Lucas Mir and Antonio Vaya Soler, Energy Analysts in the Division of Nuclear Technology Development and Economics at the Nuclear Energy Agency, outline the potential of nuclear energy in developing the hydrogen economy.

The use of hydrogen is forecast to rise in coming years as part of government and private stakeholder plans to reach net-zero emissions by the middle of the century. The creation of the so-called ‘hydrogen economy’ – where use of the element spreads beyond the industrial sector to become an energy carrier for transport, heating, and power applications – will require vast amounts of reliable low-carbon energy. Existing and future nuclear reactors can provide part of that energy and contribute to the global economy’s transition towards net zero.

According to the net zero pathway of the International Energy Agency (IEA, 2021),1 annual consumption of hydrogen will more than quintuple to over 500 Mt by 2050. That will require support for research, development, and demonstration programmes; a strong and constant political commitment; and the ability to set and agree upon technical and regulatory frameworks for hydrogen handling and trading.

Goals for developing the hydrogen economy

Strategies for developing the hydrogen economy are typically characterised by three time horizons – 2025, 2035, and 2050.

The first priorities, in the short term to 2025, are to close the competitiveness gap between fossil fuel-based hydrogen production pathways and water electrolysis, alongside decarbonising existing uses of hydrogen.

By 2035, in the medium term, electrolytic hydrogen production is expected to ramp up as new GWe electrolyser capacity becomes available. Industrial applications will continue to lead demand for hydrogen, while new usages in the transport sector enter the market.

After 2035, the demand for low-carbon hydrogen is expected to increase due to its growing role in the transport sector, as well as for other applications. Hydrogen will become increasingly commoditised and may no longer be structured around limited areas of production and consumption, referred to as ‘hubs’ or ‘valleys’. By that time, given increasingly stringent carbon constraints, low- and high-temperature electrolysis using low-carbon electricity and heat will become the leading hydrogen production pathway.

The Nuclear Energy Agency (NEA) sees the early 2030s as the turning point for global hydrogen strategies, and has published ‘The Role of Nuclear Power in the Hydrogen Economy: Cost and Competitiveness’ (NEA, 2022),2 detailing the role and potential of nuclear power in the hydrogen economy over this horizon.

A competitive option at the plant level

The most pressing challenge in establishing the hydrogen economy is to enable the decarbonisation of current hydrogen usages at a competitive price without impeding other decarbonisation objectives.

To do this, all low-carbon electricity sources are required. Indeed, producing through water electrolysis the amount of hydrogen currently consumed worldwide would represent a supplementary electricity demand of approximatively 4,500 TWh, or more than 1.5 times the current European electricity demand.

While variable renewables will play a large role in the future low-carbon energy framework, their deployment at such scales raises challenges. To that extent, discriminating between different sources of clean electricity for low-carbon hydrogen production – including via hydrogen support policies that apply a colour label based on the energy source – will only hinder the ability to meet climate change goals.

Nuclear energy as a source of dispatchable and clean electricity and heat would make it possible to operate an electrolyser at high load factors without compromising hydrogen’s carbon intensity. NEA analysis shows that nuclear power is a competitive option to produce and deliver hydrogen in most parts of the world. Furthermore, the analysis shows that the use of nuclear energy for high-temperature water electrolysis holds significant promise due to the higher efficiency of this process compared to low-temperature alternatives.

