Highland Copper’s mine development projects have the potential to provide the US with 75,000 tonnes of copper per year.

Optionality is key in mine development, and Highland Copper has the good fortune of having a number of great options to develop its Michigan assets.

The Copperwood mine development project is the smaller of the two assets and is the most advanced from an engineering and permitting perspective. Being smaller, the initial capital cost is more manageable should Highland choose to sequence building Copperwood first. This could provide fast access to production and cash flow, while also providing a strong foundation to build White Pine North.

White Pine North is a past mine development with considerable scale. Building White Pine North after Copperwood creates a strong mid-term growth profile, providing a path for Highland to develop into a mid-tier copper producer.

The first option may be the most appropriate if access to capital is more challenging. However, there is considerable reason to believe that copper developers will be prioritised from a capital perspective. The fundamental case for long-term copper price strength is clearly in place. S&P Global recently issued a study identifying the current and growing supply imbalance for copper in the US.

In the right environment, Highland Copper has options to scale production at a faster pace. Highland could elect to reverse the sequence of development and choose to build the White Pine North mine development first. This would prioritise the larger, more robust project.

Potentially the most attractive option is to jointly develop White Pine North and Copperwood. This could have the potential to create a production profile of 75,000 tonnes per year with an initial 20-year mine life. This option would potentially have significant capital and operating synergies, as well as a minimised environmental footprint. This is the option that Highland Copper is seeking to better understand with a preliminary economic assessment (PEA) that they have recently initiated.

The Copperwood mine development

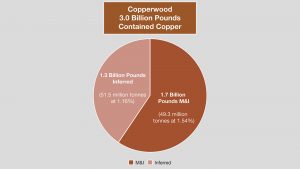

The Copperwood development could provide a meaningful step into production at a reasonable capital cost and capital intensity. Copperwood has three billion pounds of contained copper defined across measured, indicated, and inferred categories. Per its 2018 feasibility study, its initial capital cost is $244.6m (net of pre-production revenues), providing average annual copper production of 31,000 tonnes over an initial 11-year mine life. This represents a manageable capital intensity of $7,890/kt. Highland Copper is currently in the process of updating its feasibility study, and while inflationary cost increases can be expected, the capital intensity should remain favourable. The updated study will also benefit from higher copper prices.

Copperwood has all key state permits that it needs and is progressing the remaining federal water intake permit required for operations. Overall, the project is highly advanced from an engineering and permitting perspective. As such, it is positioned well for near-term mine development.

The White Pine North mine development

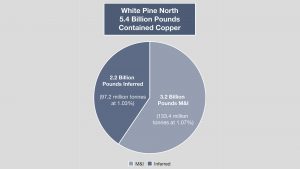

The White Pine North project is a significant step up in terms of scale. White Pine North has 5.4 billion pounds of contained copper defined across measured, indicated, and inferred categories. Per its 2019 PEA, its initial capital cost is $456.7m (net of pre-production revenues), providing average annual copper production of 40,000 tonnes over an initial 21-year mine life.

Highland is initiating an infill drill programme in late 2022, with the goal of converting a significant portion of the inferred tonnage into the measured and indicated categories.

Combined scenario

While the two projects represent excellent standalone options, a combined mine development and production scenario may be the most robust. Considering the geographic proximity of the projects – located approximately 60km apart – along with the many similarities in deposit type, mining method, and processing, Highland is considering the development of one central processing facility located at White Pine North.

The company has initiated a PEA to better define the potential of this combined scenario, which is set to be completed in the first half of 2023. As part of this study, the viability of refurbishing an existing rail line for the purpose of transporting ore and concentrate will be studied. The potential appeal of this scenario is a minimised environmental footprint and considerable capital and operating synergies.

In this development scenario, the need for a processing facility, tailings facility storage, and other infrastructure at Copperwood would be eliminated. As an underground mine, the surface disturbance would be minimal. A single processing facility would be built at White Pine North on land that has already been disturbed. White Pine North also has considerable tailings facility storage capacity in its disturbed area.

The capital and operating synergies from this scenario will be determined as part of the PEA. Under the assumption that there will be a single processing plant, general and administrative team, and technical team, there is potential for significant cost savings over an initial 20-year mine life.

Cathode plant

Additionally, the company has been analysing the possibility of economically leaching the concentrate and producing copper cathodes as a final product. This broad vision would allow for the sale of copper to manufacturers in Michigan. This would align the company’s interest with the state of Michigan and potential corporate partners that are seeking to secure domestic supply of critical metals.

The big picture

The US needs domestic copper supply. While demand continues to increase, particularly with the importance of electric vehicles and green energy, production and supply of copper in the US is growing at a considerably slower pace. This will either require the import of copper for domestic usage or an increase in US copper mine developments coming into production. The latter is likely the preference from a US perspective.

This environment favours the development of Highland’s Michigan-based assets: Copperwood and White Pine North. In particular, the combined scenario has the potential to create a production profile of 75,000t/y with an initial 20-year mine life. If the copper fundamentals lead to a higher copper price, Highland will be well positioned to advance its assets, particularly given the mine development options it possesses.

Please note, this article will also appear in the twelfth edition of our quarterly publication.