Volt Resources is developing an integrated mine to the battery graphite supply chain to meet the provenance and ESG expectations of stakeholders.

With Europe and the United States comprising two of the top three EV markets globally and predicted to stay in this position through 2030 and beyond as part of the transition to clean energy, the development of lithium-ion battery (LIB) cell manufacturing and the material supply chains to feed LIB production have guided Volt Resources’ strategy for its graphite business.

Volt Resources recently completed the acquisition of a controlling 70% interest in the Zavalievsky Graphite (ZG) Group located in Ukraine. The acquisition immediately transformed Volt into one of the few graphite producers in Europe. Combined with its development-ready Bunyu Graphite Project in South-East Tanzania, Volt Resources’ strategy to become a globally significant graphite producer is expanding to include battery anode and other value add downstream processing facilities in Europe and the United States.

Zavalievsky Graphite – European production

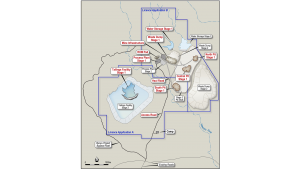

The graphite mine and associated processing facilities owned by the ZG Group are located adjacent to the town of Zavallya, approximately 280km south of the Ukraine capital Kyiv and 230km north of the main port of Odessa.

background

ZG commenced operations in 1934, mining ore from the Zavalievsky deposit – one of the largest deposits of graphite in Europe. Project production capacity is up to 30,000 tonnes of graphite concentrate/product per year. In 2014, ZG was the eighth largest producer of natural flake graphite in the world.

ZG produces more than 30 grades of graphite and, in addition to domestic sales, has exported to the following countries for decades: Austria, Germany, Czech Republic, Slovakia, Poland, Spain, Italy, Japan, Taiwan, Belarus, and Azerbaijan. The business supplies graphite products to manufacturers of high-quality lubricants, refractory products, friction materials, steel and iron foundry companies, and oil and gas producing companies.

Following a lack of investment in the business by the previous owners, recent periods of graphite oversupply and reduced product sales in Europe in 2020 due to COVID-19 restrictions, the ZG business is operating at well below nameplate capacity. Volt Resources plans to improve the performance of the business with close attention to improved environmental management and sustainable operations, including programmes to minimise the operation’s carbon footprint, the development of stakeholder relationships, and social investment, combined with improved governance throughout ZG.

Volt Resources has identified considerable benefits from the acquisition of a controlling 70% interest in the ZG operating business, including:

- Located in Eastern Europe in close proximity to key markets with significant developments in lithium-ion battery facilities planned to service the Europe-based car makers and the renewable energy sector;

- Existing customer base and graphite product supply chains;

- Excellent transport infrastructure covering road, rail, river, and sea freight combined with reliable grid power, ample potable ground water supply, and good communications;

- An experienced workforce which can assist with training, commissioning, and ramp-up for Volt Resources’ Tanzanian graphite project development. This is a key risk for financiers and could materially assist the ability to finance the company’s Bunyu graphite project;

- Potential to generate material cashflow (after CAPEX investment);

- Makes graphite products across the range and has the potential to significantly increase its higher priced large flake production; and

- Long life multi-decade mine at the 30,000 tpa nameplate production rate with exploration upside. Current mining licence extends to 2035.

In addition, the plant has a graphite purification process which produces 99.5%/99.6% TGC. Graphite products at the purified grade attract a premium price and there is the possibility to upgrade the purification circuit to meet spheronised purified graphite (SPG) purity levels.

The acquisition also includes a 55% interest in 636 hectares of freehold land upon which the mine, processing plant, other buildings, and facilities are located.

There are plans to install a processing plant to commence small scale production of SPG or battery anode material for the European LIB market within the next 12 months, increasing to +14,000 tpa of SPG production within two years. ZG’s strategic location for the supply of SPG to the European markets has attracted interest from LIB cell manufacturers and major car makers.