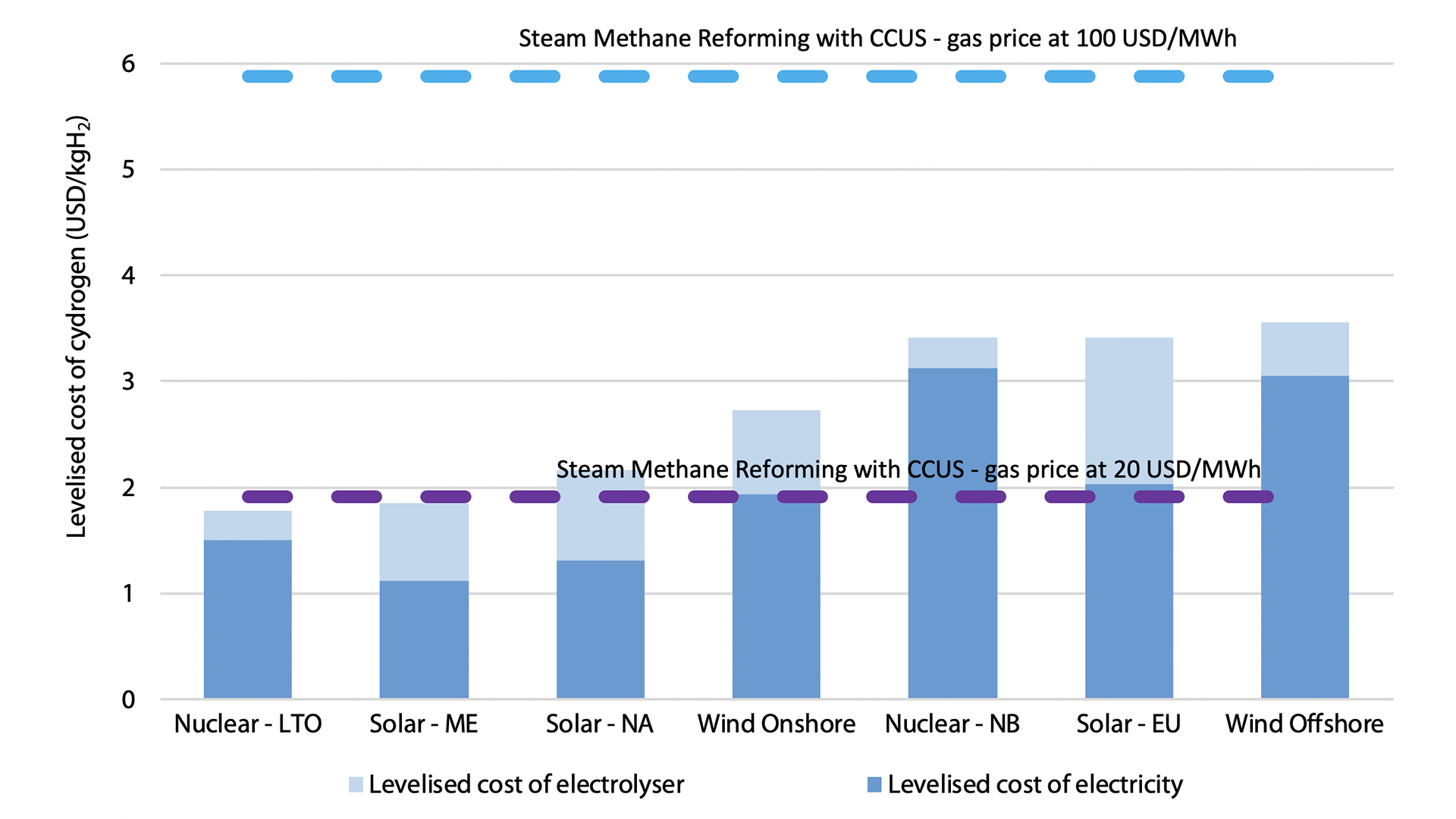

Note: LTO = Long-term operation; NA = North America; NB = New build; EU = European Union; ME = Middle East;

CCUS = Carbon Capture Utilisation and Storage

When coupling an electrolyser to a specific source of electricity, electrolytic hydrogen production at large scale below $2.5 per kgH2 will be hard to achieve in many parts in the world by 2035. However, in a context of high gas prices, the cost of producing hydrogen by steam methane reforming – the incumbent production pathway – is also expected to increase significantly. Indeed, assuming a gas price of $100 per MWh, below the prices in certain regions of the world in the second quarter of 2022, hydrogen production costs from steam methane reforming with carbon capture, utilisation and storage (CCUS) is estimated at $5.87 per kgH2, to be compared with the least competitive option for electrolytic hydrogen in the NEA analysis (offshore wind) at $3.56 per kgH2. In other words, the hydrogen market is likely to become increasingly fragmented, where regional resource endowment will largely determine the leading production pathway and the cost of hydrogen.

