Dr Corina Hebestreit, Secretary General at the European Carbon and Graphite Association, examines graphite’s role in Europe’s clean energy transition.

Energy storage is a key technology for battling CO2 emissions from the transport, power, and industry sectors. Therefore, in October 2017, European Commission Vice-President, Maroš Šefčovič, launched the European Battery Alliance (EBA) to support the battery industry in Europe throughout its whole value chain. Since the EBA launch, a European Strategic Action Plan on Batteries was published in March 2018, setting the direction for the development of a competitive battery industry in Europe. The ECGA is a member of EBA and involved in the Batteries European Partnership Association (BEPA). Innovation along a value chain can take different forms, and Europe’s battery value chain is constantly developing.

Policies – putting the emphasis on different technologies

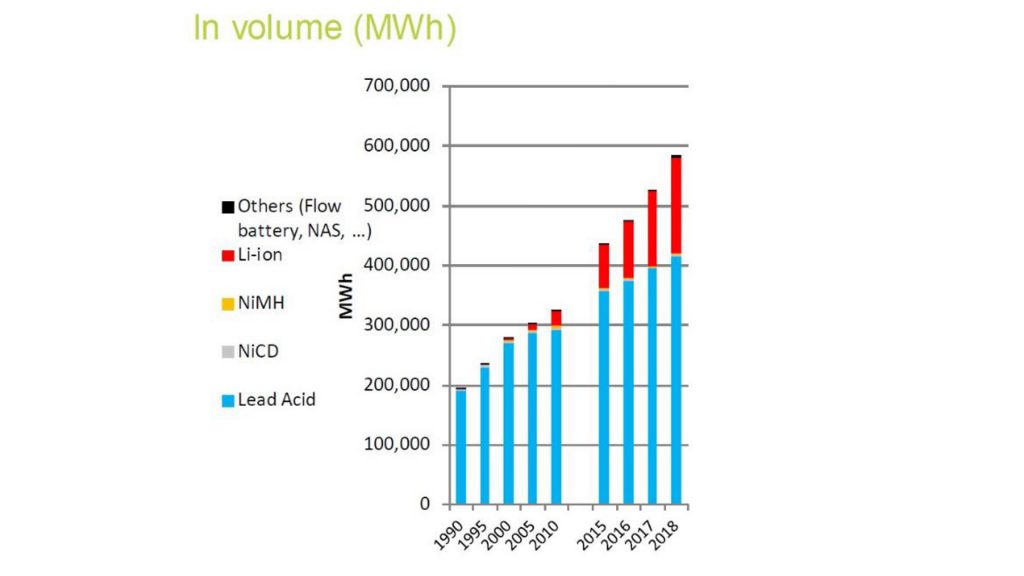

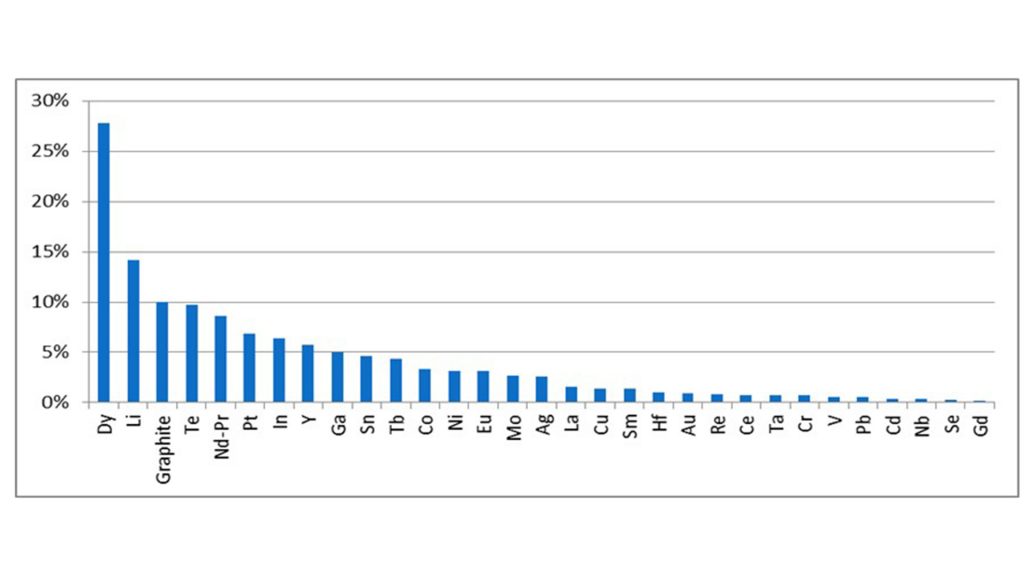

The demand for batteries and battery materials will be rising considerably in the coming years due to energy and e-mobility policies, which are driven by climate change. Some of the materials