Canadian junior Mink Ventures Corporation is well-positioned with a strong capital structure and two exceptional nickel, cobalt, and copper exploration projects in Ontario.

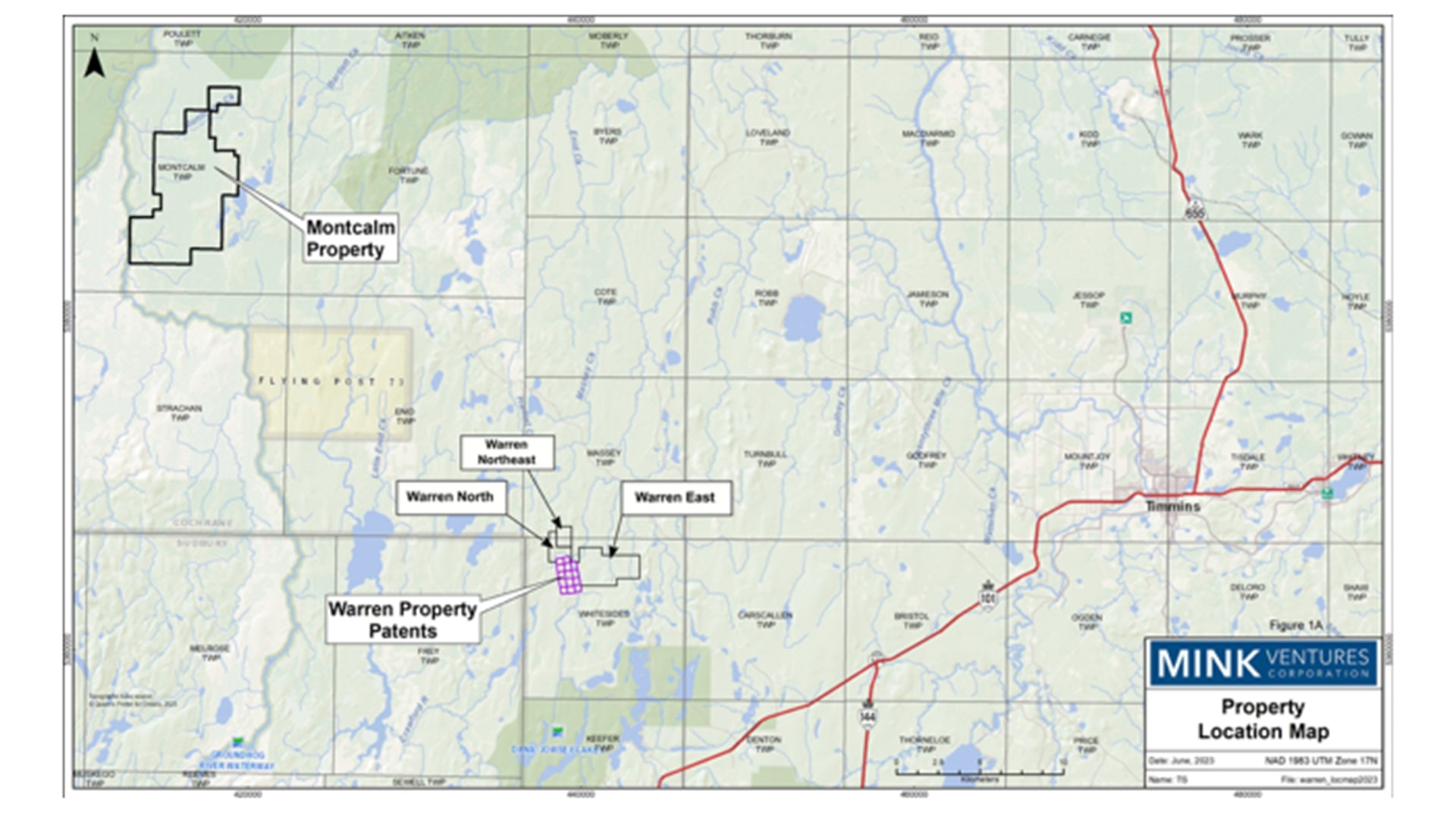

Mink Ventures Corporation (TSXV:MINK) is a Canadian junior mineral exploration company exploring critical minerals (nickel, copper, cobalt) at its Warren and Montcalm polymetallic projects in the Timmins, Ontario, area.

