Gregg Smith, President, CEO and Director of Grounded Lithium Corp., discusses the company’s recent activities as it works to produce ‘best-in-class’ lithium to support Canada’s energy transition.

Grounded Lithium Corp. (TSXV:GRD OTCQB: GRDAF) is a publicly traded, Alberta-headquartered, lithium resource company that supports Canada’s energy transition and is focused on being a ‘best-in-class’, environmentally responsible supplier of lithium in the rapidly developing electricity-powered economy.

The company extracts lithium from the production of subsurface brines in Western Canada. It generates value through a balanced model of exploration, production, and strategic acquisitions of subsurface mineral rights bearing lithium-rich brines.

Compared to conventional hard rock mining, lithium-from-brine, in particular those resources in certain locations in Western Canada, has a much shorter cycle time of delivering product to market given more simpler and faster permitting, significantly less construction timelines, and simpler operational development processes and activities.

Additionally, lithium-from-brine has a much lower environmental impact than hard rock mining, considering there is much less ground disturbance, minimal water consumption, lower carbon emissions related to operations, and no surface tailing ponds. Industry experts estimate that lithium-from-brine operations produce a third of the carbon footprint that spodumene producers do.

The first half of 2023 has been a tremendously busy time for the Grounded Lithium team (Grounded). Building upon the mineral rights acquisition initiatives in 2021 and 2022, the company acquired an additional 33 sections of lithium rights in an asset acquisition to support Canada’s energy transition. The resource evaluation firm Sproule Associates Limited upgraded Grounded’s Inferred Mineral Resource estimate to 4.2MM tonnes of lithium carbonate equivalent (LCE), making it one of the largest stated lithium resource owners in the Province of Saskatchewan.

Our geological and engineering analysis brought us to this area of Saskatchewan for optimising high-deliverability lithium-rich brines in an area with the lowest inherent projected capital costs. We did not choose Saskatchewan, so much as the compelling resource potential brought us to Saskatchewan. Saskatchewan is a highly-ranked regulatory jurisdiction that is known for supporting its resource industry, providing benefits to the entire province.

The company also initiated a lab pilot study in 2022 by evaluating six Direct Lithium Extraction (DLE) companies and then selecting two candidates to independently test lithium recovery from large volume brine samples obtained from our well that was drilled in the summer of 2022. That process successfully concluded recently with the selection of Koch Technologies Solutions (a Koch Engineered Solutions company and part of the wider Koch Industries conglomerate) as Grounded’s lithium extraction company of choice.

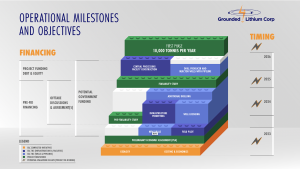

Finally, the company is in the process of finalising a Preliminary Economic Assessment (PEA) for our initial First Phase 10,000 tonne of LCE/year programme that is included in our forecasted multiple phases of our Kindersley Lithium Project (KLP). The company’s PEA is scheduled for release in the coming weeks. All of these recent essential operational milestones create the foundation for building a ‘best-in-class’ lithium resource company.

Our go-forward path

Post-PEA, Grounded looks to quickly move into more of an operational-focused phase in its development and acceleration of Canada’s energy transition. There are four focus areas that the company has identified as it prepares to initiate a field pilot:

- Delineate project area to support key technical parameters which are critical to driving superior economics;

- Selection of a DLE Technology;

- Refine a phased development approach; and

- Enhance the team with operational excellence.

Quality resource + low-cost structure = superior project economics

Resource development projects with resilience to economic variables provide superior economics to the shareholder. Hence, we selected our area with the intent of defining quality resource along with factors that provide the lowest cost structure. The various characteristics of the company’s Kindersley Lithium Project position us to be amongst those entities with the lowest capital cost per installed production capacity within the industry.

Our Kindersley Project Area geology provides a fundamental basis of a sufficiently high grade of lithium concentration (ie. 70 – 84 mg/l) in the Duperow formation that, when combined with robust well deliverability, drives economic results worthy of significant capital investment. The high lithium concentration tests conducted in the lab pilot confirmed the company’s proprietary geological models as to the trapping mechanism of the Duperow formation for lithium due to the aerial extensive porosity and thickness of the formation.

As mentioned, well deliverability is as important, if not more important, when it comes to a viable sub-surface lithium from brine operation. The flowing pressures and brine production data from our first well confirms our mapping expectations of strong brine deliverability (ie. 19,500 bbl/day capacity per well) in the production process by utilising large electric submersible pumps. This is a substantial well rate that we believe can be sustained for many years to come and was a key reason for selecting the area we wished to concentrate.

The relatively shallow vertical depth of the Duperow formation in the Kindersley area is typically half the depth as compared to the vertical depths of other target lithium zones within the Western Canadian Sedimentary Basin. The shallow depth provides the competitive cost advantages of faster drilling times and the ability to use smaller, lower horsepower drilling rigs.

The Kindersley area also allows for multi-seasonal operational surface access in an area with an abundance of services and experienced resource workers. These factors all play a crucial role in Canada’s energy transition.

With no contaminants such as hydrocarbons or hydrogen sulphide in the geological formation in this area, our pre-filtering process of the brine is minimalised. Therefore, we benefit from the savings achieved in both capital and operating costs related to remove these contaminants.

