With lithium exploration ramping up in Canada and Spain, the resource developer digs in to advance its world-class Kvanefjeld rare earths deposit in Greenland and strengthens its team.

While the lithium sector has had a bumpy ride recently, the long-term prognosis for the metal remains extremely positive, given its strong market fundamentals.

Lithium has emerged as a critical component in producing rechargeable batteries for electric vehicles and renewable energy storage systems as the world transitions towards a cleaner and more sustainable future.

The global shift towards electrification has been driving a growing demand for lithium-ion batteries as countries aim to reduce their carbon footprint and combat climate change.

With its unique properties and robust long-term market fundamentals, lithium presents a compelling opportunity for exploration companies like Australian-based Energy Transition Minerals Ltd (ASX: ETM).

Acquisition of two lithium exploration projects in Québec

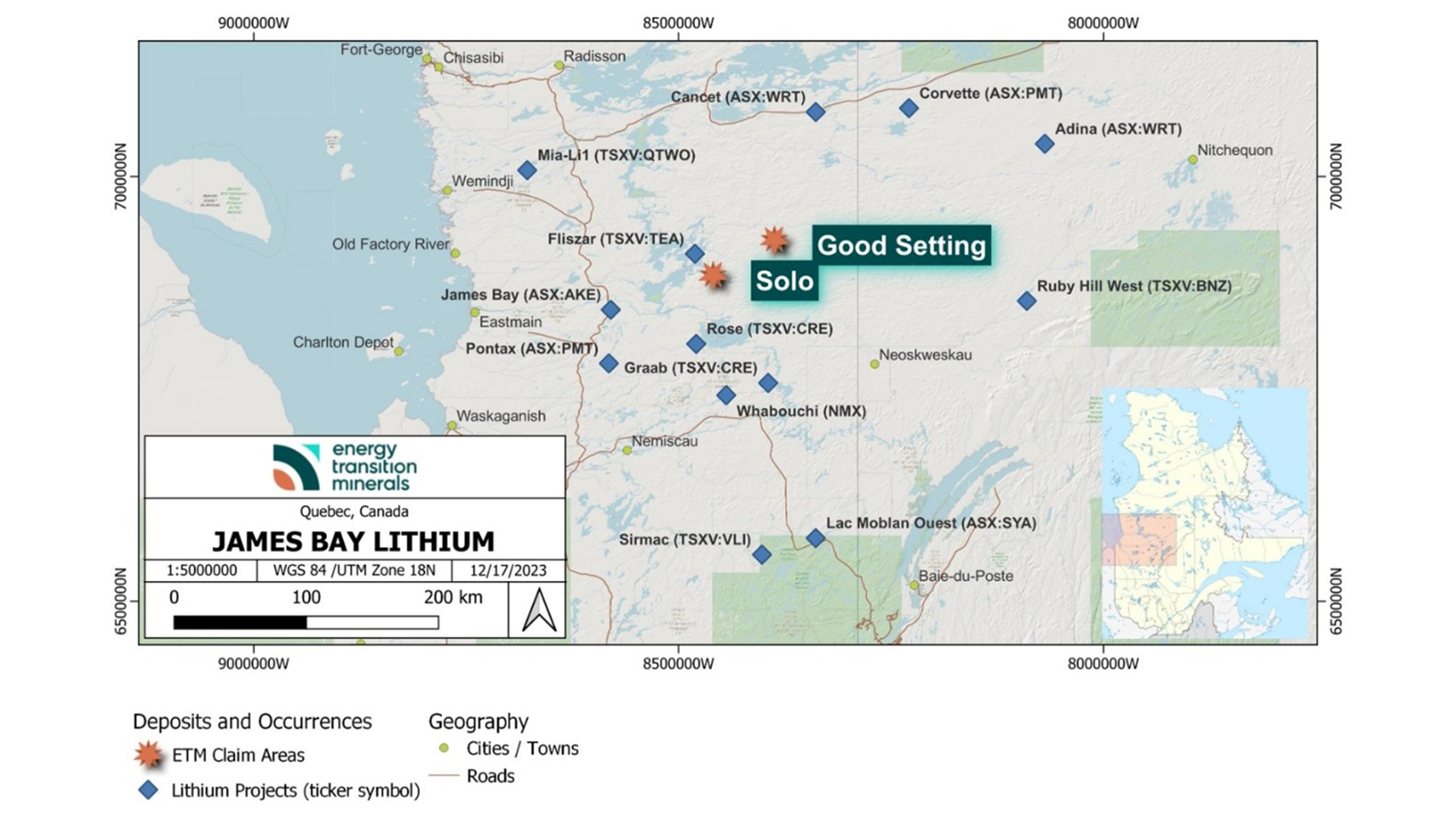

The Melbourne-headquartered company recently announced the acquisition of two exciting lithium exploration projects in Québec, located within Canada’s highly prospective James Bay area – one of the world’s premier emerging lithium provinces.

The addition of the Solo and Good Setting Projects to ETM’s global portfolio marks a significant milestone for the company as it expands its operations into this mineral-rich region, known for its recent world-class lithium discoveries.

Benefits of the James Bay area

The James Bay area in Québec, has gained significant attention in recent years due to its exceptional potential for large-scale lithium deposits. The region is characterised by its favourable geological settings, including pegmatite intrusions, which are known to host high-grade lithium deposits.

Notable lithium discoveries in the area, such as the Whabouchi and Rose Projects, have demonstrated the region’s immense potential and have attracted the interest of numerous exploration and mining companies.

Energy Transition Minerals’ decision to explore lithium in the James Bay area is underpinned by several key competitive advantages – including established infrastructure, a supportive regulatory environment, and access to skilled labour.

The James Bay region benefits from well-developed infrastructure, including road access, power lines, and proximity to deep-water ports. This high-quality infrastructure network facilitates efficient exploration activities and reduces the costs associated with project development. On the policy front, the Québec Government has implemented favourable policies and incentives to encourage mineral exploration and mining activities in the province.