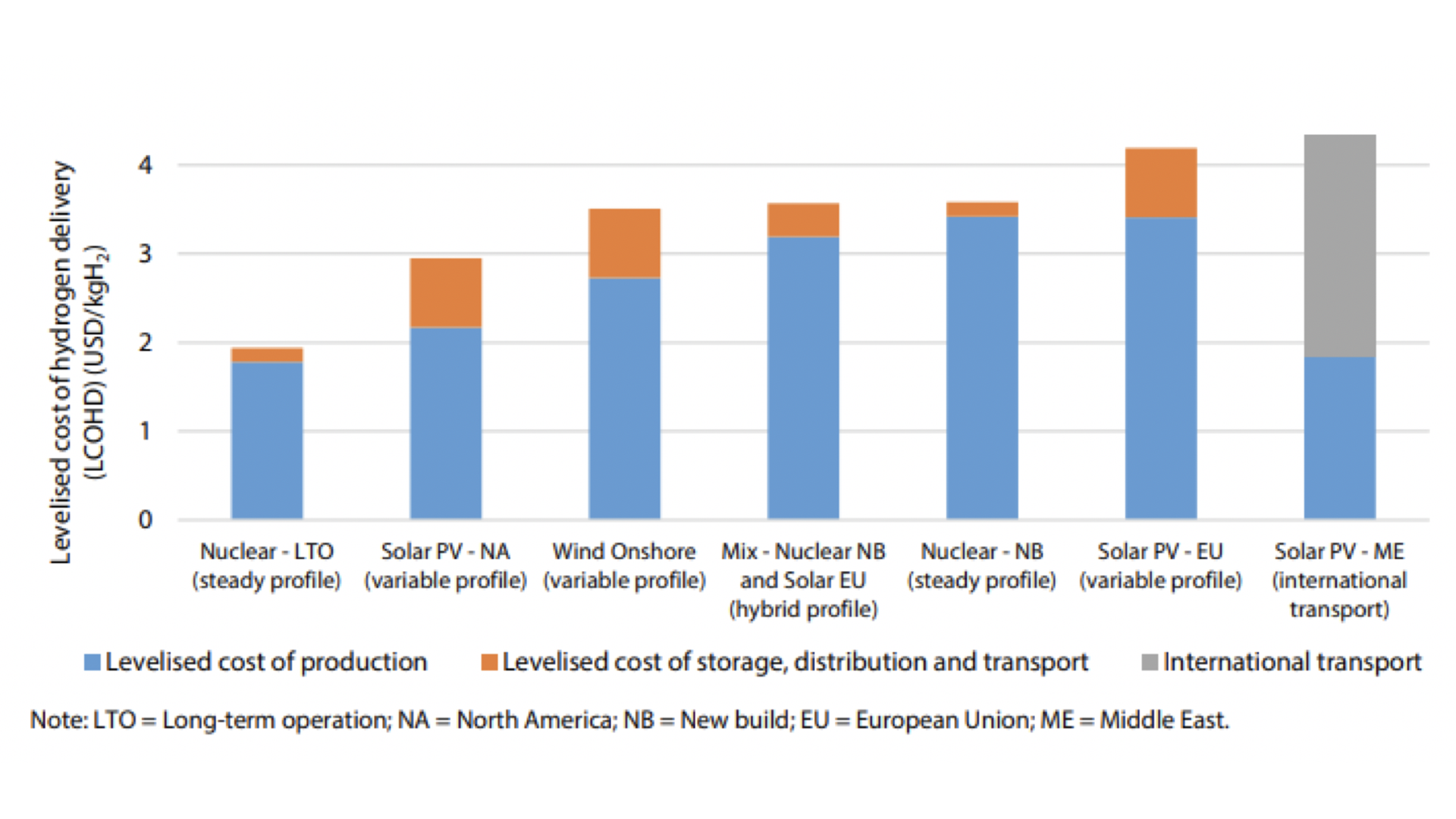

The business model of electrolysers, such as electrolysers coupled to a variable source of electricity or operated in baseload, is a key factor in the economic and the industrial feasibility of the hydrogen economy. In particular, while coupling a hydrogen production plant with a cheap electricity generation source might optimise the production cost – assuming tax and levies on electricity prices are avoided – it fails to take into account value chain costs. The NEA analysis highlights that, if the hydrogen production and consumption profiles do not match, the infrastructure design for hydrogen transport and storage is likely to be inefficient. In particular, in the short term, most of the demand will come from industry, which requires a steady flow of hydrogen and would be best served by a steady production of hydrogen.

The NEA estimates infrastructure costs (such as hydrogen transport through pipeline over 200km and storage in both geological caverns and compressed tanks) for an electrolyser operated in baseload at around $0.16 per kgH2 for a 500 MWe system that answers a continuous demand. For an electrolyser coupled to a variable production in a similar configuration, infrastructure costs are estimated at around $0.77 per kgH2. In other words, the competitiveness of baseload electricity sources such as nuclear power or the grid improves compared to variable options as infrastructure costs are taken into consideration.

The NEA analysis also highlights possible synergies between nuclear and renewable systems that offer cheap electricity, such as solar photovoltaic (PV). By leveraging nuclear steadiness and solar PV low-cost electricity, such mixed systems optimise both hydrogen costs of production and delivery.

More affordable integrated energy systems

Costs of hydrogen production and delivery do not provide information on the costs of hydrogen integration in the power system. Indeed, a large hydrogen demand, if it is to be satisfied with electricity from the grid, will impact the power system and impose system-level costs – in particular, in integrated systems with high shares of variable renewables (VRE). In such configurations, the competitiveness of nuclear power must be assessed also through integrated system cost modelling that takes into account the simultaneous interaction, cost and generation profile of each technology.