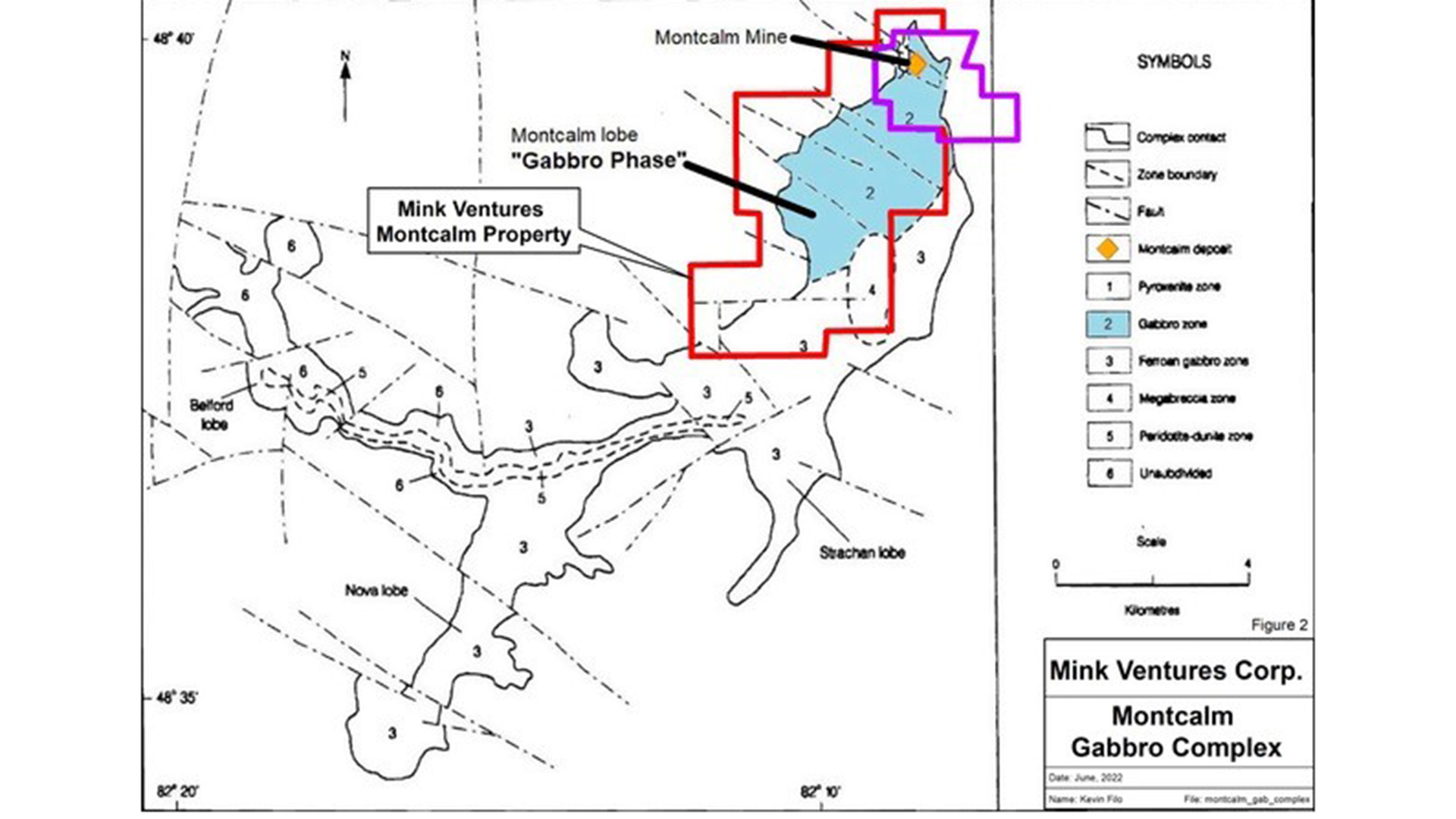

MINK is well positioned with its 40km² Montcalm project, adjacent to the Montcalm Mine, with historical production of approximately 3.93 million tonnes of ore grading 1.25% Ni, 0.67% Cu and 0.051% Co (Ontario Geological Survey, Atkinson, 2010). The mine ceased production in June 2009, and the last estimated reserve as of January 2009 was 2,800,000 tonnes grading 1.26% Ni, 0.59% Cu, and 0.05% Co. (Ontario Mineral Inventory Record MD142B09NE00007). Mink’s proximity to the former mine, which has extensions of the mine lithology on MINK’s exploration lands and numerous untested targets, demonstrates the potential for new discoveries.

