Gaynor Hartnell, Chief Executive of the Renewable Transport Fuel Association (RTFA), discusses what measures will make aviation fuel more sustainable.

The RTFA is a recently formed and rapidly growing trade association dedicated to promoting the uptake of renewable and low carbon transport fuels. This article looks at renewable routes to making jet fuel looking at the feedstocks and their availability, discusses the policies driving the uptake of this sustainable aviation fuel (SAF) and the challenges in establishing a domestic SAF manufacturing industry.

About decarbonising transport

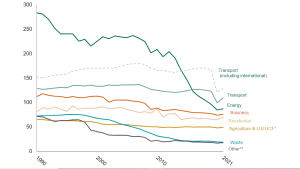

Greenhouse gas (GHG) emissions from aviation are growing, and transport is now the largest GHG-emitting sector of the UK economy. Sustainable aviation fuel has a huge role to play in reducing these emissions.

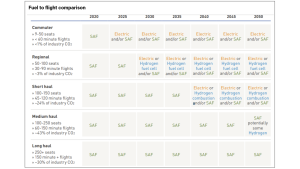

When it comes to replacing fossil-kerosene jet fuels with alternatives, SAF is quicker and far cheaper than moving to hydrogen or battery-powered flights. For longer-haul flights, there is no alternative to SAF. It is also lower in terms of lifecycle GHG emissions than the zero tailpipe emission options.

SAF and infrastructure

Switching from fossil fuel to renewable fuel generally means the same infrastructure can be used (e.g., vehicles, ships, fuel storage tanks, fuel distribution pipelines), but carbon emissions are slashed. Zero tailpipe solutions involve changing the infrastructure as well as the additional costs involved in producing the power or hydrogen in the first place. Inevitably, this is far more costly.

Targets for decarbonisation

Many jurisdictions are bringing in policies to boost the uptake of sustainable aviation fuel, as well as global target setting, by way of the November 2023 ICAO target. The International Civil Aviation Organization (ICAO) is a United Nations agency which helps 193 countries co-operate and share their skies to their mutual benefit. In November, it was agreed to strive to achieve a collective global vision to reduce CO2 emissions in international aviation by 5% by 2030.1 Whilst 5% may not seem an ambitious level in comparison with country-specific targets, it has the merit of its near-universal coverage.

The UK’s SAF Mandate, which will begin in January 2025, targets a 10% reduction in GHG emissions by 2030. Europe’s ReFuelEU Aviation Regulation will require jet fuel to comprise 6% SAF by 2030, rising to 70% by 2050.

The US has an ‘SAF Grand Challenge,’ which aims to achieve 3 billion gallons per year of domestic SAF production with a minimum 50% reduction in GHGs by 2030. This will increase to 100% of projected domestic aviation jet fuel use by 2050.

When contrasting these different policies, there is a danger of comparing apples with oranges; the main things to note are the differing eligibility criteria on feedstocks and whether the targets are based on a GHG reduction or a volumetric basis.

The UK’s policy is GHG-based. With this approach, 50% of sustainable aviation fuel with a 50% GHG-saving compared to kerosene is equivalent to 25% SAF with a 100% GHG saving. With a volumetric approach, for a fuel to be regarded as SAF it must meet or exceed a minimum GHG-saving. The US GHG threshold is a 50% saving, whereas the EU threshold is 65% (and 70% for power to liquids).

Other countries with SAF policies either currently operating or announced, include India, Indonesia, Norway, Canada, Brazil, and Turkey.

Feedstocks for sustainable aviation fuel production

Which feedstocks are eligible for sustainable aviation fuel production from a policy point of view is different from whether SAFs are eligible from a safety point of view. The latter is dealt with by fuel certification, which works on the basis of particular feedstocks and conversion pathways. Dealing first with eligibility from the policy perspective, this generally takes into account things such as:

- Is there a food versus fuel or land use concern regarding particular feedstocks?

- Are some feedstocks limited in terms of overall availability?

- Do some kinds of SAF cost more to produce and therefore need extra incentivisation?

