Roger Miksad, Executive Vice President and General Counsel of Battery Council International, discusses the key priorities to consider to create and maintain North America’s circular battery economy.

Operating for almost a century, Battery Council International (BCI) is a not-for-profit trade association representing the battery industry in the United States and North America. The organisation, which brings together leading battery manufacturers in North America and other major players from around the world, aims to support its members’ efforts to create and sustain a successful circular economy for batteries; provide members with the most up-to-date information on marketing and technical developments; and share updates on regulatory and legislative initiatives that could affect the global industry.

In conversation with The Innovation Platform, Roger Miksad, Executive Vice President and General Counsel of Battery Council International, outlined the details of battery metal exploration and development in the US and North America and explained how BCI works to support a circular economy for batteries.

What does the current US and North American battery metals landscape look like?

Currently, much attention is being paid to what are referred to as ‘critical minerals’ when it comes to battery metals. These are minerals which federal law defines as being both “essential to the economic or national security of the United States” and which “have supply chains that are vulnerable to disruption” – typically due to the lack of a robust domestic mining and/or primary processing or recycling capacity. By definition, this leaves out those minerals that have been demonstrated as essential to the economy, but which have an existing robust domestic supply chain.

These other minerals, which we prefer to call ‘strategic minerals’ are no less critical to the US economy, and are perhaps more important as they form a strong and reliable base on which all the solutions for all battery energy storage needs can be built.

The lead battery industry has built a robust and reliable domestic supply chain for the raw materials needed to manufacture batteries, and has essentially achieved a complete circular economy, with 99% of used lead batteries recycled to generate the raw materials to manufacture new batteries. That unparalleled majority-domestic supply chain ensures that the primary raw input material for lead batteries is readily available, and insulated against major international supply chain interruptions.

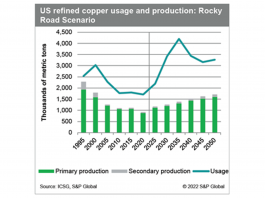

According to the U.S. Geological Survey, domestic US recycling of used lead batteries and other lead-bearing scrap provided approximately 59% of the domestic demand for lead in 2022, of which battery production accounted for 92% of demand. More than 60% of the imported lead came from Canada and Mexico, where the largest facilities are owned by or have long-term relationships with US companies. All of the lead produced in the US, and most of the lead produced abroad, comes from used lead batteries.

This level of supply chain security is unmatched by other battery chemistries. For example, the U.S. Department of State data shows that the vast majority of lithium used in batteries comes from Chile, Argentina, Bolivia and Australia, with some being extracted and produced in China. The likelihood of continued US dependence on lithium from foreign sources remains high for the extended future.

Has this outlook changed since the Biden-Harris Administration’s drive to secure a domestic supply chain for critical minerals?

Regarding the Biden-Harris Administration priorities for critical or strategic materials like lead, BCI shares the objective of the U.S. Department of Energy (DOE) to ensure a strong domestic supply chain and manufacturing base for batteries.

It is in America’s national interest that a vibrant domestic energy storage industry exists to provide the most efficient energy storage products at the most reasonable total life cycle cost. Such a strategy must include a broad range of battery chemistries and technologies, with the lead battery industry as an important partner in achieving that strategic objective.

The DOE is tasked to develop strategies to reduce America’s reliance on imported critical materials, and to increase America’s energy storage manufacturing independence through increased domestic production and recycling, and more efficient use of raw materials in energy storage units. The lead battery industry’s domestic strength is poised to act as a bulwark against the supply risks posed by other import-dependent technologies. It is imperative that Congress and the Administration recognise that strength, and properly invest in and encourage the lead battery industry.

What issues do decisionmakers in the industry and government officials need to consider moving forward to strengthen the US and North America’s battery metals supply chains?

Lead-based batteries are based on more than a century of research and development, and that R&D investment continues. On the near horizon are novel designs and lead-based chemistries which will provide solutions which could rival other chemistries. But those advances require investment from industry, government, academia, and other stakeholders. BCI cautions against the temptation for government-sponsored research to pick ‘winners and losers’ when a research programme is in the planning stage in support of a policy objective.

The U.S. Department of Energy (DOE) should also be investing in energy storage solutions – such as advanced and future lead batteries – which do not rely on those critical materials, and which already have substantial domestic manufacturing capacity and raw material supply chains. Such technologies likely provide a faster and more predictable path towards reducing America’s reliance on foreign-based critical materials by leveraging existing domestic supply chains.

How important is innovation in strengthening battery materials supply chains?

The US has committed to invest tens of billions of dollars in batteries to help secure a green future and a sustainable electric grid. BCI works closely with DOE experts and staff to promote federal investment in the basic science R&D that will produce the next generation of lead batteries. BCI is also actively engaged with legislators on Capitol Hill to ensure that our members’ batteries are part of the nation’s future energy policies.

What are the priorities of BCI in 2023?

In 2023, the opportunities for battery applications have the potential to grow significantly, despite significant regulatory headwinds in North America. Battery Council International is resolved to work on behalf of the industry to ensure a vibrant 2023.

In 2022, we saw the re-emergence of significant regulatory challenges for domestic battery manufacturing, with a level of regulatory attention to lead not seen in decades. Significant regulatory activities include the Occupational Health and Safety Administration’s (OSHA) efforts to rewrite the occupational standards for lead; the Environmental Protection Agency’s (EPA) effort to tighten air emissions standards for battery manufacturers and recyclers; a potential update to the National Ambient Air Quality Standards; and Superfund soil cleanup standards. In addition, a review of lead under EPA’s Toxic Substances Control Act (TSCA) is coming, and we will continue to see individual states take their own actions. BCI advocates in all these areas on behalf of the industry.

Roger Miksad

Executive Vice President and General Counsel

Battery Council International

https://batterycouncil.org/

https://www.linkedin.com/company/battery-council-international/?trk=company_logo

https://www.facebook.com/Battery.Council/

https://www.youtube.com/channel/UCl1iRvnBWtLjj19t88pGTfA

Please note, this article will also appear in the thirteenth edition of our quarterly publication.