Its Warren Ni Cu Co project is located 35km away along the same road, and recent work here continues to provide compelling evidence of a significantly mineralised area. Both projects have tremendous exploration potential and are enhanced by the excellent access and infrastructure available to both, as well as proximity to the skilled labour and facilities of the emerging Timmins Nickel Camp.

The company is currently conducting an exploration programme at Warren, which will be followed by diamond drilling later in 2024, and anticipates a steady flow of news. The company has only 22.5M shares outstanding, with management and directors holding 15%.

New, sustainable North American deposits required

Critical minerals are materials essential to economic or national security whose supply chains are vulnerable to disruption. Sustainable, critical mineral supply chain resiliency and security are increasingly important in a geopolitically charged world, and the focus on reducing dependence on unstable foreign sources is growing.

Junior exploration companies like MINK play a vital role in the mining cycle by discovering and evaluating potential new mineral deposits, which can lead to the development of new mines in the long term.

Significant investment in exploration will be required now in order to facilitate the new discoveries required to meet projected demand, as it takes many years from the discovery of a deposit to the development of a mine and production.

According to a recent article published by S&P Global Market Intelligence, new mines coming online from 2020-2023 are now taking an average of 17.9 years compared with 12.7 years for mines started up 15 years ago. The decline in capital investment in exploration companies in recent years exacerbates the timeline as companies operate on smaller budgets, which inevitably slows down the pace of exploration and new discoveries.

That said, technological innovation is bringing about a new era of discovery as advances in early exploration tools for geophysical surveying and sampling enable deeper penetration underground. With increased computing power, large amounts of data can be analysed and interpreted with greater clarity, improving exploration outcomes.

Ontario: The ideal setting

In Ontario, sizeable investments in building new battery factories and processing facilities continue to be announced. These will require significant amounts of raw materials to supply them. Nickel, with its high energy density and electrical conductivity make it an essential component in electric vehicle batteries and renewable energy infrastructure in addition to significant demand from its use in stainless steel. Sustainable, secure nickel, among other critical minerals, is required for infrastructure, construction, military and defence. Projected global demand in the coming years is well documented especially with the long lead times for discovery to production built in to the equation. Even with new, high carbon cost supply coming onstream from Indonesia, that is currently affecting the production of nickel globally, the long-term need for sustainably sourced North American supply is valid.

MINK is well positioned with its two Ni Cu Co projects, which are ideally situated with low geopolitical risk factors. Ontario is a top-ranked Canadian jurisdiction. The province is mineral-rich, with a wide range of deposits that make a significant contribution to the economy and the local communities.

Furthermore, MINK is operating in a part of Northern Ontario where there is a clear and articulate process for building solid relationships and working side by side with local communities and First Nations. MINK’s projects fall in the traditional territory governed by the Waban Tribal Council, which has developed a straightforward process and model for discussion and negotiations that is now being replicated across Canada and admired globally.

Polymetallic deposits typically offer better value/ton, especially when located in established mining camps with existing infrastructure. Access and infrastructure to MINK’s projects, the adjacent Montcalm Mine, and the Timmins Mining Camp are exceptional.

The access to green hydropower with measurably lower carbon costs, all-weather roads which run adjacent to MINK’s projects, mining infrastructure through a very established mining camp, and a straightforward permitting process for both of MINK’s projects add tremendous value to the equation and long term potential.

It provides for extremely cost-effective exploration, from the availability of drills, crews, skilled labour force, equipment, lower mobilisation costs, and, in MINK’s case, significant efficiencies in logistics to move between its two projects, which are located only 35km apart along the same Montcalm Mine Road.

MINK is using state-of-the-art geophysical technology to penetrate deeper underground and map conductivity and resistivity in 3D to assist in its hunt to find new critical mineral deposits at its polymetallic Montcalm and Warren projects. Warren is the current focus of Mink’s exploration, and the project continues to provide compelling evidence of a significantly mineralised area.

