Minerals exploration specialist Romios Gold is working towards a partnership for Golden Triangle copper targets and has made significant progress with copper and gold exploration in Nevada.

As a veteran Canadian-listed junior explorer, Romios Gold (RG.V) continues to identify high-potential precious and base-metal targets across its numerous properties in both British Columbia and Nevada. Under new leadership, the company is narrowing its focus towards its high-grade Nevada copper and gold targets while entertaining potential partnership opportunities on its Canadian core-asset base.

Golden Triangle, British Columbia, Canada

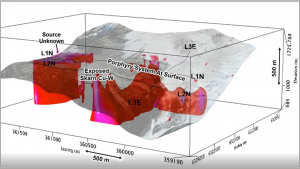

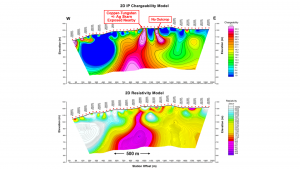

In autumn 2022, Romios announced the discovery of a broad, very strong induced polarization (IP) anomaly underlying its Trek South copper-gold-silver porphyry target and a newly discovered associated area of widespread copper-tungsten skarn. The company’s total land package in the Golden Triangle covers over 400km2 and is host to numerous precious and base metal targets along the same geology and many of the trends as the Brucejack, Eskay Creek, and Galore Creek deposits.

The Trek South target was discovered in 2021 after the local snow and icefields had melted back far enough to expose mineralised and altered bedrock, and the company’s 2022 summer field programme completed a highly successful induced polarization/magnetotelluric (IP/MT) survey identifying a very strong and quite large IP anomaly pointing to substantial sulphide mineralisation at shallow levels right under the centre of the previously identified copper-gold-silver porphyry system.

The company is very excited by the results of the IP/MT surveys and the new mineralisation discovered this past summer. It is hard to imagine a better target coming out of the programme and Romios is eager to begin drilling at Trek South and exploring potential joint-venture partnerships to take the Trek South project forward towards a potential discovery.

A newly discovered very large IP/MT target ready for drilling

The IP anomaly at Trek South is at least 800m long and 250-500m wide, and extends to a depth of at least 650m. The MT survey indicates that it carries on to a depth of over 2km.

The first indications that the company had something important was the 2021 discovery of a 1km-wide zone of very strong epidote alteration, overlayed with an 800m-wide stockwork of quartz-pyrite veinlets with many showings of highly anomalous gold, silver, and copper values. This type of alteration and veining are typical of the peripheral zones around and over the top of a porphyry copper-gold system.

The size of the Trek South porphyry and skarn target is quite substantial and similar to a number of major deposits in the region. It represents Romios’ most significant project in British Columbia’s Golden Triangle for several important reasons, including:

- It now has an expansive, and very strong, geophysical anomaly indicating that sulphide mineralisation begins at shallow depths under the centre of the exposed porphyry copper-gold target;

- A large area of copper-tungsten skarn mineralisation was discovered in 2022 right beside this porphyry system and overlying part of the IP anomaly;

- There are three other IP anomalies nearby that have not been ground-tested yet, providing even more blue-sky potential; and

- The potential access route to the site is very favourable as Trek South is just 1.3km from the cleared and partially constructed road from Highway 37 to the Galore Creek site and is about 10km from the site of the proposed Galore Creek mill.

New discovery of a local tungsten skarn

In addition to this exciting geophysical discovery, a very important geological discovery was also made in summer 2022. Romios’ mapping crew located a large area of previously unknown copper and tungsten skarn with patchy sulphide mineralisation in limestone and other sedimentary rocks.

Skarns are created when fluids from granitic intrusions interact with calcium-rich sediments to form massive zones of different minerals and this process can create rich ore deposits right beside a porphyry orebody in some cases.

Romios’ skarn samples contained high levels of both copper and tungsten. The skarn outcrops are scattered over an area at least 275m x 80m across, and they trend off under overburden, so the full extent has the possibility of being much bigger.

