Rambler’s world-class high-grade copper-gold mine is poised for take-off, both operationally and through its significant expansion and exploration potential.

Mining and development company Rambler Metals and Mining Canada has 100% ownership in the Ming Copper-Gold Mine, a fully operational base and precious metals processing facility at Nugget Pond and a year-round bulk storage and shipping facility at Goodyear’s Cove, all located on the Baie Verte Peninsula, Newfoundland and Labrador, Canada.

The company has established a production profile to meet current mill capacity of 1,350 MT per day, with a target grade of 2% copper (Cu), and is evaluating growth opportunities from that base.

Along with the Ming Mine, Rambler also owns 100% of the former producing Little Deer Complex.

In 2021, as part of its transformation, Rambler rebranded with a new logo to depict its key attributes and aspirations.

The Rambler ‘Circuit Board Tree’ depicts a Tuckamore – a common sight in Newfoundland and Labrador. It is a unique Newfoundland word for a tree growing along the coast, stunted by the harsh conditions. These trees hug the ground as they grow in line with the prevailing winds.

With its underground root system through to its branches, the Rambler tree represents the transformation of underground minerals to supply the world with metals for high-tech and industrial products, all whilst overcoming the challenges of our natural environment.

The green ‘e’ points to Rambler as a green organisation that operates with an environmental conscience to produce clean energy minerals while making a significant economic contribution to the community, the region and the country.

History of Baie Verte

The Baie Verte region has been host to several high-grade copper-gold mining operations over the past 100 years. Despite this, the region remains largely underexplored.

The Ming Mine operated until 1982, working to a depth of 750m below surface with a vertical shaft and decline access pursuing high-grade massive sulphide ore. The larger Lower Footwall Zone, interpreted as the feeder system to the high-grade zones, had limited diamond drilling and was not mined.

Following further exploration and tenement consolidation, in 2012 Ming Mine recommenced operation using its existing infrastructure and the processing facility at Nugget Pond.

In 2020, after several years of struggling performance and financial stress, each a cause of the other, a recapitalisation and turn-around process was initiated. In 2021, redevelopment of the underground mine set about creating a platform to enable a consistent supply of high-grade ore to fully utilise the Nugget Pond Mill.

Operational turnaround of the Ming Mine

Ming Mine has a well-defined mineral resource, and the metallurgy is well-proven with a 95-97% copper recovery at the mill. The quality of the copper concentrate produced is well-regarded by the market. The key to success of this operation is the planning and execution of the underground mining itself.

While there are distinct technical elements to mining, success hinges around recognising the risks associated with dealing with a natural resource (geology, geotechnical, etc.) and having appropriate mitigations in place to deal with that variability (e.g. appropriate inventories and stockpiles) and ensuring that mine development and infrastructure are established and maintained to support the level of production planned.

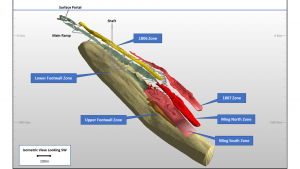

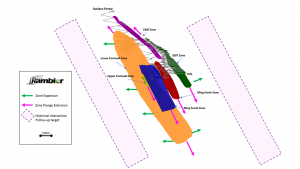

For the very first time, Ming Mine now has multiple mining zones established to ensure that there are always adequate sources of ore available for mining. Mining from these zones is scheduled to provide an optimal blend to the mill that maximises the value of its throughput capacity. We are targeting 1,350 tonnes per operating day at a grade of around 2% copper, and have established ore stockpiles to decouple the mining and milling operations. Ongoing development to maintain that capability is committed.

Accomplishing the turnaround has been widely communicated to the market and has been achieved through sourcing the right competencies, supplemented with contractors, and improving the way in which mining is executed.

Rambler is on track with its 2022 production target of 7,000 tonnes of payable copper. This represents a 100% uplift on 2021 and, given the performance to June 2022, the second half of 2022 will be a 100% uplift on the first.

Operational comparisons with the past are not relevant. The mine has moved on with what has been established over the past 18 months.

Rambler’s resource base

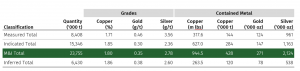

Rambler’s most recent Mineral Resource Estimate, effective 31 March 2022, is shown below.

An important observation is the high average copper grade of the resource at 1.80% using a 1% cut-off. This deposit ranks as a high-grade deposit in global terms. There are new copper projects being considered today with grades of <0.5% Cu with a capital cost of several billion dollars.

Recognising that the Ming Mine can now be a reliable producer of copper, at current scale we mine around 500,000 tonnes of ore per year.

Ignoring the inferred mineral resource at 6.4 million tonnes grading 1.86% Cu, as of March of this year the Ming Mine’s measured and indicated (M&I) resource estimate contained just over 428,000 tonnes of copper, in situ. That is about a billion pounds of copper resource grading 1.80% Cu.

Based on the limits of historic suboptimal production rates, the current mine plan for the project (as declared on the website) is targeting only 131,000 tonnes of copper, just 30% on the known mineral resource. Following the recent increases in production efficiencies, the company is updating its NI43-101 Technical Report to include the new de-risked mining strategy with all the high-grade mineral discoveries made since 2018.

