Neil Condon and Felix Hall from EIP take a look at the important role patent applications and policies can play in the success of businesses in the UK space sector and beyond.

The rapid growth of the UK space sector

The UK space sector is worth over £17.5bn each year and is growing faster than the rest of the UK economy. Its workforce, which comprises around 48,800 people, is the most highly qualified in the UK and has a productivity level per employee that is 2.5 times the UK average.

The sector already forms an important part of the UK’s knowledge economy, and this importance is set to increase over the next decade, given that the global space economy is predicted to expand from an estimated £270bn in 2019 to £490bn by 2030.

In 2021, the UK Government published its national space strategy setting out its vision of the UK, performing cutting-edge research to sustain its competitive edge in space science and technology.

The national space strategy sets out a ten-point plan of initial focus areas, one of which is to ‘unleash innovation across the space sector’ and generate intellectual property. So why are intellectual property rights, and more specifically, patents, important for the sector?

Patent applications may help commercialise space technology

The European Space Policy Institute reported in its annual report (published June 2022) that €611m were invested in European space start-ups in 2021 and that venture capital accounted for most of such investments in the 2014-2021 period.

As innovation is central to the products and services that venture-backed companies are seeking to commercialise, it is not surprising that close consideration of the patent rights protecting those products and services is an important part of the investment process.

The Luxembourg-based company, OQ Technology, which is a satellite telecom operator developing technology to improve global IoT connectivity, recently received €13m in Series A funding. It has a number of pending patent applications protecting its technology.

The European Space Policy Institute further reported in its annual report that whereas early-stage VC investments in European space start-ups have increased over the last few years, only two Series C funding rounds have been recorded, both by the Finnish company Iceye OY.

Our investigations show that Iceye OY has been diligent in filing patent applications to protect its technology. It has seven published International (PCT) patent applications and, interestingly, as of March 2023, has filed at least sixteen not yet published UK applications which may already have been used or can be used as priority filings for further international patent applications.

Patents can protect unauthorised use of technologies

Patents are publicly available information and can act as a ‘hands-off’ warning to competitors. Ultimately, granted patent applications can be enforced in patent infringement litigation to stop or prevent a third party’s unauthorised use of the technology covered by the patent and to recover monetary damages caused by any infringement.

To date, patent litigation in the space sector is relatively rare, but history shows that the amount of patent litigation in a technological sector tends to increase as the value of the technological sector increases.

International co-operation is essential for space sector growth

The national space strategy sets out the importance of international co-operation in unlocking growth in the space sector. Patent applications are one way to help facilitate co-operation. Patents can be licensed to others in return for a licence fee. This can generate a revenue stream for a business whilst allowing wider dissemination of innovative technology.

A company may look to licence technology that it no longer intends to use itself directly. For example, recent press reports indicate that whereas UK-based company Arqit Ltd no longer intends to build its own satellites for a space-based quantum encryption network, it intends to license the technology it has developed in this field to other organisations. Arqit Ltd has a patent portfolio consisting of around 27 patent families, a number of which are relevant to quantum key distribution.

Companies may also participate in patent cross-licensing agreements to give access to each other’s patented technology.

Mitigating risks associated with existing patents

It is also important to carefully manage the risks posed by third parties’ existing patent rights. This may involve running specific Freedom to Operate (FTO) searches prior to launching a new product or service to mitigate the risk that a competitor has granted patents or pending applications that cover the new product or service.

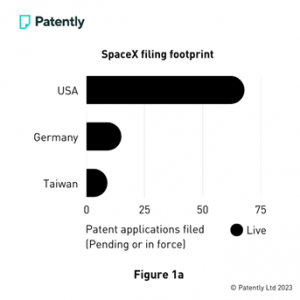

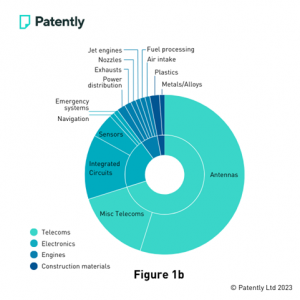

It can also provide useful intelligence to run so-called ‘watching searches’ to monitor the patent filing strategies of companies of interest. For example, SpaceX’s portfolio of pending patent applications and granted patents (Fig. 1a) is concentrated in the US, with a smaller number of filings in Germany and Taiwan. Most of its portfolio (Fig. 1b) has been classified as pertaining to Telecoms technology, in particular antennas and electronics, which are likely of importance to the Starlink project.

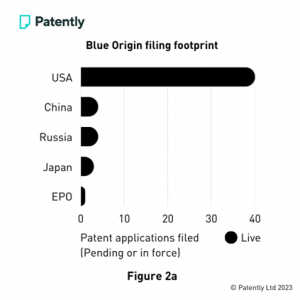

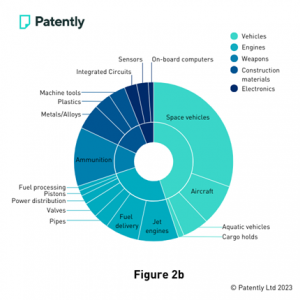

Blue Origin’s portfolio of pending patent applications and granted patents (Fig. 2a) is also concentrated in the US, with a smaller number of filings in other jurisdictions that traditionally have had rocket launching facilities. The majority of its portfolio (Fig. 2b) has been classified as pertaining to space vehicles and engine technology. Interestingly, a small part of the portfolio has been classified as also pertaining to weapons and, in particular, ammunition technology. However, we do not believe that this is because Blue Origin has filed patent applications specifically directed towards weapons technology. Instead, this is because the patent offices which have classified the relevant patent applications believe that the space vehicle and engine technology that underpins these patent applications may also be relevant in the field of missile (and other such projectiles) technology.

Overall, patent applications are important tools for attracting investment, deterring competitors, facilitating co-operation, and can reduce corporation tax. Care should be taken to mitigate the risk presented by third-party patents.

Neil Condon

Partner

EIP

Felix Hall

Senior Associate

EIP