The biggest surprise was that assays from these skarns returned unexpectedly high tungsten levels – the company had not seen any significant tungsten in the area before and were not specifically looking for it during the sampling programme.

A total of 21 samples from the skarn returned tungsten assays of up to 0.68% WO3, average 0.24% WO3 (WO3 = tungsten trioxide). These high values are in spite of the fact that the samples were not taken from where high tungsten levels would necessarily be the highest (based on the company’s results) as exploration was focused on sulphide pods in the skarn. The main tungsten mineral is known as scheelite, and it is usually off-white in colour and very hard to pick out without the use of a UV light. In 2023, Romios intends to return to the site with UV equipment to look for and sample the tungsten mineralisation specifically to get a true sense of its extent and concentration. In addition, the skarn also contains appreciable copper levels: up to 0.98% copper, averaging 0.27% copper.

There are two critical points about this mineralised skarn:

- The outcrops are 200-300m from what the company believes is the source pluton and we can normally expect that the grades and size of the skarns will increase as we move toward the pluton along strike and at depth; and

- The skarns overlie the north end of the 800m-long IP anomaly and are the likely source of at least some of this anomaly. To have mineralisation overlying such a large and strong IP anomaly is a very good sign for what we might find once we start drilling along this target.

Proximity to infrastructure is crucial for project success

On top of Romios’ exciting geological and geophysical target, the geographical advantages of Trek South compared to other projects in the region are substantial.

Trek South is just over 1km away from the partially constructed and cleared road route into Teck and Newmont’s giant Galore Creek deposit, and we can literally see the site of the proposed Galore Creek mill from the property.

Galore Creek is currently in the final stage of a pre-feasibility study, and it is hoped that they will proceed to the development stage in a few years and complete the road and pipeline infrastructure through Romios’ Trek claims to Galore Creek. Even in the absence of additional progress at Galore, the road to Trek South from the nearest highway is already partially complete, providing a significant jump-start for completion.

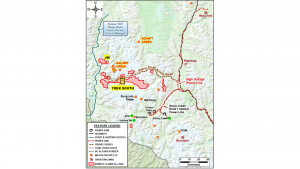

Focusing exploration activities on Nevada assets in 2023

Nevada is ranked one of the top mining jurisdictions and is ranked the fourth largest gold producer in the world, making it a priority for Romios due to the significant unrealised mineral potential of its assets there, and the fact that each asset is road-accessible for cost-effective, year-round operations.

Romios holds two projects in Nevada in classic mining camps and has already identified visible gold within extensive vein systems at the Scossa Mine Project where its past drill programmes intersected ‘Bonanza’ grades over multiple metres. The Scossa Mine Project is centred on a former high-grade gold mine which was in production from 1930-1941.

Additionally, the company recently staked a new property in the Walker Lane Trend called the Kinkaid Project, and early reconnaissance programmes have returned very exciting high-grade copper, gold, and silver grab samples.

Former high-grade gold producer: Scossa Mine Project

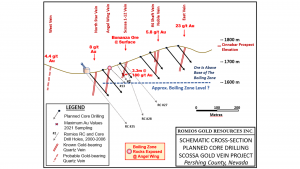

The Scossa Mine is a former high-grade gold producer that began operations in the early 1930s and closed during the Second World War in 1941. It produced high-grade ore from five epithermal veins in faults up to six feet wide and is located at the intersection of two major gold belts: the Sleeper Trend and the Sulfur-Lovelock-Austin Trend / Rye Patch Trend.

The average grade of material mined during its 11 years of operations was over 1 oz/t Au. In fact, some ore was so rich it did not require processing and was stored directly in the bank vault in Lovelock.

Mining was restricted to the upper 120m of the system due to limitations in technology at the time, however, the geology of similar deposits nearby suggests there could be an additional more than 300m of potential ore left beneath the old workings. Some of these parallel veins are just under 500m long, but were only mined in small sections before mining stopped at the beginning of the Second World War. Since that time, ten additional veins that have never been tested by drilling have been identified.