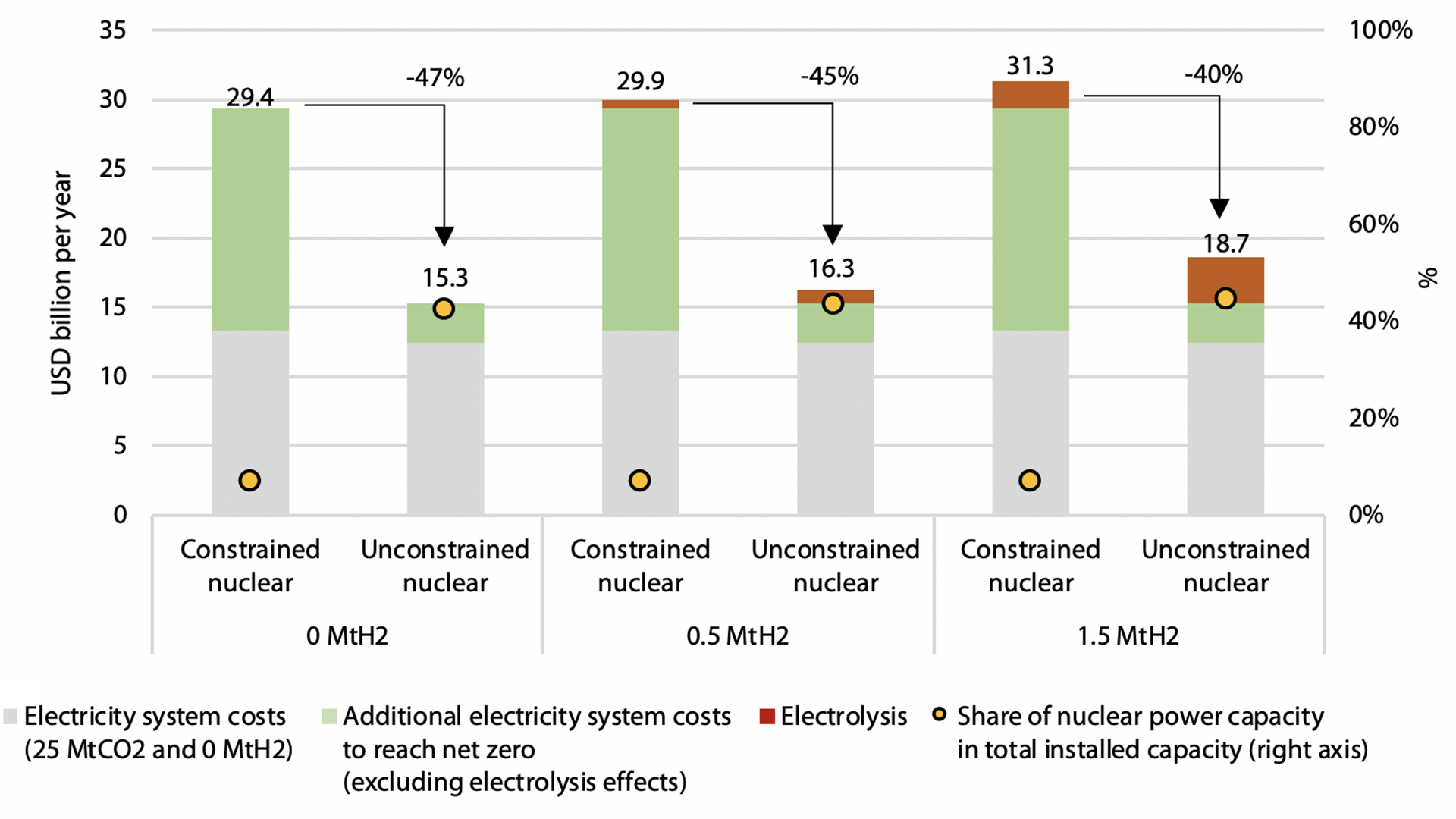

Take, for example, scenarios (as illustrated in Fig. 3) for a highly interconnected country with a varying carbon constraint (25 MtCO2 and 0 MtCO2), a varying share of nuclear power in the total installed capacity (constrained nuclear case and unconstrained nuclear case) and different exogenous hydrogen demand levels (0.5 MtH2 and 1.5 MtH2). In the constrained nuclear case, new nuclear build is not allowed, whereas in the unconstrained nuclear case nuclear power can expand to minimise system costs. By comparing the constrained nuclear and unconstrained nuclear cases, the value of nuclear power in an integrated power system can be demonstrated.