As Volt Resources is now a producer of graphite products in Europe, there is a great opportunity to build relationships and obtain access to capital to support the expansion and product development plans for the graphite business.

About Ukraine

Ukraine has a population of 41.9 million and at 603,549km2 is the second-largest country in Europe in terms of area. Ukraine’s mineral wealth was a key contributor to the economy of the former Soviet Union but it has historically been underexploited in the post-Soviet era. Located over several platforms and folded tectonic units, the country’s geological structures have given it significant natural resources, including significant iron ore, coal, natural gas, oil, salt, sulphur, graphite, magnesium, kaolin, and nickel deposits.

Low construction and operating costs in the Ukraine are a key attraction for international resource companies, largely driven by excellent major infrastructure, including railway, power lines, and ports, coupled with a highly skilled, relatively low-cost labour pool.

The Ukraine co-operates with the European Union through the Eastern Partnership, which aims to foster political association and economic integration between the European Union and the Eastern Neighbourhood countries (Armenia, Azerbaijan, Belarus, Georgia, Moldova, and Ukraine).

The Ukrainian government also signed and ratified an Association Agreement with the European Union in 2014, and the Deep and Comprehensive Free Trade Agreement between Ukraine and the European Union entered into force on 1 January 2016. Ukraine’s move away from Russian influence and towards European integration has attracted major miners like ArcelorMittal (NYSE:MT) and Glencore (LSE:GLEN) into the Ukraine. The Ukrainian government has stated that the door is open for foreign investment in the country’s mining sector.

EU Support through strategic partnerships and alliances

The EU and Ukraine have launched a strategic partnership on raw materials, with the aim of achieving a closer integration of raw materials and batteries value chains. In July 2021, EU Vice-President Maroš Šefčovič and the Prime Minister of Ukraine, Denys Shmyhal, signed a Memorandum of Understanding (MoU) underpinning the partnership.

The strategic partnership with Ukraine will include activities along the entire value chain of both primary and secondary critical raw materials and batteries and, in line with the objectives of the EU’s Critical Raw Materials Action Plan, it will help diversify, strengthen, and secure both sides’ supply of critical raw materials, which is essential for achieving the green and digital transitions.

More specifically, the strategic partnership aims to develop three key areas of work, as defined in the MoU.

- First, it focuses on the approximation of policy and regulatory mining frameworks, and notably the environmental, social, and governance criteria across all activities;

- Secondly, the partnership aims to better integrate critical raw materials and battery value chains to develop minerals resources in Ukraine in a sustainable and socially responsible way. To do so, it will engage with the European Raw Materials Alliance and the European Battery Alliance as platforms for EU and Ukrainian stakeholders, including funding and investment organisations, to collaborate and develop joint venture projects and other business opportunities; and

- Finally, the partnership also encourages closer collaboration in research and innovation along both raw materials and battery value chains using Horizon Europe.

Furthermore, the EU and Ukraine endorsed a first roadmap, a set of concrete activities and joint projects to advance the strategic partnership in the period 2021-2022. Specifically, it will help to:

- Develop a low carbon strategy and roadmap to decarbonise raw material mining, extraction, and processing in Ukraine;

- Strengthen the sustainable and responsible sourcing and processing of raw materials and batteries in Ukraine by organising capacity-building events for public administrations and training for companies;

- Digitalise and strengthen the data management of Ukrainian mineral resources/reserves by creating a ‘Data room’ – a repository with digital geological reports – and de-classifying and re-assessing raw materials reserves using international standards;

- Enhance the use of Earth-observation programmes and remote sensing to strengthen new resource exploration and monitor the environmental performance of mines during operations and post-closure; and

- Identify and conduct joint-venture projects for EU and Ukrainian industrial and investment actors by using the Business Investment Platforms of the European industrial alliances.

The European banks, i.e. the EIB and the EBRD, will also mobilise financial and investment instruments to support concrete actions under the Memorandum of Understanding and the Roadmap.