have been classified as critical for the European economy in terms of economic importance and supply risk. Natural graphite was classified as critical in all three jurisdictions: Japan, USA, and Europe.

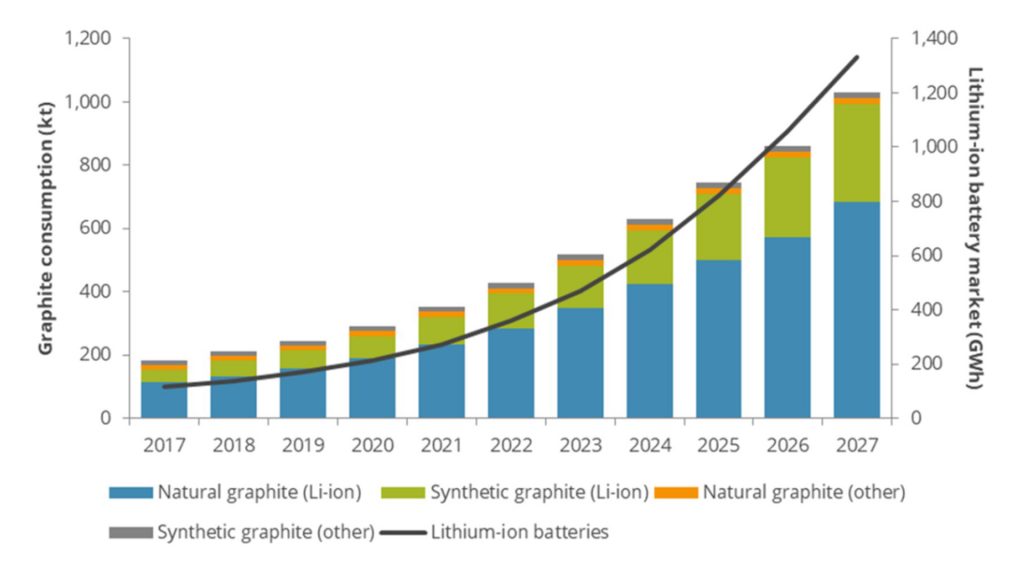

Forecasts show that there is a growing demand for both natural and synthetic graphite, indicating the rising importance of the mineral for new technological solutions. Benchmark Mineral Intelligence suggests that there will be a significant increase in graphite demand for lithium-ion battery (LIB) anodes.

Different batteries need different minerals

To reach current sustainability goals, batteries must exhibit an ultra-high performance beyond their capabilities today. An ultra-high performance includes energy and power performance approaching theoretical limits, outstanding lifetime and reliability, and enhanced safety and environmental sustainability. This triggers new research and technological developments into current applications and systems, but will also help develop new systems. However, to be commercially successful, production of these batteries and their value chains must be scalable to cost-effective large-scale production.