These policies and a streamlined permitting process create a supportive environment for companies like ETM to advance their projects. Québec also boasts a highly skilled and experienced workforce in the mining sector. The availability of local expertise and services ensures that exploration activities can be conducted efficiently and effectively.

Capitalising on the growing demand for lithium

The commencement of lithium exploration at the Solo and Good Setting Projects represents an exciting opportunity for ETM to capitalise on the growing demand for lithium and contribute to the global transition towards clean energy. With its strategic location, favourable geological settings, and supportive government policies, the James Bay region provides an ideal platform for the company to unlock the potential of lithium and create value for its shareholders.

Earlier this year, the company also announced the commencement of its second drilling programme at the highly promising Villasrubias Lithium-Tantalum Project, located in central-western Spain. This new exploration phase follows the successful initial drilling campaign conducted in Q2 2023, which led to the discovery of significant high-grade lithium and tantalum mineralisation, including intervals grading up to 1.23% Li2O with accessory tin and tantalum.

The new drilling programme will initially comprise up to 2,000 metres of drilling across 14 holes, with a maximum drill depth of approximately 150 metres. The company has engaged Geoplanning, an experienced drilling contractor, to conduct the program using two diamond drilling rigs.

The drilling campaign is expected to span over eight weeks, with assay results to be published progressively as they become available. This second drill campaign is based on the outcomes of an extensive geophysical report, which was developed by TECNICAS GEOFISICAS with the University of Salamanca’s participation, providing valuable insights and targets for the company’s exploration activities.

A comprehensive rehabilitation programme was also prepared as part of ETM’s commitment to sustainable and responsible mining practices. This included sealing drill holes and replanting with native plant species to prevent erosion, control dust, and enhance land stability. ETM has also secured land access agreements with six local landholders, reflecting the company’s dedication to community collaboration and environmental stewardship.

