To capitalise on the significant potential of nuclear energy, the industry must address cost challenges associated with small modular reactors to compete with alternative low-carbon sources.

This is the principal finding of the latest Wood Mackenzie report, ‘The nuclear option: Making new nuclear power viable in the energy transition’. The report identified that despite policy support, the cost of new nuclear and small modular reactors (SMRs) is the largest economic barrier to their adoption. This means that although nuclear could play an instrumental role in decarbonising electricity production, the current economic landscape makes other energy sources more attractive.

“At current levels, the cost gap is just too great for nuclear to grow rapidly.”

Nuclear costs four times more than solar and wind

Nuclear represents a low-carbon alternative to the environmentally harmful fossil fuels that have exacerbated the global climate crisis. The first commercial nuclear power plant began operating in the 1950s, and today, there are around 440 reactors working globally, producing 10% of the world’s electricity.

Currently, nuclear is the second largest source of low-carbon power worldwide, with around 50 countries utilising nuclear. As the planet strives to decarbonise its energy sector, the uptake of nuclear, along with other green technologies, such as hydrogen-fired power, gas or coal with carbon capture and storage, geothermal, and long-duration energy storage, are set to increase. Estimates suggest that nuclear capacity could increase by 280 gigawatts (GW) by 2050.

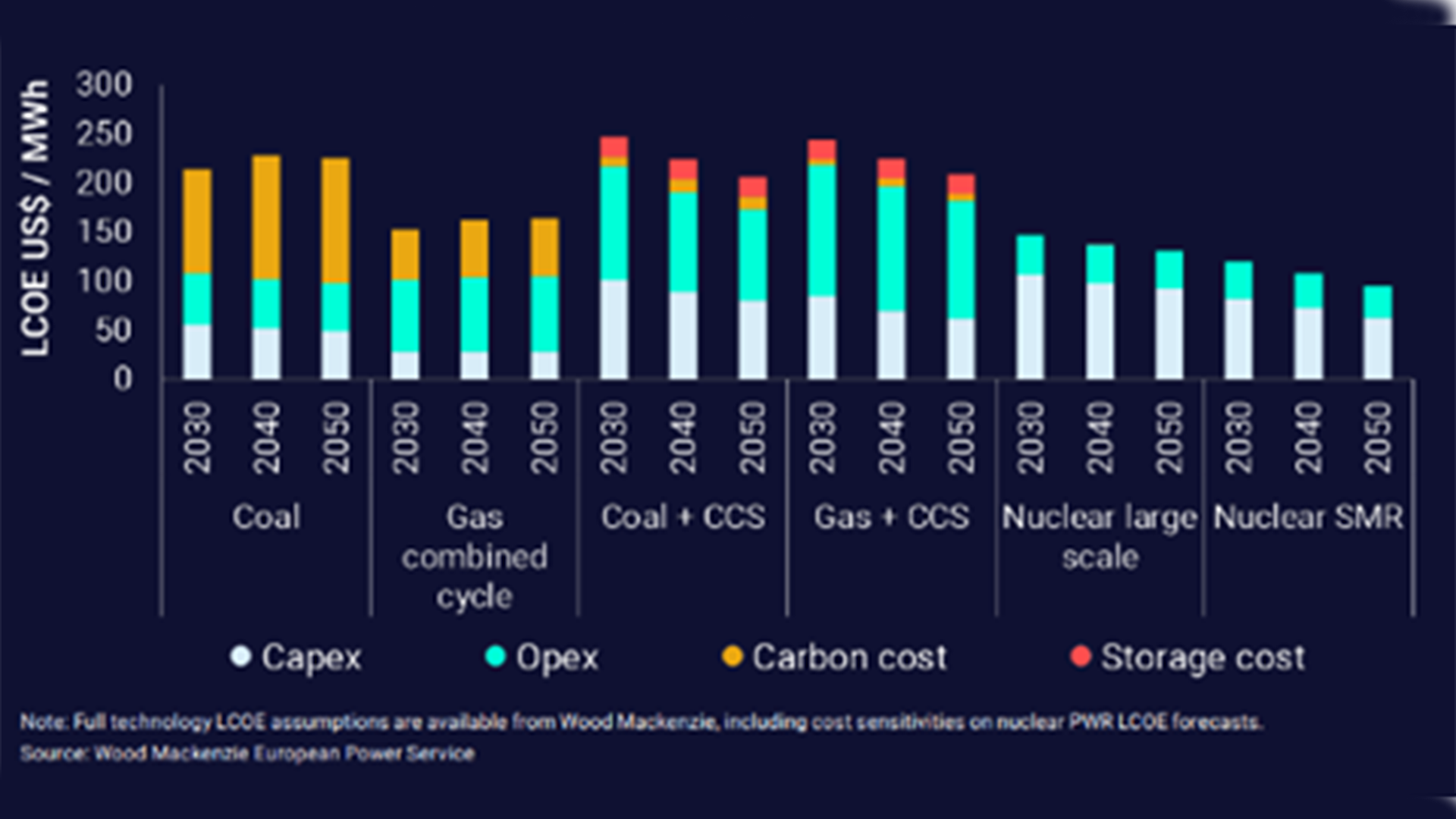

However, the reports found that conventional nuclear power has a levelised cost of electricity (LCOE) of at least four times that of wind and solar, which impacts the uptake of the energy source. To reduce costs, SMRs are designed to be modular, factory assembled, and scalable. This means small modular reactors are much quicker to market, taking just three to five years compared to a large-pressurised water reactor (PWR) that takes ten years to build.

Fig. 1 suggests that if costs fall to $120 per megawatt-hour (MWh) by 2030, SMRs will be competitive with PWRs, coal, and gas worldwide, with further price declines expected between 2040 and 2050 as small modular reactors achieve economies of scale.

Reducing the SMR cost barrier