SAFs made from crops are not eligible under the UK or EU SAF Mandates due to land use concerns, whereas they are eligible in the US.

It is generally acknowledged that there won’t be enough oily waste feedstocks (which are the cheapest to convert into SAF), and therefore other waste feedstocks and the power-to-liquid (PtL) conversion route will be required. The UK and EU mandates, therefore, have sub-targets for PtL. The US Grand SAF challenge offers greater tax incentives for SAF, which achieves higher GHG savings than the 50% threshold but does not have any explicit targets for PtL or waste-based SAF.

There are four very broad feedstock groups for making SAF (or indeed any kind of liquid or gaseous fuel), these being:

- Purpose-grown crops

- Oily or fatty wastes, such as used cooking oil

- Solid biomass and wastes, and

- Electricity and CO2, the feedstocks for making PtL fuel.

It is also possible to ferment industrial waste gases which contain carbon monoxide, producing a simple alcohol which can be further processed.

Crops and oily feedstocks

Purpose-grown oilseed crops and oily wastes are the cheapest materials to convert into fuel. In simple terms, they are oily liquids already, so they need relatively little processing to convert into an oily liquid fuel. Aviation fuel made this way is known as HEFA (hydro-processed esters and fatty acids).

Solid feedstocks

Solid wastes and agricultural residues need more processing to turn into liquid fuel, making this route more expensive than the HEFA pathway. However, it is still cheaper than PtL, as the feedstocks themselves contain energy.

With feedstocks such as residual Municipal Solid Waste (i.e., what’s left after recycling), some of the energy (e.g., plastic film) comprises fossil fuel. If using plastics in this way delivers significant carbon savings against the counterfactual (incineration with electricity generation), the resultant fuel is referred to as RCF (Recycled Carbon Fuel). Both the UK and the EU allow RCF to be incentivised in renewable fuel policies.

It’s five times better for the environment to make fuel out of residual MSW than to generate electricity from it², because much of our electricity is already zero carbon, whereas our transport fuels are almost entirely fossil fuel.

Power-to-liquid

When it comes to PtL fuels, all the energy involved comes from the power source. For PtL fuel to be green (i.e., low to zero carbon) the power source must be low to zero carbon in the first place, i.e., renewable electricity (or nuclear power).

The process involves electrolysing water to make hydrogen and oxygen and reacting the hydrogen with carbon dioxide to make a simple hydrocarbon gas _ methane. More chemistry can be carried out on this methane to build up bigger hydrocarbon molecules which are a direct substitute for fuels made from crude oil.

Resource availability

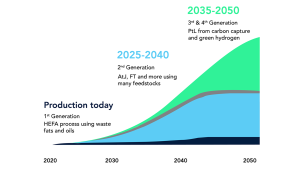

There is a global trade in biomass feedstocks. As decarbonisation progresses, more demand for feedstocks will be created, and supply chains will be developed to meet that demand. The collection of UCO and other waste fatty materials is gaining pace, but it is recognised that ultimately, this feedstock will be constrained in terms of availability. See the ‘production today’ curve in the Fig. 3.

As electrification picks up pace in vehicles (including trains), more and more of the feedstocks that had been used to substitute for petrol and diesel will become available for use in other transport modes. In addition, feedstock supply chains, know-how and production capacity will grow for converting biomass and solid wastes to fuel. See the ‘2nd generation’ curve in Fig. 3.

Power to liquid (PtL) capacity will have to expand to meet the shortfall, shown in Fig. 3.

Ultimately all fossil fuel sources will need to be replaced, and all the world’s fuel will need to come from renewable sources. The same goes for the other things that use fossil fuels in their production, from plastics to pharmaceuticals and synthetic fibres to car tyres. The objective should be keeping the fossil carbon under the ground in the first place.

Making safe sustainable aviation fuel

Jet fuel comprises around 15–20% by volume of aromatics (ring-shaped hydrocarbons). Aromatics interact with rubbery materials such as gaskets and valves in engines or fuel storage equipment in a different way than other hydrocarbons. They dissolve into the rubber more and swell it. Therefore, a valve that would be fuel-tight at a certain proportion of aromatic components may leak if the proportion is lower.

