Shazan Siddiqi, Technology Analyst at IDTechEx, discusses the current challenges surrounding charging infrastructure for electric vehicles and fleets.

With electric vehicle (EV) sales continuing to surge, it has been noted that a better, more accessible charging infrastructure is needed to mirror this growing demand. At present, the majority of EV charging is completed at home using a wall-mounted charger. However, this is not entirely accessible for all EV owners, for example, those who live in apartments or terraced houses. Therefore, the expansion of charging infrastructure is a necessity required to ensure that EV owners can make long journeys without experiencing range anxiety.

IDTechEx has highlighted the importance of charging infrastructure in their report ‘Charging Infrastructure for Electric Vehicles and Fleets 2022-2032’. Innovation News Network asked Shazan Siddiqi, Technology Analyst at IDTechEx and co-author of the report, about the current challenges facing charging infrastructure for EVs and fleets and how future charging trends will help address the rising demand for charging infrastructure.

The current challenges surrounding charging infrastructure

Without enough charge points, EV ownership is impractical. In Europe, IDTechEx research has found there are approximately 16 EVs per public charger. While initially a target of 10 EVs per public charger was set by the EU, EV sales have far outpaced public charger installations in 2021. There is currently some uncertainty as to how many EV charge points are needed and where they should be located – at home, in streetlamps, or long-distance corridors etc. Public charging is seen to have two overlapping but distinct roles: meeting the needs of existing owners and addressing the concerns of potential future EV owners purchasing an EV.

Existing EV owners rely primarily on home and workplace charging. However, they consistently report a desire for more extensive and fast public charging to enable them to undertake longer journeys without being anxious about their EV range. Installation of additional public charging infrastructure can also help increase EV uptake as potential buyers feel a sense of charging security to aid their purchase decisions. When people can see that charging stations are popping up around them and that the service will work for them, they are more likely to make the switch to EVs. Access to public charge points should not be a ‘postcode lottery’ but instead be as ubiquitous as the current network of refuelling stations.

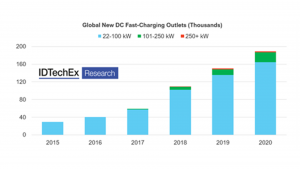

There are significant barriers to having a sufficient public charging network coverage, the most prominent being the hardware and installation costs. The upfront hardware purchase price is often exceptionally large, with the fastest DC charging hardware costing $100,000 to $150,000. IDTechEx research has found that, historically, most DC fast chargers installed publicly belong to the 22-100kW power class due to their lower upfront cost compared to high power chargers.

Installation costs are highly variable, and while the general trend observed is that hardware costs have been going down, there is no consensus among industry stakeholders about the direction of future installation costs. In addition, there is a high dependence on state and local incentives in many places that encourage electric vehicle supply equipment (EVSE) installation through funding and technical assistance.

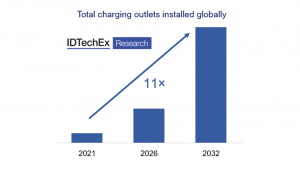

Historically, large charging station projects have tended to be unprofitable due to high upfront costs; therefore, electric car use will need to become more widespread before they can turn a profit. The ideal end state is a sustainable, market-driven industry. It will never reach that status unless it unlocks a real value proposition. With the massive influx of affordable EVs with sufficient range and fast charging capabilities, the market now requires an accelerated growth of charging networks, deployment of an increased number of chargers per location, higher charging speeds, and improved reliability and availability of charge points. Research by IDTechEx expects an 11-fold increase in total charging outlets installed globally in 2032 compared to 2021.

Grid woes

Managing the potential incremental energy demand that EV charging could put on the grid is crucial. Expert assessments vary on how much electricity demand will increase with widespread EV use. The US Department of Energy predicts a 38% increase in electricity consumption by 2050, primarily due to a high penetration of EVs. Increased electricity demand would necessitate investment in new generation and upgrades to the grid (including transformers, substations, and eventually transmission lines).

While this raises concerns that are often highlighted in the media, studies have shown that the additional electricity demand will pose little risk to the security of the national electricity supply of various countries. For example, in the UK, the National Grid’s analysis estimated that by 2046, peak demand due to EV charging would be 30GW. However, this is an ‘extreme’ scenario that is highly unlikely to occur. As quoted in their most likely scenario, a more realistic figure saw peak demand from EVs alone being around 5GW, about an 8% increase on today’s peak demand value. National Grid and IDTechEx believe the switch to EVs will not be as extreme, and consumer behaviour will change to avoid charging at peak times, therefore resulting in a less significant increase to peak demand.

Various other technologies are now being tested to address this (smaller than expected) increase in demand. EV owners can use smart charging, which aims to shift charging times from peak to off-peak times without any user intervention for a new age electric vehicle charging infrastructure. This is achieved through software that can enable vehicle charging when electricity prices are low – for example overnight, or at times of high renewable electricity supply. ‘Time-of-use’ tariffs are widely used by energy suppliers, rewarding customers who use power at times of low demand.

An extension of smart charging, the concept of vehicle to grid (V2G) is that when supply is low, and demand is high, EVs connected to the grid can release power back into the grid. Owners of the vehicles can then be paid for this balancing service. Some suppliers have been developing V2G offers for their customers, though availability is currently limited by the lack of compatible EV models. Finally, the use of battery buffered energy storage systems to support high power charging sites is also being explored.