The Warren Project

MINK’s work on the Warren Project to date has focused on the Warren Patents, where the company has the right to earn a 100% interest in the project by completing certain work commitment expenditures by March 2025. The Warren Patents host numerous historical occurrences of nickel, copper, and cobalt associated with coincident geophysical responses.

Upon completion of a review of all historical data available, a cursory preliminary prospecting programme in the summer of 2023 confirmed the presence of massive sulphide mineralisation with significant copper and nickel mineralisation in the ‘A’ Zone. This work allowed the ‘A’ Zone to be selected as a high-priority drill target. In early 2024, a six-hole (507m.) drill programme was completed on the ‘A’ Zone.

Wide zones of low-grade mineralisation were intersected in all holes along with a higher grade intercept of 0.48% Ni, 0.17% Cu and 0.07% Co over 0.9m within semi-massive sulphide typical of that found in the ‘A’ zone surface trenches.

A substantial prospecting programme is currently underway to prioritise numerous historical nickel, copper, and cobalt occurrences for a second round of drilling. This recent work has now connected the dots between five separate nickel-copper cobalt showings over a 1.5km strike length that is supported by numerous geophysical surveys which help pinpoint conductive and magnetic anomalies.

These are coincident with significant surface mineralisation, confirming the geophysical response. Now, the plot thickens, and the team will prioritise where along the 1.5km strike offers the best chance for discovery in the upcoming drill programme.

The company expects to begin drilling towards the end of the summer when the forest fire risks are lower and when the results from the summer programme have been compiled into the database. The company has raised funds to complete the programme, which will also enable it to meet its requirements to earn its 100% interest.

No exploration permits are required for future work on the property as patented mining claims do not require permits, and no assessment work is required to maintain patented lands in good standing. There are now sufficient assessment credits on the patented claims, which can be distributed to maintain its other adjacent lands (Warren E, Warren NE) in good standing beyond the year 2027.

Montcalm project

The company’s Montcalm project is located 35km away from its Warren project and is adjacent to Glencore’s Montcalm Mine. Limited exploration was done at the mine while in operation, so it has only been drilled down to 450m vertically. Gabbro hosted nickel deposits typically host multiple shoots.

A good analogy is the Lynn Lake A mine in Manitoba, which hosted about 28 million tonnes of nickel copper cobalt mineralisation within 15 ore shoots in the gabbro host. Only three have been located so far at Montcalm.

Still, the fact that a producing mine was developed from those confirms the high-grade system is pregnant, and there is a significant opportunity for additional discoveries to be made at the former mine and on MINK’s adjoining property. MINK controls 10km of the 15km gabbro unit hosting the Montcalm Mine. Since the 1970s, only 44 generally shallow holes have been completed across MINK’s 40km².

At Montcalm, MINK employed a different target development approach than previous operators. Mink utilised a state-of-the-art bore hole induced polarisation (IP) survey along with conventional surface IP to target areas with strong magnetic responses.

The justification for this type of approach was the presence of known disseminated copper-nickel sulphide mineralisation on the Montcalm Mine property with a strong magnetic anomaly and no electromagnetic (EM) conductor.

IP surveys have the capability to detect both disseminated mineralisation and/or more massive zones of conductive mineralisation, which are typically seen by EM. The surface IP survey work detected a multitude of new targets associated with strong magnetic responses, and the borehole IP also detected a deep-seated, previously undetected conductive zone at approximately 500m below the surface, also associated with a strong magnetic response.

Very limited drill testing of targets demonstrated the presence of disseminated sulphide mineralisation, which demonstrated the effectiveness of this target development approach. Although no economic sulphide mineralisation was detected in the limited drilling conducted by MINK, numerous high-priority targets remain to be drill tested.

At this time, MINK has earned its 80% interest in the project, and its substantial assessment work, along with banked assessment credits, will allow the corporation to hold the property well into 2028. The property is fully permitted for exploration into the year 2025.

MINK is in an enviable position to many of its peers, with its tight capital structure, funded programme to complete the earn-in option at Warren, banked assessment credits to hold its two projects in good standing for several years and two exceptional, polymetallic, critical minerals’ exploration projects with significant discovery potential. MINK sits at a perfect entry point along ‘The Lassonde Curve’ for those investors who understand the benefit of participating at an early stage and who can patiently appreciate high-risk high-reward opportunities.

Please note, this article will also appear in the 19th edition of our quarterly publication.