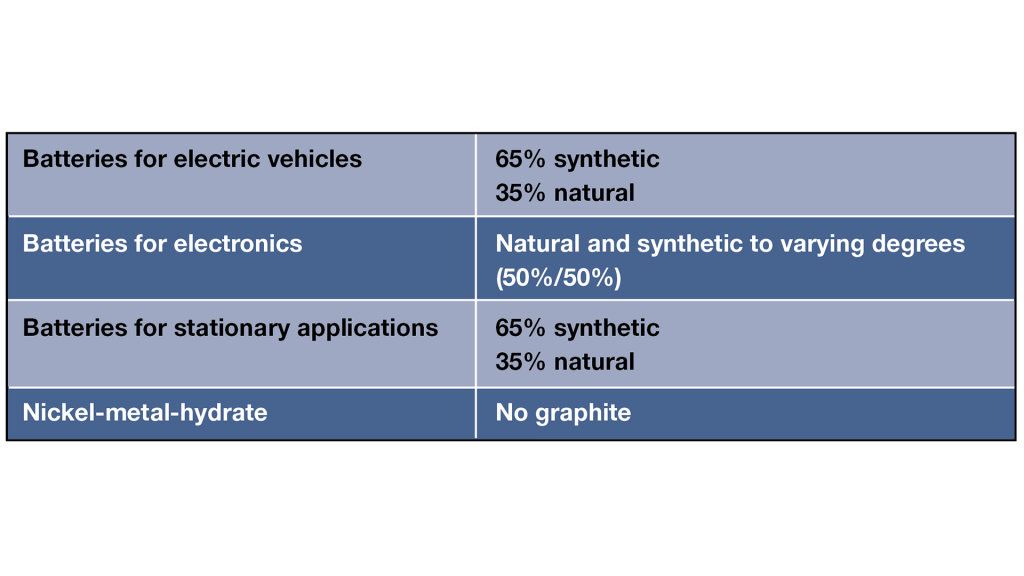

Different battery types need different minerals, some that are produced from naturally occurring minerals, some from synthetically produced substances and, in some cases, the mix of both leads to the best possible performance. There is no reason to believe that this will change in the future. The types of batteries and composition may change, but performance, availability, price, and production costs are the most important factors to consider.

Graphite is used in a variety of batteries due to its excellent performance, availability, and cost. However, graphite deposits are not that rare and there is still considerable room for new deposits to be discovered with modern exploration technologies. Furthermore, demand will trigger investment, leading to increased availability across the globe. Leading experts forecast the market for graphite to grow by a factor of five by 2030.

Natural graphite can and has already been replaced to varying degrees by synthetic graphite, which is also readily available in Europe. The best performance of LIBs even depends on the mixture of the two used. Europe is in danger of rendering its supply of synthetic graphite as critical due to its current energy policies and the cost of sustainable energy. Producing synthetic graphite is energy intensive and high energy costs are detrimental.

Addressing criticality: Diversification of supply

Access to natural graphite

Up to now, China has provided about 50% and Brazil has provided approximately 12% of the EU’s supply of natural graphite. Europe currently has two small graphite mines operating in Austria and Germany, but both do not deliver into the battery market because the mined grades are not suitable for batteries.

Europe’s wish to improve its economic resilience and to decrease dependency has led to new exploration, mine development projects, and investments into processing. With modern exploration technologies, new results are expected.

Worldwide, a significant number of exploration projects are under development. At the end of December 2018, there were 157 known projects globally, ten of which were located in Europe. Graphite deposits have been identified in the Czech Republic, Finland, Norway, and Sweden.

The extractive industry has repeatedly called for improvements in the permitting processes and a higher public acceptance of mineral extraction, both of which are needed for renewable energies, energy storage, and e-mobility.

European policymakers are trying to secure alternative access to critical raw materials via its strategic partnerships with Canada, the Ukraine, and certain African countries. Extensive work is being carried out under these partnership agreements to allow the EU to secure a sustainable supply of such minerals, for the future. ECGA has members in the Ukraine and Mozambique and has been liaising with other mining companies in Sri Lanka, Madagascar, and Brazil to foster a larger worldwide co-operation.