This updated life of mine forecast will then serve as the backdrop to evaluate further expansion opportunities aimed to fully maximise the entire mineral resource endowment. The end goal would be to demonstrate the opportunity for a +15-year life of mine with three times the size of our current output, potentially producing around 25,000 tonnes of copper per year.

There is a strong case to ‘right size’ the scale of the Ming Mine to better reflect its resource base and create more value for shareholders. This considers the potential of the Ming Mine based just on what we know today. Building upon our recent diamond drilling successes, there is even more to be gained from further exploration.

Exploration potential

Rambler recommenced diamond drilling in 2021, largely focused around in-fill drilling to improve detail for mine planning and design.

Additionally, some holes have been drilled to upgrade inferred resources to indicated and measured status. All our known mineralised zones are open down dip.

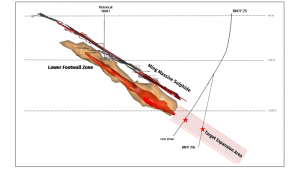

Drilling has consistently shown that both the quality and the scale of the resource zones improve with depth. This is characteristic of volcanogenic massive sulphide (VMS) deposits.

In 2017, drilling from surface intersected 102m of 1.7% copper in the Lower Footwall Zone, over 1,500m below surface. This drilling confirmed that mineralised grades and thickness were both improving with depth and remains open to further exploration.

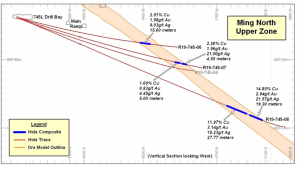

In 2019, drilling in the Ming North Zone from underground returned exceptional results with the highlight being hole R19-745-08 with 27.77m at 11.97% Cu and 19.30m at 14.85% Cu.

In 2021, drilling into the Ming North Zone from a lower level (785) hole R21-785-17 returned the best intercept of 48.59m at 6.30% Cu.

In 2022, Rambler has identified two previously unknown mineralised zones from its probe drilling on the 510 level from the Lower Footwall Zone. Importantly, in common with all our known mineralised zones, these new deposits are open down dip. Even more exciting is that they are open up dip and could potentially extend to surface. More exploration is required and will form part of the development strategy for the Ming Mine.

All exploration data is available on our website.

Ming Mine Sustainability

Rambler aims to conduct its business in such a way that maximises value for shareholders. When it comes to business sustainability, this means managing the risks and capitalising on the opportunities.

Rambler is fortunate to be supplied with electrical power largely generated by hydro schemes, which are an inherently renewable energy source. As we consider options to expand and grow the business, Rambler has the opportunity to source power from a high-voltage commercial line that transects the Ming Mine mining lease. With a supply of low-cost hydroelectricity, Rambler can consider options to replace diesel-powered equipment with electric/battery, recommission the 500m vertical shaft for hoisting to eliminate ore trucking to surface, and consider processing facilities near the mine site that could both expand production and eliminate the current 44km road haul to the Nugget Pond milling facility. All of these projects would reduce carbon emissions, while at the same time reducing operating cost.

To maximise resource recovery in the underground mining process, we backfill the stope voids to provide stability and reduce pillars that sterilise ore. Given the high value of the mineral resource in situ, systems for consolidated backfill have the potential to take this to another level. There is a source of old mine tailings nearby which is a provincial government liability, and for which backfill may provide a solution to an ongoing environmental issue. The underground could also provide a location for a significant proportion of mine tailings generated by a new mill at the mine site. In both cases, these projects could increase resource recovery, lower cut-off grades, reduce operating cost and increase mine life, as well as reducing surface impacts and costs of tailings management.

There is federal financial support for carbon emissions reduction in Canada as well as environmental improvement projects more generally. Rambler aims to apply for these funds wherever possible to assist further in the evaluation and implementation of these initiatives.

Critical minerals

Canada has designated copper as a critical mineral and there are pools of funding and allowances to encourage the exploration for and development of copper resources. Rambler will seek to maximise these opportunities.

As the world seeks to reduce carbon emissions, the drive towards renewable energy will push the demand for copper, both in terms of electricity generation and transmission, such as for wind farms, and in consumption, such as motors for electric vehicles (EVs). New copper projects coming online are scarce, frequently low grade requiring high capital investment, and often in challenging parts of the world.

Rambler is well-placed to supply the market with a quality copper product. In the future, the provenance and the carbon content of materials will become increasingly important, and Rambler can capitalise on its sustainability attributes.

Targeting investor appreciation

Understanding what has changed and why Rambler is in a different space is key for investors to appreciate the true value potential of the company.

The historical performance of Ming Mine is just that, history. Previously, Ming Mine was never developed sufficiently to support the level of production that was expected of it. Underperformance and disappointment were unavoidable.

Despite the challenges of a weak balance sheet, Rambler has turned a corner. The company is well-developed with the right skills and is becoming increasingly resilient to the challenges that it has progressively addressed.

An operating and cash-generative copper-gold mine in Newfoundland, Canada, producing at an annualised rate of 8,000 tonnes copper per annum with a goal to produce around 25,000 tonnes of copper per year, plus its significant exploration potential, should have a value of several hundreds of millions of dollars in today’s market.

The true value of Rambler makes the current balance sheet, as well as future capital growth requirements, eminently manageable issues from which shareholders can realise significant upside.

Rambler is gaining the attention of investors that have moved to the next chapter.

Please note, this article will also appear in the eleventh edition of our quarterly publication.