It looks like lithium and lithium hydroxide is here to stay, for now: despite intensive research with alternative materials, there is nothing on the horizon that could replace lithium as a building block for modern battery technology.

Both lithium hydroxide (LiOH) and lithium carbonate (LiCO3) prices have been pointing downwards for the past few months and the recent market shakeup certainly does not improve the situation. However, despite extensive research into alternative materials, there is nothing on the horizon which could replace lithium as a building block for modern battery technology within the next few years. As we know from the producers of the various lithium battery formulations, the devil lies in the detail and this is where experience is gained to gradually improve energy density, quality and safety of the cells.

With new electric vehicles (EVs) being introduced at almost weekly intervals, the industry is looking for reliable sources and technology. For those automotive manufacturers it is irrelevant what is happening in the research labs. They need the products here and now.

The shift from lithium carbonate to lithium hydroxide

Up until very recently lithium carbonate has been the focus of many producers of EV batteries, because existing battery designs called for cathodes using this raw material. However, this is about to change. Lithium hydroxide is also a key raw material in the production of battery cathodes, but it is in much shorter supply than lithium carbonate at present. While it is a more niche product than lithium carbonate, it is also used by major battery producers, who are competing with the industrial lubricant industry for the same raw material. As such, supplies of lithium hydroxide are subsequently expected to become even scarcer.

Key advantages of lithium hydroxide battery cathodes in relation to other chemical compounds include better power density (more battery capacity), longer life cycle and enhanced safety features.

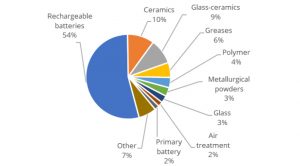

For this reason, the demand from the rechargeable battery industry has displayed strong growth throughout the 2010s, with the increasing use of larger lithium-ion batteries in automotive applications. In 2019, rechargeable batteries accounted for 54% of total lithium demand, almost entirely from Li-ion battery technologies. Though the rapid rise of hybrid and electric vehicle sales has directed attention to the requirement for lithium compounds, falling sales in the second half of 2019 in China – the largest market for EVs – and a global reduction in sales caused by lockdowns related to the COVID-19 pandemic in the first half of 2020 have put the short-term ‘brakes’ on the growth in lithium demand, by impacting demand from both battery and industrial applications. Longer term scenarios continue to show strong growth for lithium demand over the coming decade, however, with Roskill forecasting demand to exceed 1.0Mt LCE in 2027, with growth in excess of 18% per year to 2030.

This reflects the trend to invest more into LiOH production as compared to LiCO3; and this is where the lithium source comes into play: spodumene rock is significantly more flexible in terms of production process. It allows for a streamlined production of LiOH while the use of lithium brine normally leads through LiCO3 as an intermediary to produce LiOH. Hence, the production cost of LiOH is significantly lower with spodumene as source instead of brine. It is clear that, with the sheer quantity of lithium brine available in the world, eventually new process technologies must be developed to efficiently apply this source. With various companies investigating new processes we will eventually see this coming, but for now, spodumene is a safer bet.

DrM’s FUNDABAC Filter for various lithium extraction and purification steps

With its impressive experience gained in this industry, DrM is actively involved with a number of technology companies developing purification stages with the target to improve efficiency and streamline the process. Both for spodumene and brine as source material, we are being contacted as a technology partner to provide equipment and knowhow as early in the development stage as possible. With pilot equipment readily available in strategic places such as Australia, Chile, Argentina, China, Korea and Japan we can ensure quick turnarounds and provide flexibility in the often-complex decision-making process. DrM has so far supplied over 60 FUNDABAC® polishing and guard filters for various extraction and purification steps for these two streams.

Please note, this article will also appear in the fifth edition of our quarterly publication.