Jeff Townsend, Founder & CEO, and Olimpia Pilch, Founder & COO of the Critical Minerals International Alliance, emphasise the importance of rare earth elements for the transition to a green economy.

When we think of the global economic transition from fossil fuels to renewables, we often think of electric vehicles (EVs) and lithium-ion batteries. These batteries are incredibly important; however, even more so are rare earth permanent magnets. Without them, the global net zero transition is simply not feasible.

Rare earth magnets permeate our homes and offices. They can be found in numerous vehicles, such as trains, buses, and cars. If the latter is taken in isolation, 66 rare earth magnets are required to construct a modern EV. Additionally, they are present in a range of consumer technologies: mobile phone speakers and charger cable ports, to list but two examples.

They are also a prerequisite for establishing the greener, more technological future we all wish to see. The wind turbines that contribute toward a supply of renewable power and the satellites that assist with information sharing are both formed of rare earth magnets.

Funding barriers to rare earth magnet projects

In spite of the fact that rare earth magnets are integral to almost every aspect of modern life, many people still conceptualise magnets as those found on their fridges. Thus, the importance of rare earth magnets is difficult to articulate.

Despite their importance to the creation of the green economy, the difficulty of explaining this to voters has reduced their funding compared to other critical minerals.

Subsequently, UK State funding does not favour rare earth magnets. The Automotive Transformation Fund has been granted over £750m to build a gigafactory economy in the UK.

By comparison, the rare earth magnet focused Driving the Electric Revolution has only been granted £80m.

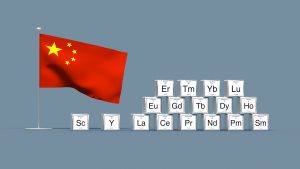

A further barrier to increased state funding for rare earth magnet projects is that rare earths, 17 of which are clustered together on the periodic table, have highly complex, opaque, and volatile supply chains.

Ironically, rare earths are not particularly rare either. They can be found across the globe. The reason for their somewhat puzzling name stems from the fact that they are rarely found in enough abundance to make them economically viable to mine.

Nevertheless, their growing importance has started to make well-established deposits more attractive as the world races to meet the forthcoming demand shortage.

China’s control of the global rare earth supply

What is most troubling for many is that the processing and refining of rare earths are monopolised by one nation. Figures from the International Energy Agency (IEA) show that China accounts for 60% of rare earth production,1 87% of processing, and 92% of magnet production.2

China now effectively controls rare earth supply globally. The Chinese Communist Party (CCP) has been increasingly willing to invoke this control in bilateral and multilateral fora, employing rare earths as a tool of economic statecraft.

In 2010, following the arrest of Chinese fishermen by the Japanese Coastguard, China suspended rare earth exports to Japan, awakening the world to the strategic consequences of over-reliance on a nation that has little regard for human rights and environmental responsibility.

Over a decade later, China placed Lockheed Martin and a unit of Raytheon Technologies on an “unreliable entities list”3 over arms sales to Taiwan. All the while, China was reviewing a potential ban on the export of rare earth elements (REEs) to countries it deemed to be a security concern.

It does not take a four-star General to see the connection between the two events and their catastrophic implications for the construction of Western military hardware. In particular, the US F-35 jet fighters.4

As a consequence of the US, along with a preponderance of European nations, trading the security of supply for lower prices, the Western security apparatus has been detrimentally affected.

Poor environmental, social, and governance (ESG) outcomes do not cease to exist because they happen in China, their effects on the security of rare earth supply have been tangible. Alas, it is only now that the West has come to view them as a problem.

The harsh reality of REE extraction in China has been reported since the early 2000s. Nonetheless, it failed to percolate in the public conscience of Western nations.

Fortunately, civil society has begun to question how REEs are sourced, as well as how the inevitable impact of their extraction on the planet can be mitigated.

The likes of author Guillaume Pitron have also assisted greatly in spurring the West’s collective conscience by highlighting the horrific consequences of negligent mining practices; the cancer villages of inner Mongolia are an example of the many consequences he highlights in his book, the Rare Metals War.

Nevertheless, China’s influence continues to extend outside of its borders.

China’s role in Myanmar’s rare earth industry

Since the 1980s, China has controlled the supply of REEs. However, as its domestic mining industry boomed, the cracks began to show. Illegal mining was rampant, the environment was suffering, and many senior Chinese officials began to express concerns about dwindling resources.

From 2016 onward, the CCP closed many of the heavy rare earth mines in Ghanzhou, Jiangxi Province, China’s rare earth kingdom. This meant that the country’s state-owned processors required new sources of raw materials to supply the global market.

Rather than improving ESG standards within their own jurisdiction, said processors let the non-ESG exploitation run rampant in neighbouring Myanmar.

The world’s third largest producer of REEs, Myanmar produced an estimated 26,000 metric tons of rare earth oxides in 2021 alone. This is a conservative estimate.

Accurate data remains unobtainable, but suffice to say, it is a commonplace view that a far more significant quantity was produced, largely as a consequence of illicit Chinese and artisanal mining.

China has also had little recourse about leveraging Myanmar’s ongoing instability, following the coup d’état of 2021, to further exploit the nation’s vast resource potential.

