With new developments in projects old and new, Sokoman Minerals Corp. is set to become a key player in the Canadian mining landscape.

Sokoman Minerals Corp. has earned a reputation as the Primary Discovery Company in Newfoundland and Labrador, Canada.

Among the largest land holdings in the province, encompassing over 150,000 hectares (>6,000 claims over 1,500km2), are two important 100%-owned projects: Moosehead and Fleur de Lys, a 50% strategic Alliance with Benton Resources on three large-scale properties, Grey River, Golden Hope, and Kepenkeck; as well as a variety of other properties and land interests.

One of the notable aspects of its projects is its proximity to infrastructure. The region’s well-established transportation and energy networks significantly reduce development costs and logistical challenges. This advantage positions Sokoman Minerals to move forward efficiently, ensuring the project’s economic viability.

The Moosehead project is the flagship

Moosehead is the project that started the current round of gold exploration in Newfoundland. The high-grade gold discovery in drill hole MH-18-01 11.90 m @ 44.96 g/t Au (incl. 1.35 m @ 385.85 g/t Au) ignited a land rush and brought many exploration ventures to ‘the rock’. Drilling on Moosehead continues to confirm high-grade orogenic lode gold and provide further insights into the complex geological controls of high-grade mineralisation.

At present, seven distinct gold zones have been discovered, although, with further drilling, they may merge into a single, large, more easily mineable deposit. The recent discovery has been the 463 Zone, which is located approximately 100m below the limits of the modelled Eastern Trend and features a different mineralisation style with multiple, narrow, locally high-grade veins in the footwall and perpendicular to the main Eastern Trend. The new 511 Zone was intersected in two holes 250m south of the South Pond Zone. The mineralisation style found is similar to that seen at most gold zones at Moosehead and is often associated with higher-grade, VG-bearing quartz veins.

The Fleur de Lys Project: The latest discovery

The Fleur de Lys Project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and, as such, represents a readily accessible yet underexplored, district-scale gold target in the Newfoundland Appalachians. Company representatives have recently returned from Ireland, where a field tour of the significant gold deposits of the area was completed. The trip confirmed many features directly comparable between Fleur de Lys and the Irish gold deposits.

Adjacent to Newfoundland’s current Au production on the Baie Verte Peninsula, the property of 1,920 claims (480 km2) has seen little modern exploration yet features numerous cross-cutting structures and Au anomalies in till/soil/rock/lakes. Reconnaissance till sampling has defined multiple gold targets, and an overburden drilling program outlined a district-scale, prospective corridor of approximately 30km strike length.

Ongoing exploration at Fleur de Lys has outlined an area of very angular, visible gold-bearing float dubbed the Golden Bull prospect, measuring 300m in length and as-of-yet unknown width, with numerous pieces of banded quartz weighing up to several tonnes. The Golden Bull discovery is located in the property’s northern portion, four kilometres west of the historic mining town of Baie Verte. The mineralisation consists of strongly banded quartz, with up to 2% disseminated pyrite, arsenopyrite, sphalerite, and minor chalcopyrite. Visible gold is noted. Assay results from recent metallics assays of the grab samples ranged from 0.37 g/t to 9.03 g/t.

