Andrew Phillips, Executive Director and Chief Financial Officer at Lithium Power International Ltd, analyses the rapid development of batteries and how they are driven by the demands of EV makers.

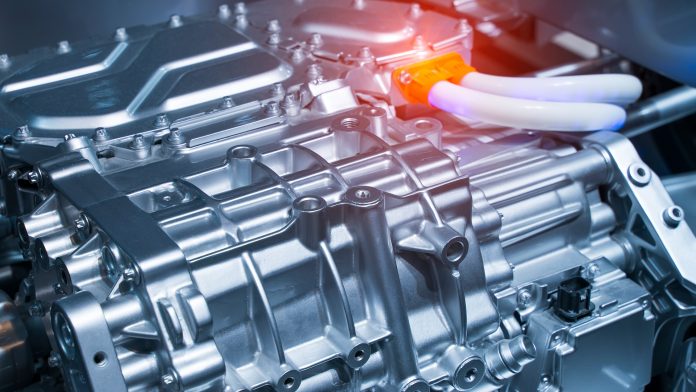

Sales of electric vehicles (EVs) are growing rapidly as motorists respond to the promise of cleaner and cheaper motoring. But many are bewildered by the choice of power units, otherwise known as batteries, now being offered. For generations, auto buyers have focussed on the number of cylinders in their internal combustion engines. That gives them an idea of the range they will get, acceleration and the towing power. Range is a crucial determinant for EVs because of the slow rollout in recharging points, and it is holding back many that would be buyers.

The good news is that technological developments mean that lithium battery elements are lasting longer between charges. That does not simply come down to size. The larger they are, the heavier the vehicle becomes. The answer also lies in their chemistry.

Global chemicals giant BASF notes there are 2.5 times more chemicals in EVs than in vehicles with internal combustion engines. It estimates that the demand for cathode active materials used in EV batteries – including the most pervasive, lithium – will increase by around 21% each year to 2030. It estimates the market will eventually grow to 4,200kg tonnes of lithium worth €100bn. Large amounts of nickel and cobalt will also be needed. But battery makers are already being confronted with soaring input prices, causing them to look at how they can achieve efficiencies.

Developments in lithium battery elements

Lithium iron phosphate (LFP) battery elements have been attracting attention recently because of their lower density and longer life cycle. Tesla uses LFP in their Model 3 range of cars because they allow tight packaging in its car body and have high stability. But these new batteries have a shorter range, making them better for city dwellers than long-distance cruising. Mercedes-Benz has announced the same type of chemistry will be used in its small and family models of cars, including the EQAs and EQBs, to avoid using costly nickel cobalt manganese (NCM) and nickel cobalt aluminium (NCA) batteries. By making such changes, both automakers are compromising energy storage so they can lower input costs.

Plenty of other innovations are likely. For instance, in September 2021, Chinese car company NIO launched an innovative 75kWh hybrid battery pack. It mixed two different battery cell chemistries in one vehicle. One used high energy density NCM, and the second used cheaper LFP batteries. NIO expects that it will increase the range of several models of its EVs by replacing the 70kWh batteries which it has used in earlier versions of the car.

Then there are so-called solid-state batteries. These are sometimes billed as game changers because they can store more energy and charge faster. Simply put, they are sandwiches that contain layers of liquid electrolytes, which contain lithium-ion battery element’s, held between layers of separators. They are still a couple of years from hitting the market but are expected to have more stability and safety. That means they could also be faster to recharge. Laboratory versions of solid-state batteries have been made, but the step towards mass production has yet to be achieved. But this has not dampened the excitement of some carmakers. GM, for instance, announced in October 2021, it would build a new factory in Michigan to develop solid-state cells. Other carmakers to show interest include Toyota, Ford, Hyundai, Kia and VW. Curiously, Tesla has yet to show its hand.

The search for economies in batteries will likely continue for some time while supply chains accommodate new demand for these metals. Lithium, however, is not easy to substitute. That is why battery-grade lithium carbonate has recently traded on spot markets at around $15 per kilogram. That is a gain of at least 50% in one year. Expectations are that it will continue to rise because of the long lead times in developing new supply. While new sources are being developed, such as Lithium Power International’s Maricunga project in Chile, demand is expected to outstrip supply for some time.

A possible challenger to lithium is sodium, although these neighbours on the periodic table of elements have critical differences. Sodium has been used in batteries before, but lithium was preferred by Sony, the pioneer of rechargeable batteries when it was first developing the technology because it was lighter and easier to work with.

However, leading Chinese battery maker CATL recently said that it would start to use sodium along with lithium in some of its new batteries because it was cheaper. But sodium has a considerable handicap. While it can be found almost anywhere, its ions are larger and heavier than lithium’s ions. That means sodium batteries would also be larger and heavier. Therefore, it is possible that sodium batteries could be used in power plants but not commonly in EVs. Electrive.com has also reported that CATL intends to press ahead with its sodium research because of the possibility that nickel and cobalt inputs could be eliminated.

Battery metal markets

How this fervour of innovation impacts global commodity markets in the long term is yet to be seen. S&P Global’s market intelligence division reported that: ‘EV makers are feverishly innovating, attempting to bring down raw material costs and charging times’. It predicted that global battery demand could increase more than fivefold by 2025. ‘(They) will eat up an increasing share of the world’s lithium, cobalt, nickel and other metals needed to make batteries. Already the proportion of these metals dedicated to the EV market is growing, threatening to trigger a shortage. Passenger plug-in EVs will be responsible for an estimated 68.2% of global lithium demand and 39.3% of cobalt demand by 2025. Approximately 12.8% of primary nickel demand will come from passenger EV-makers.’

S&P Global poses the rhetorical question that: ‘Changes in battery metal prices have contributed to 60-110% increment in battery metals costs across various battery types in the past 12 months. With a high growth forecast for passenger PEVs sales, can the battery metals market keep pace with demand?’

Please note, this article will also appear in the eighth edition of our quarterly publication.