ETM’s local partner, Technology Metals Europe sl (TME), has signed a collaboration agreement with the University of Salamanca and the Spain Institute of Geology and Mining (IGME) to further the development of exploration projects in the region. This partnership underscores ETM’s commitment to engaging with the local community and leveraging regional expertise to advance its projects responsibly.

Kvanefjeld Rare Earth Project

Meanwhile, at the company’s foundational asset, the world-class Kvanefjeld Rare Earth Project in Greenland, ETM has taken decisive action to protect shareholders’ interests by filing a statement of claim with the International Arbitration Court in Copenhagen against the Governments of Greenland and Denmark.

With JORC-compliant resources of over one billion tonnes, Kvanefjeld is one of the world’s largest deposits of rare earth elements (REEs). These elements are crucial for the global energy transition and have the potential to fundamentally change the balance of the global rare earth market.

Given its strategic geopolitical significance, ETM believes that every avenue to advance the project to production must be explored to unlock the enormous inherent value in the deposit for the benefit of all stakeholders. This involves acting on the legal front by activating the dispute resolution mechanism embedded in the licence contract and working in parallel with all stakeholders and strategic partners to find a negotiated path to development while allaying and addressing the legitimate concerns of all parties.

The current legal situation focuses on the progress of the arbitration proceedings regarding whether Act 20 applies to the Kvanefjeld Project. In January 2024, the Arbitral Tribunal, by a majority decision (two out of three arbitrators), ordered GMAS to provide security for the legal costs of the Greenland and Denmark Governments if these governments were to prevail in the arbitration and GMAS was ordered to pay some or all of their legal costs; the company agreed with that order and believes that it has a strong case in its favour.

It is important to note that the Tribunal’s decision on security for costs is an interim decision. It does not ultimately determine any other issue in dispute between GMAS and the two governments.

Engagement in Greenland

In the meantime, ETM has taken steps to deepen its engagement and operations in Greenland, particularly in renewable energy and sustainable development, to support the future development of the Kvanefjeld REE project. This was evidenced recently by the appointment of Svend Hardenberg as the company’s Greenland Strategic Advisor to the Board. Svend is a highly respected Greenlandic businessman and former politician whose role is to help guide ETM’s strategic initiatives, enhance relationships within Greenland, and advocate for the importance of the Kvanefjeld Project as a potential source of critical minerals for the global energy transition.

The company also recently strengthened its board with the appointment of highly experienced international corporate finance and mining executive, Aris Stamoulis, as an Independent Non-Executive Director. With a distinguished career spanning nearly three decades in corporate and structured finance, Aris previously served as Corporate Finance and Executive Director with ASX-listed rare earths company Hastings Technology Metals, where he played a key role as part of the senior executive team in securing finance for the Yangibana Rare Earths Project in Western Australia.

A leader in sustainable mining practices

The appointment brings additional independence and balance to the ETM Board, further enhancing the company’s governance structure. This appointment is a testament to ETM’s proactive approach to ESG and its dedication to maintaining the highest standards of corporate governance. By embracing the recommendations of the ASX Corporate Governance Council, ETM is positioning itself as a leader in responsible and sustainable mining practices.

As the company continues to advance its critical minerals projects, it remains committed to integrating ESG considerations into its decision-making processes, risk management framework, and stakeholder engagement initiatives. ETM recognises that strong ESG performance is not only essential for the company’s long-term success but also crucial in contributing to the global transition towards a more sustainable future.

With this addition to the Board, Energy Transition Minerals is well-positioned to navigate the evolving ESG landscape, meet the expectations of its stakeholders, and deliver on its promise of supplying critical minerals essential for the global energy transition while maintaining the highest standards of environmental, social, and corporate governance.

The company remains focused on developing and financing supply chains for metals and materials critical to the world’s decarbonisation. With exploration projects in Western Europe, North America, and Greenland, ETM is well-positioned to contribute to the global energy transition while adhering to the highest sustainability standards and responsible mining practices.

Please note, this article will also appear in the 18th edition of our quarterly publication.