As the lithium-ion battery and electric vehicle markets continue to grow, so too does the demand for LIB nickel. Could Queensland Pacific Metals hold a solution to the inevitable LIB nickel supply-chain battle?

The Queensland Pacific Metals Townsville Energy Chemicals Hub (QPM TECH) will produce 15,000 to 16,000 TPA of nickel, in lithium-ion battery-grade nickel sulfate, with initial production commencing in 2023. QPM TECH will employ the DNi Process™1 to create a project which has first quartile operating costs, is fast to market and has the smallest environmental footprint of any nickel production process.

Robert Friedland described the next few years as being ‘The revenge of the miners’.2 He is correct but as many know, it is difficult to predict who will fare better in this battle for nickel intended lithium-ion batteries.

Supply chain issues

In 2020, lithium-ion batteries (LIBs) intended for electric vehicles (EVs) consumed only 4% of the ~2.3M TPA of global nickel production. However, by 2030, that ~4% (~90,000 tonnes3) is forecast to grow to between 20% and 40%.

Tesla alone forecast that they would need 1.15M TPA nickel in lithium-ion batteries by 2030.4 By 2040, world nickel demand for EVs is forecast to be 2.6M TPA, compared with today’s total nickel production for all uses5 of 2.3M TPA.

If you are a nickel consumer, and especially if you are part of the EV supply chain, you should already be worried. But wait, it gets worse.

Elon Musk states that the price of nickel is the “biggest concern” for electric-car batteries.6 The reality however, is that it is more likely that the availability of LIB-grade nickel will limit production of high efficiency EVs. This limited availability will force more short range and standard range EVs to use nickel-free lithium iron phosphate (LFP) batteries. But, nickel-based lithium-ion batteries (NMC, NCA, etc.) are 50% to 60% better than LFP batteries.7

Some market analysts claim that the replacement of internal combustion engine vehicles by EVs will not happen overnight and that the transportation industry will be slow to progress. Are you willing to bet your business on a slow change in EV nickel demand?

Nickel demand forecasts are so large, and the scenarios are so unappealing, that in some cases it seems to have led the LIB and EV industries to ignore an unattractive reality.

Here is the reality. Consider the lithium-ion battery plant as being a nickel consumer. It took ~two years to build the – first of a kind – Tesla Gigafactory in Nevada but:

- It typically takes five to ten years to develop a nickel mine;

- After having secured an ore source (e.g. the mine), it takes another three to six years to develop a production facility; and

- For high pressure acid leach (HPAL) plants, they typically take more than two years to reach nameplate production – or worse, most never reach nameplate.

This is why I describe the current situation as an EV nickel supply chain train wreck.

The solution: accelerated nickel production

Accelerated nickel production is not going to happen unless the people with the money start investing in the upstream part of their supply chain. That means, EV and battery producers must get involved in LIB-grade nickel production.

However, no-one expects battery and vehicle producers to become explorers, miners, chemical processors or refiners. But the battery and vehicle producers can become investors and secure their supply chain, otherwise it is going to become the ‘revenge of the miners’, a battle no-one should want.

But where can this nickel come from? This table summarises the bleak, but not terminal, prognosis for rapid growth in nickel production.

What’s wrong with nickel pig iron, ferronickel and HPAL as a nickel sulfate source?

The battery and vehicle producers are going to have to pick some winners. But are nickel pig iron and ferronickel the answer? The answer is ‘no’ (see below).

From a chemistry perspective, you certainly can convert nickel pig iron (NPI) and ferronickel (FeNi) to LIB-grade nickel sulfate. However:

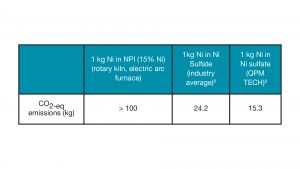

- The NPI and FeNi must first be converted to an intermediate product called nickel matte. This pathway from ore to nickel matte is an expensive process and a huge greenhouse gas emitter (see Table 2);

- Refining matte to LIB-grade nickel sulfate is very complex and expensive (capital and operating cost); and

- The environmental footprint is ugly: GHG emissions, tailings, sulfur dioxide emissions, waste streams, slags.

The incentive price is ~US$10/lb nickel. However, because it can be done and because there is so much global NPI and FeNi production, there will no doubt be some production by this route. But it will be expensive.

Importantly, the nickel from this processing route may not be acceptable in most of the world. Although it is not logical and although people do not pay attention to where the nickel comes from for their kitchen sink, they do care where the nickel comes from for their electric vehicle.

What about HPAL? Is that an answer to the LIB nickel supply chain? Probably ‘yes’, but it has challenges. The environmental credentials of nickel derived from HPAL are much better than for LIB-grade nickel from NPI or FeNi. However, only one to two of the world’s HPAL plants have been commercially successful. Furthermore, the tailings and effluent co-production with HPAL is still a challenge for most of the world, at least in high rainfall, seismically active regions where most HPAL plants are proposed.

