GEUS’ Per Kalvig emphasises the importance of increasing the global production of rare earths and highlights Greenland’s vast reserves.

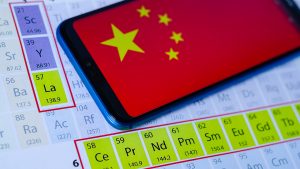

As the world looks to meet its decarbonisation goals, the global demand for rare earths has significantly increased. These elements are used in a variety of applications, including everyday technologies like our mobile phones and permanent magnets that are used to power wind turbines.

As rare earths have several important applications, it is crucial that countries across the globe ensure that they have a secure supply. Although China currently dominates the rare earth market, countries in the West still have the ability to develop industry. Greenland, in particular, has a significant number of reserves and resources of both rare earths and critical minerals. However, global production needs to greatly increase to ensure that the ever-rising demand is met, subsequently facilitating the energy transition.

To gain insight into the current rare earth market and Greenland’s potential in the critical minerals sector, The Innovation Platform spoke to Per Kalvig, retired senior researcher of the Geological Survey of Denmark and Greenland.

What are rare earth elements and why are they essential to the global transition to clean energy?

Rare earth elements are 17 individual elements that have similar chemistry and physical specifications, appearing in the same environment. The range of them varies from site to site, according to what geological environment they stem from. Nowadays, industry mainly focuses on about four to five of these rare earth elements for developing permanent magnets, such as neodymium, praseodymium, and dysprosium, in particular. With respect to price, neodymium has the highest cost, which illustrates its necessity in a mining operation.

Neodymium magnets are advantageous for pocket devices, such as smartphones, because they can be manufactured very small and still be very powerful. Rare earths are important for green technology, and this goes much further than their use in electric vehicles and wind turbines, as electronics are also crucial for the energy transition. It is very difficult to distinguish what technology is green or not as we need electronic devices to facilitate this transition.

Rare earths are increasing in importance for our modern society, causing a growth in demand for particularly neodymium, praseodymium, and dysprosium, as previously mentioned. Ten to 15 years ago, the main consumption sector was catalysts for cars and processing for the oil business. The two rare earths vital to this were lanthanum and cerium. Approximately 75% of rare earth demand was for lanthanum and cerium, and at the time they were fairly well-priced. This price, however, has dropped significantly as they have been overproduced. There is a dynamic in the market that will continue, and it is expected that in the future we will see inventions replacing the magnet types that we are using now.

This is one of the problems; investors are not keen to invest in dynamic and uncertain sectors. At the upper end of the value chain, mineral exploration projects have been very successful in attracting investors, and downstream, wind turbine factories, for example, can attract investors. However, in between these ends are complicated processes that do not attract investment. Because it is a multi-element business, the developer must find offtake for all of the elements otherwise there is no business case. Specific businesses must therefore be found for all of the produced substances.

This also means processing all of the elements that go into the different industries. The process is service specific for each sub-sector or for each purpose. There are many stages of specialised companies involved in this complicated net of processing steps. This sometimes gets overlooked, and it gets reduced to the question, “why can’t we source neodymium?” Neodymium is a co-product and does not come out of the mine by itself like gold, and this needs to be recognised.

Can you outline the current constraints to securing critical raw material supply chains, and explain how this can impact the green energy transition?

The biggest constraint is the geopolitical issues related to China. China has organised its industry so that they are in control of the downstream part of the rare earths supply chain. They do not focus on the upstream part of the supply chain because they can import the end products from other countries, and have arranged offtake agreements with certain foreign groups. These groups have no choice but to partner with China due to the country’s dominance of the supply chain. China also controls the price, so in the event that competitive groups pop up outside of China, we can see that the country moves in two directions: China buys minor shares in the project or controls the price to keep it down.

This occurs not just because China is strong, but of what we see in Western countries’ efforts. They try and replace the role of China but it is very naïve to attempt to compete with China with only one or two large projects. Western countries should instead focus on lots of small projects in niche markets. Some of the raw materials for this may come from secondary sources like scrap and by-products. In some cases, we can extract rare earths from iron ore which is discarded anyway. Many small flows may be able to utilise and develop the market.

Industry in the West has to grow from a very small scale, because even if you have managed to produce the end product, then you have nowhere to go because the many manufacturers of magnets are controlled by China. The market for all these projects is still in China, so you need to not only develop the rare earths business but also develop the industry demanding the projects. These two things are in balance.

It appears that, currently, in the West, there is a large focus on the rare earths but we neglect a lot of elements that we are in the exact same situation with. Why should we pull the rare earths industry out of China, if we are not independent in the case of other elements? For centuries, the world has been reliant on raw materials coming from one place, and this still frequently occurs.

For example, China is in control of steel and aluminium as the country imports iron ore from Brazil and Australia to produce and export these commodities. China is able to control the production of certain commodities because of its political systems and subsequent strategies. In Western systems, incentives are developed, and then it is left to hope that industry takes these so that the sector can develop. Western industry used to outsource to China in the 1990s, and they developed patents and IP rights. There is a wall that is now very difficult to break.

It is understandable, however, that the defence industry wishes to keep Chinese sources out of their weapon systems, and in that situation, it is risky to be dependent on one source. The only way to do this, as previously mentioned, is to support and develop small steps along the way, slowly expanding the Western rare earth industry.

What are Greenland’s reserves and resources of rare earths and other critical materials?

There are large resources of rare earths in Greenland, and it is usually stated that there are approximately ten deposits. Three of these are being developed: Sarfartôq, Kvanefjeld, and Kringlerne.

Kvanefjeld was developed by an Australian group and they reached a very advanced stage of rare earth development. However, in 2021 Greenland implemented a ban on uranium mining, banning the exploration of deposits containing uranium concentrations of more than 100 parts per million. The project had to be stopped due to the content of uranium in the deposits.

Kringlerne is another huge resource that is run by an Australian group that is at a very advanced stage and has obtained an exploitation license. It is rumoured that they are due to come online in 2024. From the current plans, the project will produce around 5,000 tonnes of rare earths but there is potential for this to be scaled up.

Sarfartôq has recently been reactivated by Neo Performance Materials, a magnet producer based in Canada, with a separation plant in Estonia. Recently, they got a grant from the EU to develop a magnet factory. Here, we will have a fully integrated supply chain from mine to magnet. No information of the planned production has been revealed.

In the next four to five years, this will make up a small fraction of the total demand for rare earths, so despite the resources being enormous, the problem in meeting the ever-increasing demand is bringing projects online and being able to process the minerals. Until recently, the capacity of existing mines has been sufficient, and the production capacity has been boosted. In the near future, indeed, we will need more production in addition to the rare earths that are currently produced.

Per Kalvig

Retired senior researcher

The Geological Survey of Denmark and Greenland

https://eng.geus.dk/

https://www.linkedin.com/company/geus/

Please note, this article will also appear in the thirteenth edition of our quarterly publication.