Bonanza grade intercepts with tremendous potential

Romios has held the Scossa Mine Project since 1999, and the company’s first DDH drill campaign in 2000 hit some Bonanza grade intercepts including:

- 3.35 m @ 180.2 g/t Au, 4.0 g/t Ag;

- 1.98 m @ 268 g/t Au, 21.8 g/t Ag; and

- 1.51 m @ 62.49 g/t Au, 73.4 g/t Ag.

During the following years, two small RC drill programmes in 2004 and 2006 were undertaken to test the depth potential of the system, leaving the previously identified near-surface high-grade mineralisation to be tested at a later time.

Assays of up to 23 g/t gold and 99 g/t silver at surface

Sampling along all exposed veins, dumps, pits, etc. has helped to define the many potential ore shoots and has further confirmed the significant potential of the Scossa Project. A 3D model of the former underground workings was recently commissioned to help develop a drill programme to assess the high-grade potential of Scossa. This model shows a number of obvious targets, including an untested area with high potential for significant mineralisation immediately down-plunge at shallow levels from the historic workings.

Diamond drilling planned for 2023

In 2023, Romios plans to deploy a diamond drill at Scossa to follow-up, test, and expand the Bonanza intercepts from 2000. A planned fence of holes will be drilled across the Scossa vein network to locate the paleo-boiling zone, which represents the base of the high-grade mineralisation, and to then test the expected high-grade zones above that base. A total of up to 2,000m will be drilled to test the veins below the 120m level where former operations ended in 1941, as well as the extensive shallow portions of the veins above the boiling zone that were not mined in the past but show signs of mineralised shoots.

Management Team

Stephen Burega – President, CEO and Director

Burega brings 13 years of management and operations experience in the mining and natural resources sectors, including corporate development and fundraising; joint venture due diligence including structure and negotiations; and management of public markets. His deep emerging markets background, along with a strong understanding of stakeholder management, social development, and structured community engagement and programming, also positions him well to lead Romios’ First Nations community engagements.

John Biczok P. Geo. – VP Exploration

Biczok is a professional exploration geologist with over 40 years of experience in a wide range of ore deposit types, including many that are relevant to Romios’ various mineral properties such as copper-gold skarns, massive sulphides, shear-hosted gold, iron formation-hosted gold and various exhalative type deposits (Pb-Zn, barite). Among his achievements was the discovery of a new ore zone at Musselwhite, initiation of the work that led to the discovery of the past-producing Brewery Creek gold deposit in the Yukon and leading the team that discovered the Monument Bay gold deposit in northern Manitoba.

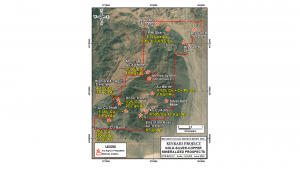

Early-stage blue-sky exploration at Kinkaid Project

Found in southwestern Nevada within the Walker Lane Trend, Romios staked 109 claims that make up the Kinkaid Project in late 2021.

Romios’ initial reconnaissance work has identified dozens of old mine workings and prospect pits that have returned high-grade results from numerous grab and chip samples with up to 7.39% copper, 33.7 g/t gold, and 1,725 g/t silver.

Rediscover Romios

Romios Gold sees 2023 as a year of opportunity to reintroduce the company and its core assets to a marketplace eager for new discoveries. The company now sits on a very large, newly discovered copper-gold-silver-tungsten target in the Golden Triangle of British Columbia, Canada, a region that has seen tremendous interest and investment over the past decade by many of the world’s major producers. Romios also provides its shareholders with an opportunity to experience early-stage blue-sky exploration potential and a very clear and dedicated commitment to aggressively move forward with exploration on its high-grade gold and copper-gold projects in Nevada, which is one of the world’s top mining jurisdictions.

Please note, this article will also appear in the thirteenth edition of our quarterly publication.