David Kelly, Chief Corporate Officer at Cubic, discusses how Apple’s EV departure has altered the industry and how other manufacturers must scale up their projects.

The auto industry will breathe a sigh of relief at the news that Apple is mothballing its secret EV project. This means one fewer threat in a closely fought market. The news highlights how difficult it is to design and build cars at scale—even with Apple’s substantial cash and resources.

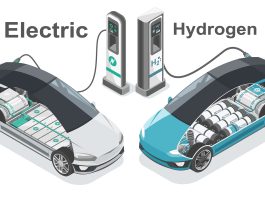

Apparently, the project struggled from the start, with Apple changing leadership and strategy several times during the decade-long affair. This, alongside the current slowdown in EV sales and a lack of charging infrastructure, is thought to be the reason for the pivot.

Despite Apple’s EV departure, other mobile phone makers are still in the game. After unveiling its first electric vehicle, the SU7, at MWC last month, Xiaomi has revealed it will begin deliveries in late March as it looks to capitalise on a lucrative billion-dollar market. McKinsey estimates that 95% of new vehicles sold globally will be connected by 2030.

The convergence of hardware, software and user experience is the battleground on which new entrants to the market, like Xiaomi, are competing with EV-natives and legacy OEMs.

Although annual global EV sales are currently experiencing a slowdown across Europe, China and North America, the total software-defined vehicle (SDV) market is growing. Seven in ten of the most valuable companies in the world generate billions from data-based services.

And that Tesla and BYD’s share price and five-year revenue projections far outstrip those of legacy OEMS, emphasising just how essential it is for car manufacturers to deliver value-added software services to their vehicles despite Apple’s departure.

Shifting consumer demands in the SDCV era

A recent McKinsey study found that 38% of drivers are willing to change their allegiance for better connectivity, which rises to 51% in the battery electric vehicle (BEV) market. A survey from JD Power last year indicated that, while technology is a leading reason to purchase, it must be well executed and get plenty of use.

Improving the in-car experience is no longer a case of porting over mobile apps to an automotive context. Drivers demand a seamless and secure in-vehicle experience. Top of the list for value-added services, consumers are willing to pay for high-beam assist, stability controls and upgraded infotainment systems. In short, drivers are willing to pay for software features that are new and innovative to the driving experience.

The challenge for legacy OEMs is that their origins lie in metal press, not software. Apple’s CarPlay and Android Auto, which is used by Xiaomi, are supported by 98% of all new vehicles. Both products are built by the most user-friendly software companies in the world.

While legacy OEMs have been quick to support these platforms, the long-term value is that they build and control the software in their vehicles, not third parties.

In 2022, Apple engineering manager Emily Schubert said 79% of US buyers would only buy a car if it supported CarPlay. This is another reason for relief as legacy OEMs move to remove third-party apps and build their own.

Improving the in-car experience

The smartphone legacy is that consumers expect their devices to be updated, patched and improved with software updates, which is now also true for SDVs.

Over-the-air (OTA) updates can improve safety, comfort, and performance. Tesla’s recalls at the end of last year put this in stark relief. Though widely reported as a ‘recall’, barely a single car left a driveway. Instead, a patch was pushed OTA and updated all the vehicles without any inconvenience to the driver.

Legacy OEMs should pay attention to this, as it drastically changes how repairs and updates are delivered.

The challenge for native EVs

This year BYD announced it will make a large play for the European and US markets. Although a major player in its domestic market, it will likely find it difficult to enter the global market due to differing regulatory environments, import tariffs and weak brand loyalty.

With tough rhetoric about placing tariffs on foreign car exporters in the US presidential race, native EV manufacturers’ success is also not assured. Legacy OEMs, however, have already made significant inroads into overseas markets and built significant brand loyalty.

This means that the main goal for OEMs is to improve their software offering.

Closing the gap after Apple’s EV departure

Software native entrants are still looking for a piece of the billion-dollar pie. However, several roadblocks are hampering their efforts to go global—roadblocks that legacy OEMs have already overcome.

Automakers are already pouring billions into EV charging infrastructure and have the supply chains to build effective charging networks. Plus, their existing customer base and partnerships with dealerships also mean they are well-positioned to sell their vehicles en masse.

In contrast, SDV-native entrants need to build entire supply chains and distribution networks from scratch just to complete on a level playing field.

With OEMs having a much smaller gap to close following Apple’s EV departure, their task is overhauling the in-car experience to entice customers to make the switch to SDVs.