Pulsar Helium’s Topaz Minnesota project is well positioned to help alleviate the global shortage.

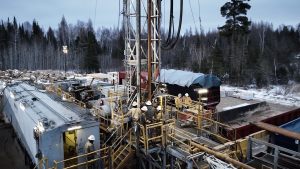

In February this year, Pulsar Helium Inc (Pulsar) announced extraordinarily high helium concentrations of up to 13.8% from its Jetstream #1 appraisal well drilled at its Topaz project in Minnesota.

This has positioned Topaz as the highest-concentration helium discovery in North America and expectations are high for its upcoming work programmes.

Cliff Cain, CEO of the Edelgas Group (an international gas advisor firm engaged by Pulsar), commented: “Comparing this to our extensive database for helium occurrences around the world, we are pleased to say the results from the Jetstream #1 appraisal well are the highest helium concentrations that we have ever seen. This marks an important milestone for Pulsar and we are delighted with such a positive outcome for our client.”

Jetstream #1 is located only 50ft from LOD-6, a hole drilled in 2011 by a mineral exploration team looking for nickel. Hole LOD-6 unexpectedly encountered a gas accumulation at 1,760 feet below ground level. After the well blew the core barrel and drilling fluid out of the hole, the gas was sampled, primarily to see if it was explosive, and it was found to contain approximately 10.5% helium by concentration.

The gas flowed freely for four days, with no apparent decrease in pressure until it was capped. A recent interview conducted with David Oliver, who helped cap LOD-6 described the venting gas as “screaming like a jet engine.”

Pulsar is the first mover in the exciting new helium district of Minnesota, having drilled Jetstream #1, it has also acquired important geophysical data in the Topaz project and is in the process of acquiring further seismic, gravity and magnetic geophysical data.

This broad compilation of data has suggested additional areas of potential interest, as such, the company has been actively consolidating its land position. Further well operations will occur at Jetstream #1 this month (May 2024) with acquisition of additional down-hole logging data and pressure build-up and flow testing operations.

Upon completion of the May work programme at Jetstream #1, the data gathered by Pulsar will be shared with Sproule International Limited, an independent consulting and advisory firm, to conduct a resource calculation update for the Topaz project.

The helium shortage is causing a reliance on non-US sources

In the past 25 years, the production of helium in the US has decreased. In 1999, the US produced 118m cubic meters; in 2023, just 59 cubic metres were produced.

In contrast, 2023 saw the highest consumption of helium in the US for over a decade, with the aerospace, electronics, and medical sectors by far the biggest consumers.

Until recently, the US was the largest supplier of helium, with the world’s largest stand-alone repository, the Federal Helium Reserve. Earlier this year, the Federal Helium Reserve (est. 1925) was privatised but is a shadow of its former self, once holding over 44 billion cubic feet (Bcf) of helium, but since plummeting to approximately 4Bcf today.

As the global helium shortage persists, the world becomes more reliant on non-US sources. The Russian natural gas company Gazprom is working toward achieving full operational capacity in 2025.

Meanwhile, Qatar is now the world’s largest helium-producing nation. Both these sources contain inherent risks for helium consumers in the US, including distance to travel (helium is a small atomic size and likes to leak) and geopolitical risk (the Qatar diplomatic crisis of 2017-2021 and sanctions on Russia).

With the helium shortage continuing, Pulsar is advancing its discovery at the Topaz project in Minnesota to determine its potential to contribute to US supply and provide a safer domestic alternative for consumers.

As recently detailed in the MIT Tech Review, the era of cheap helium is over, with its price nearly doubling since 2020 from $7.57 per cubic meter (Pcm) to highs of $14Pcm in 2023.

Research conducted by the Edelgas Group suggests that global helium requirement is estimated to increase from 6.1Bcf in 2023 to 8.1Bcf in 2030, with the following fast-growth sectors requiring significant quantities of helium:

Medical technology

Helium plays a crucial role in medical treatments requiring enhanced oxygen intake, such as addressing upper airway obstruction in conditions like asthma and chronic obstructive pulmonary disease.

Additionally, helium is essential for the operation of MRI scanners, where liquid helium cools the superconducting magnets within the machines.

Notably, the medical sector stands as one of the foremost consumers of helium, highlighting its pivotal role in advancing healthcare technology.

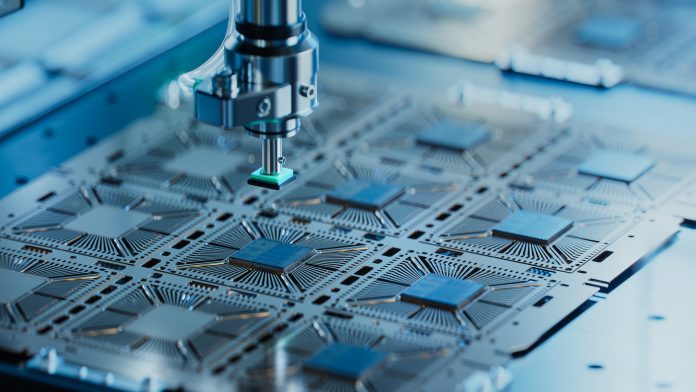

Consumer technology

Helium is essential in the manufacturing and assembly of many electronic devices. It serves multiple critical roles in semiconductor fabrication, crucially important chips that can be found in thousands of products, including artificial intelligence (AI), computers, smartphones, appliances, gaming hardware, and household entertainment systems.

Helium is also employed as a purge gas to establish clean environments, eliminate contaminants, and ensure controlled atmospheres, which is vital during microchip manufacturing.

Aerospace

Liquid helium is used as a pressure agent for cryogenic fuel tanks in space rockets. As the rocket burns fuel, the fuel tank is purged with liquid helium to maintain pressure. When you see a rocket on the launch pad with gas emanating from its side, it is likely to be helium boiling at -268.9ºC.

In addition to the primary markets listed above, helium is in increasing demand across a variety of burgeoning frontier markets, including:

Drones

Drone electronics, including flight controllers, sensors, communication systems, and navigation modules all require the integration of semiconductors, enabling drones to operate autonomously, navigate complex environments, and execute missions with precision.

Advanced semiconductor technologies, such as microprocessors and integrated circuits, empower drones with computational capabilities, enabling real-time data processing, image recognition, and decision-making algorithms.

Lasers

Widely used across the manufacturing, transportation, and military sectors, helium is integral for many types of laser, and are critical for cooling, ranging and targeting. The fibre laser market is projected to grow by 145% between 2019 – 2030.

Data storage

By 2025, it is estimated that 181 zettabytes (181 trillion gigabytes) will be created, captured, copied & consumed globally. Since 2013, cost-effective & highly efficient helium hard drives have been essential for powering high-volume data storage centres.

Robotics

Helium is used extensively in the manufacturing of semiconductors which play a crucial role in robotics. Semiconductors (specifically microcontrollers and microprocessors) constitute the brain of a robot. They’re responsible for processing instructions, controlling movements, and managing various tasks enabling robots to execute complex algorithms and make decisions based on sensor input.

Renewables

Battery technology is playing an increasingly pivotal role in the ‘green energy transition’. Battery storage technologies enable energy from renewables to be stored and then released when the power is needed most, helping maintain balance between supply and demand within the power system.

Helium is commonly used in leak detection tests during battery cell, module, and pack production processes.

Please note, this article will also appear in the 18th edition of our quarterly publication.