IDTechEx research has found that smart charging technology and off-grid charging solutions will become more favourable where grids do not have the available excess capacity to generate increased amounts of power with existing infrastructure. With the right planning, technology implementation, and regulatory measures, EVs can be an asset to the energy system, as well as to the environment.

EV leasing market

“Leasing and Personal Contract Purchase (PCP) deals can certainly help make the purchasing of new vehicles more affordable. This is especially true when dealership contributions and government electric vehicle incentives can be combined to take the sting out of the initial deposits,” explained Dr James Jeffs, Technology Analyst, IDTechEX

“This can make the monthly repayment of a new EV very comparable to an equivalent internal combustion engine model. The real benefit then is the cost of ownership reduction the owner will see when it comes to fuelling their vehicle. Instead of paying £150 on the lease and a further £100 per month on fuel for a petrol or diesel car, it is more likely to be £170 for the vehicle and £20 for the electricity. Month to month, this can make a noticeable difference to family finances and have people questioning why they would go back to petrol or diesel.

“In the future, IDTechEx expects that autonomous and shared mobility options will provide even cheaper transportation. When autonomous services become commonplace, and you can reliably, cheaply, and safely get to any destination you need, then the burden of vehicle ownership will come into question. For some people, owning a vehicle will always be more than cheap transportation; it represents status, symbol, interest, or hobby. But for the majority of drivers, it is a simple equation of convenience and cost.”

Fleets are electrifying and charging solutions are needed

Across a large fleet, the comparable operating and ownership savings of EVs are extremely significant. Fleet operators also want to act on their corporate social responsibility goals and acquire greener credentials as they reduce the environmental impact of their business activities. Governments are also encouraging the adoption of electric buses and trucks. The European Union has established targets for Member States of up to 65% (2030) for electric buses and up to 15% for trucks by 2030.

By 2030, total market penetration for electric medium-duty trucks (MDT) in Europe is predicted to be 21%, whilst penetration into the heavy-duty truck (HDT) market will be 7.3%, according to IDTechEx forecasts. The operation pattern of fleet vehicles means that they require different charging infrastructure considerations than passenger cars i.e., the limited windows of time available for charging require higher power charging as longer dwell times directly affect profit margins.

Currently, most electric buses use overnight depot charging due to lower energy costs during those hours and the ability to charge over a more extended period. However, almost all-electric buses also rely on fast charging during operating hours – called opportunity charging. This allows electric buses to be charged with a rapid and intense blast of power (normally 150+kW) at strategic points along the route to ensure sufficient range.

The fleet charging depots of the future are likely to utilise renewable energy generation on-site (usually solar), high power chargers with pantographs, battery buffered storage to enable grid independence, and the use of smart charging software that uses dynamic load management (DLM) to balance the grid. By integrating fleet telematics solutions, operators are also able to track the location and state of charge (SoC) of each vehicle and better prepare their depots ahead of demand.

We are seeing companies like Heliox, ABB, and Siemens leading the field in developing such depot and opportunity charging solutions. Siemens is also working with Einride AB, a leading developer of autonomous and electric transport systems, to supply power to autonomous trucks via a robotic fast-charging system. More recently, Daimler, Traton & Volvo invested a considerable sum of €500m to establish and operate a public charging network for battery-electric heavy-duty long-haul trucks and coaches in Europe. The CharIn organisation is also working towards a megawatt charging standard with collaboration from multiple industry players. The target charging capacity for their High-Power Commercial Vehicle Charging (HPCVC) standard is 4.5MW – transferring this much energy over a short duration requires a unique design in the cabling, connector, and charging inlet.

Another interesting development is the use of inductive supercharging for fleets. The inductive charging technology provides fast (over 200kW), wireless, automated, opportunity charging for fleets with no moving parts. Various bus operators are spearheading this, and taxi and delivery fleets are following suit, piloting their own programmes. Players like Momentum Dynamics, Wave, and Tesvolt are involved in commercialising and bringing this technology to market. IDTechEx believes that inductive charging will become an essential component of future autonomous vehicles.

Battery swapping services for taxis and ride-hailing vehicles are also being explored as they currently offer the quickest turnaround time for a fleet vehicle. The latest generation of battery swapping stations from Aulton (who work with BAIC’s taxi fleet in China and are backed by BP) can complete the entire process in under five minutes. Ample is another Silicon Valley start-up looking to push on this front and has partnered with Uber to swap out depleted battery modules for fresh ones within minutes instead of charging them using a cable. Gogoro’s e-scooter fleet in Taiwan uses a self-service battery swapping model, which has been successful and is speculated to expand and revolutionise the largest electric powered two-wheeler (ePTW) markets of China and India.

Charging infrastructure deployment presents many challenges and opportunities as the EV market evolves. The value chain offers opportunities to hardware suppliers, network operators, and management platform providers. New players will emerge, but it is not a race to the top, but instead, a race to diversify along the value chain with a considerable upside for winners. IDTechEx’s recent report on Charging Infrastructure for Electric Vehicles covers this dynamic market and provides insights into the emerging technologies, players, business models, and granular market forecasts with segmentation by public and private units as well as different charging power levels.

Shazan Siddiqi

Technology Analyst

IDTechEx

www.idtechex.com

Please note, this article will also appear in the ninth edition of our quarterly publication