful and for the corresponding automotive manufacturing jobs to be safeguarded instead of being offshored, the EU needs to ensure domestic resilient supply chains of critical raw materials.

Two primary technologies involved require critical raw materials: batteries and drivetrain motors.

- The European Battery Alliance has addressed the batteries’ lithium/cobalt/nickel supply chain issues. The solution was an IPCEI (Important Projects of Common European Interest), which allows Member States to lever their national budgets to provide direct state aid to strategic assets for the EU’s broader benefit; and

- The drivetrain motors’ rare earth permanent magnet supply chains, however, are a much more challenging case. Unlike the case of batteries, the supply chain challenge and the corresponding solution do not lie proportionately within Member States. The EU Member States that are hosts to most automotive jobs tend to be larger countries, whereas the EU Member States that are host to the EU’s most strategic rare earth assets tend to be smaller. Therefore, applying the same IPCEI policy prescription for rare earths might not work that successfully, as smaller EU Member States that have the most strategic rare earth assets do not have the ability to leverage their national budget to tackle the financial risk of the solution they are host to, in order to solve the problem that is located in larger Member States.

What it takes to address the financial risk for rare earth business cases in the EU

The financial risk would benefit from financial support for EU domestic rare earth supply chains in the magnitude and unique ability of the EU Innovation Fund to support CAPEX and OPEX. It takes support of this kind to unlock the business cases of such strategic assets in smaller EU Member States. This funding tool has the unique ability to support both CAPEX and OPEX with sustainability-linked outcomes.

Policy options under consideration

The financial support of the Innovation Fund unlocks large-scale business cases to address the policy challenge as swiftly as possible.

Expanding the scope of the Innovation Fund

Expanding the scope of the Innovation Fund is a critical legislative step for establishing a competitive European rare earth separation and permanent magnet manufacturing supply chain.

Rare earth strategic assets in the EU Member States

Currently, Estonia has the only industrial-scale commercially operating rare earth midstream facility in the ‘Western world’. Unless the right economic incentives are created to develop magnet-making plants in Europe, European automotive, wind turbine and industrial pump manufacturers face consequential supply chain risks. To accomplish this expansion, there is an urgent need for both large-size CAPEX support and OPEX support to develop an independent rare earth value chain in the EU. There is the policy conundrum:

- The current EU grants for CAPEX cannot add up to the scale required, and the Just Transition Fund allocations are capped; and

- The Innovation Fund is the only grant mechanism that has legislated OPEX support.

Why an IPCEI alone cannot help in this case

In effect, the IPCEI is a competition law exemption for EU Member States to provide direct state aid to industries of strategic European interest. Without this IPCEI exemption, state aid is not allowed. However, this direct state aid comes from the national government budgets, not from EU sources. This works well for the large-budget Member States (e.g. Germany, France, Italy, Spain etc.), but it is a very steep challenge for Member States with smaller (or constrained) national government budgets that have already established strategic assets of rare earths to build on (e.g. Slovenia and Estonia).

Expanding the EU Innovation Fund offers a quick, win-win, and politically non-contentious solution

The EU Innovation Fund has the uniquely legislated exemption to allow for both CAPEX and OPEX funding. The rare earth industry does not qualify for the EU Innovation Fund because the growth in our industry is driven by EV manufacturing – i.e. green mobility. By contrast, the EU Innovation Fund’s evaluation criteria are constrained by the current Cost Fraction formula for GHG Avoidance.

Two proposed amendments to the ETS Directive, currently under consideration at the Committee on the Environment, Public Health and Food Safety (ENVI) in the EU Parliament are:

1 AM-353: www.europarl.europa.eu/meetdocs/2014_2019/plmrep/COMMITTEES/ENVI/AM/2022/03-22/1245924EN.pdf

2 AM-1189: www.europarl.europa.eu/meetdocs/2014_2019/plmrep/COMMITTEES/ENVI/AM/2022/03-22/1249629EN.pdf

For media requests or to meet with REIA’s members to discuss the reasons to support the proposed AM-353 and AM-1189 within the ETS Directive Update, please contact Dr Nabeel Mancheri using the details below.

Dr Nabeel Mancheri

Secretary General

Global Rare Earth Industry Association (REIA)

nabeel.mancheri@global-reia.org

www.global-reia.org

https://www.linkedin.com/company/gloreia/?originalSubdomain=be

https://twitter.com/REIA_global

Please note, this article will also appear in the tenth edition of our quarterly publication.