More importantly, HPAL plants have a high capital intensity, slow ramp-up and high failure rate, HPAL plants can be done well but you must be knowledgeable. If you want to invest in HPAL, ignore the projects claiming low capital intensity which do not express their costs on a nickel-equivalent basis and think twice about project developers who do not include full life cycle analysis and waste management costs. But, please, do invest in the good HPAL projects, we need all the MHP for nickel sulfate that they can produce, too.

The EV industry is a green industry. Apart from tailings and effluent disposal, GHG intensity is also important. The greenhouse gas intensity of alternative nickel sulfate production pathways is shown in Table 2, including the Queensland Pacific Metals Townsville Energy Chemicals Hub (QPM TECH) project which is the least GHG-intensive process.

The DNi Process™ alternative – the QPM TECH Project

The QPM TECH project will import high grade nickel ore from New Caledonia, a short shipping distance to Townsville in northeast Australia. It will be processed by the DNi Process™ at a zoned, heavy-industry precinct through to nickel and cobalt sulfate and other by-products.

The DNi Process™11 uses atmospheric pressure, nitric acid leaching, not smelting (NPI, FeNi) or high-pressure acid leaching with sulfuric acid (HPAL). HPAL is thought to represent one of the main production pathways to LIB-grade nickel sulfate but incorporates a number of challenges.

Although the sulfuric acid used in HPAL is cheaper than the nitric acid used in the DNi Process™, it is not recyclable, requires high temperature (~250˚C) and high pressure (~50 atmospheres) to leach the nickel from the ore. In contrast, in the atmospheric pressure DNi Process™, the nitric acid is used at low temperatures and is recycled (>98% recycled), reducing the operating cost and environmental footprint.

The differences between the QPM TECH project and HPAL are shown in Table 3.

Why was the DNi Process™ not commercialised years ago?

The DNi Process™ is not new. It was patented in 2008.14 So, if it is so good, as appears to be the case, why has it not already been commercialised? The answer is a simple one, timing. When the process was invented (and then extensively piloted) in the middle of the last decade, the aim was to create a green process to produce nickel metal for the nickel market – stainless steel and alloys (effectively the only end use for nickel).

Therefore, attempts to commercialise the DNi Process™, despite its successful development, failed. This was simply because the timing coincided with the rapid development of improved nickel pig iron production, especially from the rotary kiln-electric furnace process. That process was, and generally still is, the cheapest way of getting nickel into stainless steel. However, it is not the cheapest way, nor the cleanest way of producing LIB-grade nickel and cobalt sulfate. Ten years ago the lithium-ion battery market did not exist. It does now. Timing is everything.

Status of the QPM TECH project

The DNi Process™ technology was extensively piloted on a range of ores in the middle of the last decade. To supplement and confirm that piloting, QPM has just completed piloting with New Caledonian ore sourced from QPM’s mining partners. The pilot plant (shown below) was successfully completed in February 2021. Pilot plant samples have just been sent to potential purchasers.

In 2020, QPM signed non-binding MOUs with LG Energy Solution and Samsung SDI for the supply of up to 16,000 TPA nickel. QPM has now commenced a feasibility study and is targeting first production in the second half of 2023.

Australia and the EU/UK lithium-ion battery nickel supply chain

Australia is obviously a stable, Tier 1 jurisdiction. Battery chemical supply from Australia is secure, stable, reliable and high quality. Commercial and contract law is very compatible with LIB and EV manufacturer countries.

In the case of high-value lithium-ion battery chemicals (e.g. nickel and cobalt sulfate), the transportation distance, cost and greenhouse gas footprint is negligible. Geography is not an issue.

Australia, and especially the QPM TECH project, present an attractive supply chain option for the EU, UK, North American and north Asian lithium-ion battery and electric vehicle industries. If these industries do not want to be caught in the LIB nickel supply-chain battle, then Australia and the QPM TECH project presents a very attractive option.

References

- The DNi Process™ is owned by Altilium Projects (Australia) Pty Ltd. see www.altiliumgroup.com

- https://resourceglobalnetwork.com/2021/01/19/robert-friedland-predicts-revenge-of-the-miners-in-post-covid-world/

- https://www.mining.com/nickel-demand-for-evs-expected-to-shoot-up-in-the-next-20-years/

- Tesla 2020 battery day cited in https://investingnews.com/daily/resource-investing/base-metals-investing/nickel-investing/tesla-nickel-battery-day-details-needed/

- Mostly stainless steel and nickel alloys

- https://www.mining.com/web/musk-says-nickel-is-biggest-concern-for-electric-car-batteries/

- https://stockhead.com.au/tech/battery-day-tesla-confirms-nickel-as-metal-of-choice/

- One of the world’s largest HPAL operations (Ramu Nickel) disposes tailings by deep sea tailings placement

- Nickel Institute

- Minviro LCA study

- Described in a separate article in this issue

- The saprolite ore is half the ore body but contains high magnesium concentration which consumes sulfuric acid

- Stainless steels are passive to nitric acid. In fact millions of tonnes per year of nitric acid are transported around the world in stainless steel

- US8038767 ‘Method of recovering metal values from ores’

Please note, this article will also appear in the sixth edition of our quarterly publication.