Access to synthetic graphite

Sustainability of manufacturing

As mentioned previously, synthetic graphite is a viable substitute for natural graphite in batteries and enhances their performance. Improving the sustainability of synthetic graphite manufacturing is closely linked with expertise in managing high temperatures, chemicals, closed production processing systems, lower energy consumption, and increased use of renewable energy in European grids. Making the synthetic graphite production process more sustainable will help assist Europe’s transition to clean energy.

European carbon, and natural and synthetic graphite producers are strictly regulated by EU and national legislation, are permitted according to the EU’s Best Available Techniques (BAT) under the Industrial Emissions Directive (IED), and are actively contributing to the UN’s SDGs.

Recent investments in new processing plants

New processing plants are currently being built in Sweden, Finland, Norway, Germany, and other parts of the EU to provide state-of-the-art processing and manufacturing facilities.

For example:

- Vianode is investing in new facilities including a sophisticated laboratory and development centre, and an industrial

pilot facility at the Heroya Industrial Park in Porsgrunn, Norway, for new large-scale industrial production;

• SGL Carbon, a synthetic graphite manufacturer for anode materials in Europe, will develop materials with increased performance, and energy-efficient and sustainable manufacturing processes to novel recycling concepts (IPCEI project);

• Leading Edge Materials is working on a graphite-processing plant that would produce spherical graphite, battery-grade graphite, and other forms of processed graphite at the company’s Woxna mine site in Sweden;

• Talga Resources is constructing a scalable battery anode production facility and integrated graphite-mining operation in Northern Sweden, which is expected to start production in 2023; and

• Imerys Graphite and Carbon opened a brand-new research centre in Switzerland in 2020, mainly dedicated to developing new synthetic graphite grades specific for LIBs.

Sustainability along the lifecycle

Europe has a well-established recycling culture and infrastructure when it comes to cars and batteries. Currently, EVs are dismantled, and their batteries are reused for energy storage. They are recycled and reprocessed as were/are the lead-acid batteries. With the increased volume of these batteries in the market and at the end-of-life stage, these activities will also grow, and new systems will emerge.

Graphite from these batteries can be reprocessed and used in other graphite applications such as electrodes, friction, powder metallurgy, carbon raisers, refractories, and is therefore not wasted.

Whether the graphite anode material can be re-utilised for the same application in the future, depends on the successful research in this area. Direct recovery of graphite materials for the same application is still at the initial stage of development.

Outlook

From a performance perspective, due to its fast charge turnaround and battery longevity, car makers have preferred a mix of synthetic graphite. Synthetic graphite also gives the material an advantage in terms of consistency of supply quality relative to natural graphite.

Reflecting the rapid-demand growth forecast for the sector, both synthetic graphite and natural graphite will remain critical materials for anodes in the EV battery industry, with supply of both materials forecast to rise to meet surging demand from the EV sector.

Unlike other battery raw-material markets, notably lithium, where insufficient near-term supply is propelling prices higher, graphite supply is less of a challenge for the battery industry, which was reflected in largely stable price developments in 2021.

The ability of graphite supply to rise with demand in the coming years will help to keep prices less volatile than in other battery raw material markets and will protect the industry from substitution by competing anode technologies in the longer term.

ECGA is the representative association of EU carbon and graphite producers, including the EU-based graphite electrode producers going into Europe’s steel and foundry industry, electrodes and cathodes for the aluminium and ferroalloy industry, as well as a wide variety of speciality graphite and carbon products for applications ranging from electric motors to modern battery technology. ECGA represents 100% of EU based production of graphite electrodes (steel ind.), of cathodes (aluminium industry and foundries), of Soederberg anodes and pastes, and of graphite currently mined in the EU.

Dr Corina Hebestreit

Secretary General

European Carbon and Graphite Association

http://www.ecga.net/

https://www.linkedin.com/in/corina-hebestreit-1069679/?originalSubdomain=be

Please note, this article will also appear in the ninth edition of our quarterly publication.