A six-month investigation by Global Witness found that China’s mining of REEs in Myanmar has led to ammonium sulphate leaking into the water supply and poisoning local communities, the majority of whom never see the economic benefits of mining as profits are often utilised to fund militias affiliated with the country’s dictatorship.5

Western rare earth production

The West’s record on REE production is by no means spotless either.

The US Mountain Pass processing site has faced significant technological, environmental, and social challenges.

In the 1980s, pipelines carrying wastewater to evaporation ponds ruptured frequently; a federal investigation reported around 60 known spills. In 2002 the mine closed after a toxic waste spill, although processing continued.

Events akin to these caused a great degree of hesitancy among Western governments to pursue domestic REE production with significant vigour, arguably, causing the global supply of rare earths to become more heavily monopolised.

Western attempts to break China’s monopoly of rare earth supply chains

There have been more auspicious developments regarding Western countries’ attempts to break China’s monopoly of rare earth supply chains. The Japanese Organisation for Metal and Energy Security6 (JOGMEC) is emblematic of the policy levers Western countries can pull to assure a stable and responsibly-sourced supply of REEs.

JOGMEC was established to ensure the security of industry supply chains within Japan. As a consequence of the organisation being state-owned, JOGMEC was able to sustain financial losses in favour of strategic benefits. One such strategic benefit emanated from JOGMEC’s USD$250m investment in Lynas, an Australian rare earth processing company.7

Since its 2011 investment in Lynas, Japan has obtained a secure supply of rare earths that feeds directly into its downstream producers, or original equipment manufacturers (OEMs). JOGMEC invested a further USD$9m in Lynas in 2022.

These investments were critical to both Japanese industry and the global rare earths sector for the following reasons.

Firstly, it demonstrated to the world that there is the potentiality of constructing alternative supply chains, so far as governments were willing to be proactive in their approach. Secondly, it shielded Lynas from what was a particularly damaging fall in rare earth prices from 2011 onward.

The reduced prices meant that the company was unable to sustain sufficient operating expenses and capital expenditure to continue its extraction and processing operations outside of China. Hence why REE exports to Japan were prioritised, thereby mitigating the impact of the ensuing debt restructuring.8

The final reason why Japanese investments in Lynas were so crucial, is that it demonstrated that companies were willing to get involved in the sector as geopolitical tensions over REE supplies had begun to manifest.

The above marked the commencement of what has come to be known as the New Great Game.

Where does the UK fit into this geopolitical contest?

The UK has the potential to become a regional leader in the rare earth sector.

Upstream companies like Mkango Resources have shown the UK is able to operate and be active in the upstream through their rare earth project in Malawi.

Pensana’s prospective rare earth separation plant in the North-East has tangibly demonstrated that the UK could and should establish a domestic midstream.

These projects, in combination with Less Common Metal’s magnet alloys production facility in Ellesmere Port, show that the UK industrial sector is beginning to build a supply chain that could disrupt the EU’s, as well as its own, dependence on China.

When HyProMag is factored into the equation, and by implication, the University of Birmingham, it is possible to envision the establishment of rare earth magnet recycling and production capacity on a commercially viable scale.

It goes without saying that Less Common Metals is also an integral part of any attempts by the UK to establish alternative rare earth supply chains, given that it provides the Western world with magnet metal alloying not available outside of China.

China is diversifying its stakes across the rare earth sector

China has not sat back either and has looked to new ways of improving its share of the sector. China has begun to buy shares in Western companies to diversify its stake across the rare earth sector. Shenghe Resources has a 7.7% stake in MP Materials,9 which successfully restored Mountain Pass to profitability.

In the UK and Australia, Peak Resources was regarded as a leader in establishing alternative rare earth supply chains. However, difficulty in Tanzania resulted in Shenghe Resources acquiring 19.9% of the company in 202210 and subsequently Peak Resources falling from favour in the eyes of the UK Government.

Rare earth elements are crucial for a green future

The world is transitioning to a green economy and rare earth elements and magnets are vital to this. Without them, the world cannot build the net-zero technologies of the future, nor can it guarantee the continued production of consumer electronics to meet market demands.

It would also be remiss not to acknowledge the necessity of rare earths to assuring the collective security of the West and its allies.

The race to secure alternative rare earth supply chains is just beginning. The UK has made significant progress, but much remains to be done. If the world is to counteract China’s rare earth monopoly, then collaboration, the prioritisation of ESG, and adequate state funding across allied and partner countries are key.

References

- https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/the-state-of-play#abstract

- https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- https://www.reuters.com/business/aerospace-defense/china-imposes-sanctions-lockheed-martin-raytheon-over-taiwan-arms-sales-2023-02-16/

- https://www.ft.com/content/d3ed83f4-19bc-4d16-b510-415749c032c1

- https://www.washingtonpost.com/world/asia_pacific/tibetans-in-anguish-as-chinese-mines-pollute-their-sacred-grasslands/2016/12/25/bb6aad06-63bc-11e6-b4d8-33e931b5a26d_story.html

- https://www.jogmec.go.jp/english/index.html

- https://www.jogmec.go.jp/english/news/release/news_10_00010.html

- https://www.wsj.com/articles/miner-lynas-plans-debt-overhaul-in-bid-to-stay-afloat-1477489364?mod=wsjde_finanzen_wsj_barron_tickers

- https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- https://www.mining-technology.com/news/shenghe-stake-peak-rare-earths/