The Golden Hope Project: Discovery of critical materials for the electric future

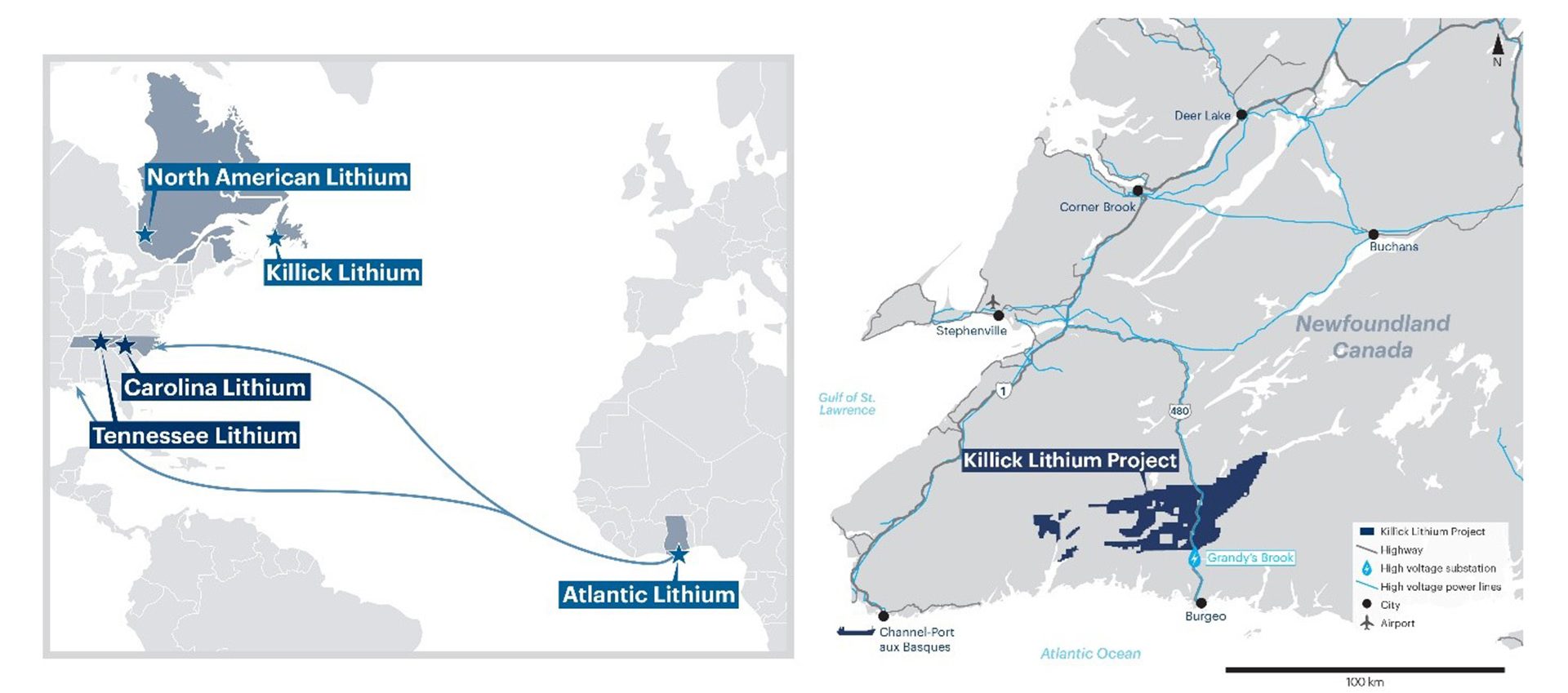

A strategic 50/50 JV partnership (the ‘alliance’) between Sokoman Minerals Corp. and Benton Resources Inc. staked a large district-scale project consisting of nearly 3,200 claims (80,000 hectares) accessed by the Burgeo Highway in southwestern Newfoundland. The property covers extensions of two major structures linked to significant gold prospects and deposits in southern Newfoundland. Geologically, the Killick Lithium property is analogous to the Carolina Tin-Spodumene Belt, one of the most important Lithium projects in the USA. The property totals 950km2 and hosts approximately 60km of prospective strike length.

Prospecting in 2021 discovered a swarm of lithium-rich pegmatite dykes, the first ever for Newfoundland. Surface grab samples returned up to 2.37% Li2O. Work to date by Benton Resources Inc. and Sokoman Minerals includes 61 exploratory drill holes, 50 of which intersected spodumene-bearing pegmatites. Mineralisation in surface trenching and drilling has been identified over a strike length of 2.5km. These early drilling results include multiple intercepts over 1.0% Li2O and demonstrate the potential for additional discoveries within the property. The exploration work in 2023 has identified numerous soil and geophysical anomalies, highlighting high-priority drill targets. The property features excellent infrastructure with proximity to paved roadways, an electrical substation, and an ice-free, deepwater port.

Piedmont Lithium has agreed to pay $2m CAD for a 19.9% equity interest in Vinland Lithium Inc., a new entity established with Sokoman Minerals Corp. (40.1%) and Benton Resources Inc. (40.1%). Through a staged investment agreement, Piedmont may earn up to a 62.5% equity interest in Killick Lithium Inc., a wholly-owned subsidiary of Vinland Lithium Inc., holding a 100% interest in the Killick Lithium Project.

Piedmont will fund ongoing exploration by Sokoman and Benton up to $12m CAD and make progress payments of Piedmont common shares valued at $10m CAD. Sokoman and Benton will retain a 2% NSR on the property. Piedmont will be entitled to 100% marketing rights and a right of first refusal on 100% offtake rights to any Lithium concentrate produced by the project on a life-of-mine basis at competitive commercial rates.

A diverse and promising portfolio for Sokoman Minerals Corp.

The Moosehead project’s high-grade gold deposit remains the flagship endeavour, and the Fleur de Lys project’s new discovery potential adds another layer of attractiveness. At the same time, the Killick Lithium project agreement solidifies many positives for the project and the Sokoman-Benton alliance, as it delivers credibility to a potentially significant critical minerals exploration play. Sokoman Minerals is well on its way to becoming a significant player in the Newfoundland mining industry.

Please note, this article will also appear in the sixteenth edition of our quarterly publication.