The European Battery Alliance (EBA) network includes the European Commission, EU member states, the European Investment Bank, and more than 600 industrial, innovation, and academia stakeholders. The EBA objective is to build a strong pan-European battery industry that is able to help Europe capture a growing market expected to

be worth €250bn a year from 2025. Industry participants across the battery value chain include Volkswagen, Tesla, Volvo, LG Chem, CATL, and Albemarle.

Formal actions being facilitated by the EBA and relevant to Volt Resources’ business and plans include:

- Create and sustain a cross-value chain ecosystem for batteries. This includes mining, processing, materials design, second life, and recycling within the EU, encouraging cross-sectoral initiatives between academia, research, industry, policy, and the financial community; and

- Facilitate the expansion/creation of European sources of raw materials.

The EBA250 includes a Business Investment Platform (BIP) together with financial institutions –public and private – and several core industrial partners. The objective of the BIP is to:

- Shorten the time to investment;

- Reduce business risk for the investee; and

- Reduce investment risk for the investor.

The European Raw Materials Alliance (ERMA) aims to make Europe economically more resilient by diversifying its supply chains, creating jobs, attracting investments to the raw materials value chain, fostering innovation, training young talent, and contributing to the best enabling framework for raw materials and the circular economy worldwide.

The Alliance addresses the challenge of securing access to sustainable raw materials, advanced materials, and industrial processing know-how. By 2030, ERMA’s activities will increase the production of raw and advanced materials and address the circular economy by boosting the recovery and recycling of critical raw materials. More specifically, the Alliance will:

- Bolster the creation of environmentally sustainable and socially equitable innovations and infrastructure;

- Implement a circular economy of complex products like electric vehicles, clean tech, and hydrogen equipment;

- Support Europe’s raw materials industry capability, to extract, design, manufacture, and recycle materials; and

- Promote innovation, strategic investment, and industrial production across specific value chains.

The alliance will initially focus on the most pressing needs: increasing the EU’s resilience in the rare earth magnet and motor value chain. They are vital to key EU industrial ecosystems, such as automotive, renewable energy, defence, and aerospace. The alliance will expand to address other critical and strategic raw materials needs, including those related to materials for energy storage and conversion (batteries and fuel cells).

ERMA will identify barriers, opportunities, and investment cases to build capacity at all stages of the raw materials value chain, from mining to waste recovery. It complies with EU competition rules and EU international trade commitments.

ERMA objectives will be achieved through two major workstreams:

- Value chain-specific consultation processes:

- Identify and respond to raw material challenges along industrial ecosystems and within wider society;

- Provide tailored solutions to industry needs;

- Unlock regulatory bottlenecks; and

- Promote stakeholders’ strong engagement and commitment through an open process

- Investment channel for raw materials projects:

- Select and prioritise cases to secure primary and secondary raw materials supply for European industrial ecosystems;

- Install the Raw Materials Investment Platform (RMIP) to bring investors and investees together;

- Define case-specific financing strategies and mechanisms;

- Assess EU funding opportunities and financing sources for investment opportunities inside and outside Europe; and

- Both workstreams will be implemented through clusters dedicated to the specific value chains.

Volt Resources is a member of the EBA and the ERMA and looks forward to being an active member of both with the support and facilitation of opportunities that both alliances provide.

Bunyu Project – development ready and scaleable

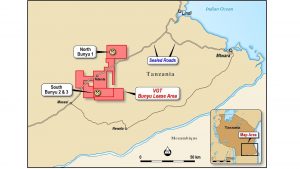

Volt Resources’ subsidiary, Volt Graphite Tanzania (VGT), is a graphite development company based in Dar es Salaam, Tanzania. VGT’s strategy is to develop a graphite mining and processing plant to produce flake graphite from the Bunyu Graphite Project’s large resource. Based on a two-stage development strategy, the aim is for VGT to become one of the globally significant natural flake graphite producers in the world.