As integrated energy systems move towards net-zero emissions, the role of nuclear power in lowering overall system costs becomes increasingly important. The system cost reduction enabled by nuclear new build increases from 7-11% under the 25 MtCO2 carbon constraint to 40-50% under the net zero constraint (Fig. 3). Indeed, displacing residual emissions is considerably more expensive if only variable renewables and storage are used. Around 190 GW of variable renewables and batteries are thus needed in the constrained nuclear case to meet the net-zero carbon constraint, leading to a doubling of the system costs at the electricity grid level compared to scenarios with residual emissions. When nuclear new build is allowed to enter the system, only 30 GW of new nuclear power capacity is needed to displace the remaining emissions. The share of nuclear power that minimises the total costs of the combined power and hydrogen system is here around 40% of the total generation capacity. The resulting electricity mix combines the low plant-level costs of variable renewables with the dispatchability of nuclear power and thus makes it possible to meet a stringent carbon constraint and significant hydrogen production at the lowest cost.

In a net-zero scenario, electrolysis is the favoured option to produce hydrogen. The electricity and hydrogen production systems thus become fully coupled and a new set of interactions between them comes into play, affecting overall system costs.

Note: Historical investments on existing capacity are not considered. The total economic system costs account for the physical costs (CapEx and OpEx) minus net export revenues. Balancing costs, connection costs and transmission and distribution costs are not considered. Discount rate = 5%.

The whole system can take advantage of the ability of electrolysers to accommodate rapid load variations, especially in moments of excess variable renewable generation. This improves overall system flexibility and reduces the cost system gap at higher levels of hydrogen demand (Fig. 3). Meanwhile, electrolysis will also increase the need for baseload electricity, improving first the availability of existing nuclear units followed by the deployment of new nuclear units as hydrogen demand increases. At the systemic level, there is thus a trade-off between the additional flexibility that hydrogen production provides for variable generation from renewables and the need for a stable supply of hydrogen for industrial purposes and the increased utilisation rates of electrolysers provided by dispatchable nuclear generation.

Hydrogen used for industrial applications further improves nuclear power’s competitiveness in integrated energy systems

By 2035, a sizeable share of the low-carbon hydrogen produced could be devoted to decarbonising industrial applications. Industry requires steady flows of hydrogen production, which can be supplied by electrolysers connected to the electricity grid and operated in baseload mode, especially if the hydrogen storage infrastructure is not available at scale. In such configurations, the case of nuclear power at the system level is further improved because the dispatchability of nuclear power allows for steady production of hydrogen, leading to lower power capacity requirements, and more efficient infrastructure designs for hydrogen transport and storage.

Taking as a baseline a scenario with hydrogen demand of 1.5 MtH2 at net-zero carbon emissions, shifting from a flexible to a steady hydrogen demand (i.e. baseload operation for electrolysers) requires an additional 23 GW of variable renewables and batteries at an additional system cost of $4bn per year, or 12% of the total system costs in relative terms. Since the flexibility of electrolysers is hampered by the steady production of hydrogen, the need for batteries, demand response, load shedding and variable renewable curtailment rises rapidly, contributing to this additional cost burden. With nuclear new build, only 4 GW suffice to meet more steady hydrogen demands at an additional system cost that is nine times lower, or $0.4bn per year. These results underscore again the competitiveness of nuclear power to meet steady industrial hydrogen demands.

The scale and dispatchability of nuclear power thus contribute to the cost-efficient design and operation of hydrogen value chains as part of integrated low-carbon energy systems, which will be needed to provide the large amounts of hydrogen required to achieve the objective of net-zero carbon emissions by 2050.

A version of this article has been published previously in NEA News, the biannual publication of the Nuclear Energy Agency.

References

1: IEA (2021), Net Zero by 2050: A Roadmap for the Global Energy Sector, IEA, Paris, www.iea.org/ reports/net-zero-by-2050.

2: NEA (2022), The Role of Nuclear Power in the Hydrogen Economy: Cost and Competitiveness, OECD Publishing, Paris, www.oecd-nea.org/nuclear-hydrogen.

Lucas Mir

lucas.mir@oecd-nea.org

Antonio Vaya Soler

Energy Analyst

antonio.vayasoler@oecd-nea.org

OECD Nuclear Energy Agency

https://www.oecd-nea.org/

https://www.linkedin.com/company/oecd-nuclear-energy-agency/

https://twitter.com/oecd_nea

Please note, this article will also appear in the thirteenth edition of our quarterly publication.