Cost challenges mean that by 2030, only a few new plants will be constructed. The price of a first-of-a-kind (FOAK) SMR is estimated to be between $6,000 and $8,000 per kilowatt (kW). The report identified that there are only six potential FOAK SMR projects planned before 2030 – ranging in power generation from 80MW to approximately 450MW. However, financing terms, commodity costs, uranium availability, and the political landscape will determine if these projects ever come to fruition.

To support lower SMR costs, at least 10-15 projects with a capacity between 3,000 and 4,500MW required for a standard 300MW SMR will need to be developed between 2030 and 2040. This significant growth in the sector would be comparable to the last nuclear growth phase between 1970 and 1990.

To achieve this, the report outlines four critical areas of the nuclear industry that must be optimised:

Governments must establish clear guidelines for planning, permitting, regulation and safety. A middle ground around permitting timelines – one that allows public, industry, and government dialogue – is needed to produce predictable timescales;

The uranium supply chain must be reinforced due to Russia’s invasion of Ukraine. The report estimates that uranium demand will double under its base-case scenario and triple under its Paris-compliant Global Pledges Scenario.

As Russia is the primary uranium supplier to low and enriched uranium markets, such as Eastern Europe and France, diversifying the supply chain will be crucial;

The nuclear workforce must advance its skillset. No commercial, new-generation SMR plant is operating today, as the expertise to build these plants must be constantly reapplied. This means developers should prioritise a few technologies instead of employing a variety of options. This will help to ensure costs stay low and reduce deployment times; and

Offtake agreements need to be established so that buyers can place a value on the ability of nuclear to drive stable zero-carbon power, zero-carbon process heat, nuclear-based renewable energy credits, and power supply for low-carbon hydrogen.

David Brown, the lead author of the report and Director of the Energy Transition Service at Wood Mackenzie, concluded: “Overall, governments, developers, and investors must work collaboratively to establish a new ecosystem for nuclear to flourish.”