Supported by the European Raw Material Alliance (ERMA) investment portfolio, Greenland Resources’ world-class Climax-type Malmbjerg molybdenum project in Greenland is positioned to help accelerate the green energy transition.

Molybdenum (Mo) is a cross-cutting metal that is used in all clean renewable energy generation and storage technologies, including wind, geothermal, solar, nuclear, and hydro. Europe is the second largest user of molybdenum worldwide and has no production of its own. The Malmbjerg deposit will be able to supply around 23% of European Union (EU) total demand from a responsible sourcing EU associate member with high Environmental, Social and Corporate Governance (ESG) standards on the mine design.

The Malmbjerg project

Greenland Resources is a Canadian public company with the Ontario Securities Commission as its principal regulator and is focused on the development of its 100% owned world-class Climax-type pure molybdenum deposit located in central east Greenland. The Malmbjerg molybdenum project is an open-pit operation with an environmentally-friendly mine design focused on reduced CO2 emissions and water usage, low aquatic disturbance, and low footprint due to modularised infrastructure. The project has Proven and Probable Reserves of 245 million tonnes at 0.176% molybdenum disulfide (MoS2), for 571 million pounds of contained molybdenum metal during the 20-year life of mine producing 24.1 million pounds of molybdenum metal per year.

As the high-grade Mo is mined for the first half of the mine life, the average annual production for years one to ten is 32.8 million pounds per year of contained molybdenum metal at an average grade of 0.23% MoS2. The Malmbjerg project benefits from a NI 43-101 Definitive Feasibility Study completed by Tetra Tech in 2022, which concluded an expected base case after-tax internal rate of return (IRR) of 22.4%, NPV 6% of $1.17bn, and a levered pre-tax IRR of 40.4%, after-tax IRR of 33.8%, and payback of 2.4 years. The high quality of the primary molybdenum Malmbjerg ore, having low impurity content in phosphorus, tin, antimony, and arsenic, makes it an ideal source of molybdenum for the high-performance steel industry led worldwide by Europe, specifically the Scandinavian countries and Germany.

Supplying Europe with molybdenum

Malmbjerg will produce MoS2 that will be shipped to Europe to be roasted and converted into sellable products like ferro molybdenum and molybdenum oxide – an important alloying element for steel and production. The steel and chemical companies in the EU will be able to get very clean alloys from an EU associate country produced with the highest ESG standards and will be able to track every single pound of the MoS2 to comply with responsible sourcing policies.

Currently, around 90% of molybdenum is manufactured from bi-product mines. Compared to primary molybdenum mines, bi-product mines contain more deleterious elements, making it more complicated to reach certain high-performance chemical and steel standards. In addition, the supply is less reliable, the grades are significantly lower, and the extraction is less environmentally-friendly, because they require more reagents as opposed to mainly water for primary moly mines.

The project will also add important economic and social contributions to Greenland, with the potential to generate LOM corporate taxes of $700m, as per the company’s recently published NI 43-101 Definitive Feasibility Study, as well as creating job security for local residents. The Malmbjerg project is aiming to be the most environmentally-friendly molybdenum mine in the world, with a very low cash cost of $6.38/lb Mo. The project is located only 1,400km from Europe.

Rising demand for molybdenum

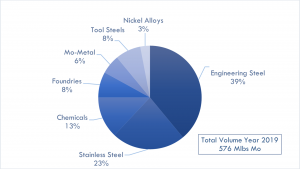

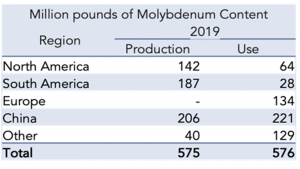

Molybdenum is a critical metal used mainly in steel and chemicals that is needed in all technologies in the upcoming green energy transition.1 When added to steel and cast iron, it enhances strength, hardenability, weldability, toughness, temperature strength, and corrosion resistance. As stated in Table 1 and 2, which are a proxy for the last decade of data, based on data from the International Molybdenum Association and the European Commission Steel Report, the world produced around 576 million pounds of molybdenum in 2019, where the European Union, as the second largest steel producer in the world, used approximately 25% of global molybdenum supply and has no domestic molybdenum production. To a greater degree, the EU steel dependent industries, like the automotive, construction, and engineering sectors, represent around 18% of the EU’s estimated $16tr gross domestic product (GDP).

In the coming decades, factors that will increase the global demand of molybdenum are: the green energy transition; the trends in high performance steel to produce stronger and lighter steel that requires more molybdenum content; the low content of molybdenum in Chinese manufactured steel compared to Western standards; and the policy that more and more requires responsible sourcing with high ESG standards that will reduce options for end users. On the supply side, bi-product mines are showing lower grades as time passes and primary product mines are depleting reserves with very few real options on the pipeline.

References

- Minerals-for-Climate-Action-The-Mineral-Intensity-of-the-Clean-Energy-Transition.pdf (worldbank.org)

Please note, this article will also appear in the twelfth edition of our quarterly publication.