Most kinds of aviation fuel have a much lower aromatics content by virtue of the chemical pathway by which they have been produced. Whilst this is a virtue (as aromatics are a key factor behind contrail formation), there must be enough aromatic content to be compatible with modern planes and fuelling infrastructure. Careful attention is therefore paid to it (along with various other parameters) during the certification of aviation fuel.

The international standard for jet fuel quality is governed by the ASTM (the American Society for Testing and Materials). It runs the standard for conventional jet fuel (ASTM D1655) as well as ASTM D7566, which is the ‘Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons’. It describes the fuel quality specifications for each qualified SAF production pathway.

For a new SAF production pathway to be included in D7566, the fuel must undergo extensive testing to define the maximum blend ratio with conventional jet fuel and demonstrate such blend is fit for purpose. Different ways of making fuel (i.e., different fuel production ‘pathways’) result in fuels of different proportions of aromatic components. It is this which determines how much can be blended with fossil jet fuel. Most types of SAF can be blended at 50%, some at 10% and some at only 5%.

At the moment, there are 11 SAF pathways certified under ASTM, and another 11 are currently under evaluation.³

Source : https://www.icf.com/insights/aviation/requirements-sustainable-aviation-fuel-financing

The challenges of moving to SAF

These are not in short supply, but on the other hand there is huge desire amongst various parties to make progress in greening aviation. Each group of stakeholders in the value chain has a part to play (including airlines, airports, fuel supply companies and investors), but I focus below on the challenges facing SAF project developers.

The technology is new. All the projects under development in the UK at the moment will be ‘first of a kind’ (Foak) projects. Project developers face a number of risks when it comes to securing finance and building their plants:

- Price risk—what price will they be paid for their SAF? To satisfy lenders, this needs to be secure or at least have an acceptable floor price underpinning it. SAF is more expensive than kerosene to manufacture; HEFA is roughly double the cost, and PtL is around 6-10 times the cost.

- Regulatory risk – are they confident the rules relating to the SAF mandate or regulatory regime they are operating under will not change in any way that would undermine them?

- Construction risk – will there be over-runs or challenges in the build-out of the project

- Volume risk – will they be able to sell all the SAF they produce?

- Will the technology work as predicted; will the feedstock be available?

- As SAF is a globally-traded commodity, will there be a level playing field in world trade terms, or put another way, will the UK’s trade remedies regime protect them against competition from imported, subsidised fuels?

The project developers will try to place these where they are best managed and must convince project lending bank(s) that their projects are viable. The price risk is generally recognised as the most challenging and as the price is largely determined by the SAF Mandate, it is only really the UK Government that can mitigate it. The lower the risk, the lower the cost of capital.

In recognition of this, the UK government has committed to introducing a Revenue Certainty Mechanism.⁴ By the time you are reading this article, the Government will have issued a consultation document setting out its preferred option for revenue certainty and a year after that, report to Parliament on progress towards implementing it. Once this is in place, hopefully by the end of 2026, the UK should be poised to really make headway in establishing a domestic SAF industry.

Conclusion

The aviation industry and Governments world-wide are recognising that a transition to sustainable aviation fuel is imperative, although massively challenging. The UK has set its sights on establishing a domestic industry and setting exemplary sustainability standards. The very welcome confirmation from the DfT regarding the specifics of how the SAF mandate will work, and their consultation on a Revenue Certainty Mechanism, are both positive developments. By getting the policy right, the UK can create the right conditions to allow a domestic sustainable aviation fuel production industry to establish and potentially export IP and expertise elsewhere.

References

- ICAO Conference delivers strong global framework to implement a

clean energy transition for international aviation - Make SAF, not electricity from household waste, urges boss of UK’s

largest airports group - ICAO – Environment – Conversion processes

- Department for Transport – New measures to support sustainable

aviation fuel industry

Please note, this article will also appear in the 18th edition of our quarterly publication.