Prime Minister Rishi Sunak has today unveiled £29.5bn of new investment for thriving UK science and innovation sectors as the Global Investment Summit begins at Hampton Court Palace.

Backing some of the UK’s fastest-growing and most innovative sectors, the Global Investment Summit has secured funding for tech, life sciences, infrastructure, housing and renewable energy projects – creating thousands of new jobs and driving growth across the country.

The summit marks a huge step forward for levelling up, with more than 12,000 jobs being created from just some of today’s investments.

The Global Investment Summit will trailblaze UK innovation

The Global Investment Summit will be opened by the Prime Minister and Business & Trade Secretary Kemi Badenoch, with notable CEOs in attendance, including Stephen Schwarzman from Blackstone, Amanda Blanc at Aviva, David Soloman from Goldman Sachs, and Jamie Dimon at JP Morgan Chase.

Barclays, HSBC and Lloyds Bank will also attend as Principal Partners of the Summit, celebrating ‘British Ideas – Past, Present and Future’, from the steam train to quantum computing. It will be followed by a reception at Buckingham Palace hosted by the King.

Rishi Sunak explained: “The Global Investment Summit will create thousands of new jobs and are a huge vote of confidence in the future of the UK economy. Global CEOs are right to back Britain – we are making this the best place in the world to invest and do business.

“Attracting global investment is at the heart of my plan for growing the economy. With new funding pouring into key industries like clean energy, life sciences and advanced technology, inward investment creates high-quality new jobs and drives growth across the country.”

The Global Investment Summit follows the government’s new £4.5bn Advanced Manufacturing Plan, a £2bn investment from Nissan which will secure thousands of jobs in Sunderland, and a new Investment Zone in the North East, which will create 4,000 jobs.

Nearly 26,000 jobs were created last year alone in the North West and North East from inward investment projects, with over 7,000 in Yorkshire and The Humber and 11,000 in the Midlands.

Which industries will the investments benefit?

In a huge boost for net zero and the UK’s world-leading renewables sector, Iberdrola has confirmed £7bn of investment as part of a total £12bn programme for 2024-28, with North Star, owned by Partners Group in Switzerland, also committing £500m and 400 new jobs to offshore wind infrastructure.

Oxford Quantum Circuits (OQC), which is showcasing at the Global Investment Summit, has also announced it is raising £85m for R&D projects. Quantum computing is a rapidly growing sector with the most start-ups in Europe and is destined for £2.5bn of public and private investment under the government’s National Quantum Strategy.

“To solve the world’s most pressing challenges – from climate change to accelerated drug discovery – we need to put quantum computers in the hands of humanity and at the fingertips of our most brilliant minds,” said Ilana Wisby, CEO of Oxford Quantum Circuits.

A £1bn investment from Dutch company Yondr will also turbocharge the UK’s tech and data capabilities, with a new 30MW datacentre in Slough that will create over 3,500 jobs.

Clean energy-tech company Aira will also spur levelling up nationwide by investing £300m into heat pump rollouts, new jobs, and upskilling.

Martin Lewerth, Aira Group CEO, said: “The UK is a crucial market to decarbonise, being one of Europe’s most populated countries and with the lowest heat pump penetration rate of just 1%.

“We are excited to introduce Aira’s innovative home energy solution in the UK, and we are confident that our offering and value proposition, which includes substantial consumer cost savings, no need for lifestyle changes, and a zero upfront payment model, will be well-received.”

In a move to spur even more innovation and investment, the government is also announcing the creation of three new regulatory sandboxes for hydrogen-powered aviation, autonomous marine vessels and drones at the Global Investment Summit.

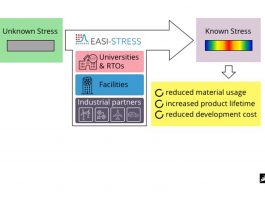

This will be in collaboration with Innovate UK, which is launching a £110m Investor Partnership for UK science and tech SMEs.