The Bunyu project has the largest graphite resource in Tanzania and one of the largest in the world. This has been achieved with exploration conducted over only 6% of the total tenement area of approximately 1,100km2. It is the project size and the expected significant increase in global demand for flake graphite that supports the strategy to develop the Bunyu Project into one of the largest graphite mines in the world.

The Bunyu Project has its key development approvals in place for the Stage 1 and importantly, Stage 2 project footprint. Volt received the Environmental Impact Assessment Certificate from the National Environment Management Council of Tanzania for the Bunyu project development and received two mining licences from the Mining Commission of the Ministry of Minerals of Tanzania.

as the Bunyu 1 Stage 1 mine, the operation includes the processing

plant and associated infrastructure. The planned location of the

Stage 2 plant and infrastructure is also identified

The Bunyu graphite deposits are suited to conventional drill and blast, and load and haul open pit mining methods.

For Stage 1, ore will be fed to the processing plant at a rate of 400,000tpa to produce a nominal 20-24,000tpa graphite product averaging 92-96% TGC at a 93% recovery.

The processing plant will incorporate the following unit process operations:

- ROM ore will be stage-crushed in primary and secondary crushers, with associated screening to recirculate the oversize back to the crushers and to produce a top-sized product ahead of grinding;

- Ore will be wet ground by rod mill for concentration by flotation;

- Flotation will recover graphite by rougher flotation followed by five cleaning stages, with regrind milling between stages, to target coarse graphite recovery;

- Graphite product will be thickened, filtered, dried, screened, and packaged in 1 tonne bags; and

- Flotation tailings will be thickened to maximise water recovery and discharged into a constructed Tailings Storage Facility.

The graphite products are subsequently transported via sealed road to port for export to overseas customers and to provide feedstock for Volt Resources’ downstream processing facilities planned for Europe and the United States.

The principal production objective of the plant design is a marketable high-grade graphite product which is sized in ranges for the purpose of targeting appropriate market segments and so maximising the value of the graphite products produced. Maximising the yield of high-value coarse flake is a key part of this objective.

Battery Anode Material

Micronising involves reducing the flakes in size to approximately 10 to 15 microns. This is done in a step by step process as the flakes move through a cascading series of jet mills. They are crushed by impact, collision, friction and shearing using a high speed rotating plate and classified to separate the target size ranges which then goes into the next mill. Once the final target size has been achieved, the micronised graphite is then ’rounded’ or spheronised, which essentially involves rolling the flakes up like a snowball in similar mills, again using a cascading, step by step approach.

The final size varies between 5 and 20 microns, depending on the application. The round shape is necessary for the spheres to be spread thinly and uniformly during the high-speed LIB manufacturing process. The round shape also results in better packing, i.e. a higher density in the battery, more active sites for the lithium to intercalate into the graphite (better rate capacity) and a longer life.

Micronised and spheronised material is then purified from approximately 94%TGC to 99.95%TGC as impurities affect battery performance. Purification processes include wet chemical purification using acids or high temperature thermal treatment, chlorine, alkaline reagents or a combination.

The final stage in producing BAM is coating with a thin layer of pitch or asphalt and heating at over 1,200°C. There are further enhancements to improve the performance of coated SPG in extending the life and capacity of LIBs.

Volt Resources is planning and developing its pathway to becoming a producer of BAM in its selected markets and will be using technology partnerships to accelerate its progression.

With two world-class graphite resources incorporated in a strategically located operating mine and processing plant in Ukraine along with a development ready project in Tanzania, Volt is well-positioned to become a globally significant graphite producer.

Volt Resources plans to become a battery anode material producer in Europe and the United States based on an integrated supply chain using graphite produced from its own operations. This provides security and continuity of supply for the business and the ability to manage product quality through the graphite supply chain to the LIB and for other graphite products.

Please note, this article will also appear in the seventh edition of our quarterly publication.