Without the need for expensive prefiltering, this also facilitates our plan for a phased development approach with a simplified and modular facility design. Initial phases funded subsequent phases of growth and continuous learning to improve operations.

Successful economic resource development projects must ‘check-the-boxes’ on several fronts. This checklist of sorts was a major determinant in the early positioning of our company, and we believe it sets the stage for a viable lithium-producing company.

Grounded ultimately anticipates moving our project forward with the permitting and licensing process for wells, pipelines, and facilities in this area in 2025. The Saskatchewan regulatory body licenses numerous wells and facilities every year for energy operations, and their process expeditiously manages approvals of licences.

The Fraser Institute recognises Saskatchewan as an industry-friendly jurisdiction that looks to support the emerging lithium industry and Canada’s energy transition. Permitting and licensing processes in the province compare very well against other jurisdictions in North America.

Our experienced team has also licensed hundreds of operations within the province and anticipates a similar expeditious process from the supportive provincial regulator and the local community. The typical reduced cycle time involved with the licensing and permitting process in Saskatchewan facilitates our overall project cost savings and rapid progress towards a commercial project.

Permitting risk is a major perceived risk in the mining industry and is justified by many examples found around the globe. Regulatory/permitting risk is expected to be minimal in the company’s jurisdiction, representing a major competitive advantage to that of other lithium mines internationally.

DLE technology

One of the company’s founding principles rests on our view that the most efficient use of both capital and time in choosing an extraction technique for lithium-from-brine was to licence an existing DLE technology rather than developing a proprietary methodology. Our team’s expertise lies in resource development and not in the development of proprietary technology.

Currently, there are over 50 companies with brilliant teams of scientists and engineers developing variations of DLE. We prudently chose to focus both time and capital resources in leveraging from that extensive base of experience.

Surrounding our core team with industry experts focused on Canada’s energy transition, we can accurately assess the merits and capabilities of the numerous technology companies that invest extensive manpower and capital resources to create the optimal commercial DLE application for our brines.

The basic DLE method involves the use of a highly selective absorbent to extract lithium from brine water. The extracted solution is then polished of impurities to yield battery-grade lithium product suitable for sale in the global market for batteries. By rejecting impurities, a higher-quality lithium product is achieved.

Grounded contracted Hatch Ltd. to initially assist in the evaluation of DLE alternatives in partnership with our internal expertise. The process involved the evaluation of six different DLE company candidates after an initial industry scan. Out of this process, the company selected two candidates to test its brine acquired from a well we drilled in 2022. These two candidates conducted extensive testing in their respective labs over the course of H1 2023.

Koch Technology Solutions (Koch) was one of these DLE companies that conducted a lab pilot, utilising its Li-ProTM technology. Koch provided superior results for both the recovery of lithium and the rejection of unwanted ions. The company selected Koch to use their DLE technology in a field pilot programme to determine longer-term results forecasted to be in operation by the end of 2023.

Koch demonstrated to us that a large, internationally recognised company can still proactively and nimbly develop a new business model. This, combined with the significant resources that the larger Koch organisation can bring to bear on a large project, creates numerous partnership possibilities to enable the phased project to be achieved as quickly as possible to meet major market demands.

Phased development

Grounded elected to implement a phased-development design, in much the same way all large-scale energy projects proceed, which provides us with an early generation of cash flow, minimises a number of operational and financial risks, and provides the continuous opportunity to improve our operational processes.

The initial phase design foresees a capacity for 10,000 tonnes of LCE/year, with the proceeding planning of additional phases throughout the company’s land base. The first phase will include the drilling of 24 production wells, six disposal wells and 54km of pipeline to connect the brine production from the wells to a central processing facility.

Given the strong deliverability characteristics of the reservoir, we forecast these wells can maintain a consistent flow rate to sustain our 10,000 tonnes of LCE/year production level for ten to 20 years, and the occasional addition of another inexpensive producing well fully sustains ongoing production levels. We believe this approach will be extremely attractive as well for potential off-take arrangements, of which the company is already beginning to conduct with various parties.

The Grounded team

Grounded is managed and operated by a proven team of resource development professionals who have extensive experience and expertise in building companies through development programmes and creating value for shareholders.

Our team includes professionals in geoscience, engineering, land management, finance and executive management who are applying their respective extensive experience into building a ‘best-in-class’ Canadian lithium company.

The team also benefits from the stewardship of a very experienced board of directors with extensive resource industry, financial and directorship experience in providing guidance to management and stewarding shareholder interests to fuel Canada’s energy transition.

We further note that our management team invested in the company at every level of financing to date, and we retain the intention to participate in all future financing rounds. This team is aligned with its shareholders as we clearly have ‘skin in the game’.

Our core team will add appropriate personnel to move the project forward at each stage in a responsible manner. In the near term, that will consist of appropriate staffing to achieve the objective of the field pilot.

Driving Canada’s energy transition

From the outset, the Grounded team relied on its experience and strategic planning to pave a pathway towards building a best-in-class lithium resource company in Canada. The company selected a DLE technology with a clear path to commercialisation, allowing the company to focus financial resources on the delineation and development of the underlying resources.

On that note, the company believes its project area addresses all the fundamental requirements for a successful economic project, namely, low-cost, consistent reservoir performance. These technical characteristics, when stewarded by a team knowledgeable in all aspects of resource development, create an environment poised to create shareholder return in a market seemingly insatiable for critical minerals.

Please note, this article will also appear in the fifteenth edition of our quarterly publication.