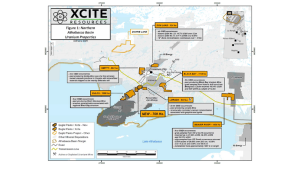

On 4 October, Xcite Resources announced its technical on its Beaverlodge Uranium projects, highlighting all the technical merits of the six uranium projects in the Athabasca Basin, Canada.

The Athabasca Basin, located in northern Saskatchewan, Canada, is unique by providing 25% of the world’s uranium supply. Its unique geology made some of the largest and richest uranium deposits in the world and counted uranium production since the 1950s.

The Lorado, Gulch, Black Bay, and Smitty Projects are historical mines that contributed to producing over 70 million pounds of uranium from 1950 to 1982 in the district. The historical production targeted shallow-depth low-hanging fruit mineralisation.

With today’s basin geological understanding, the larger deposits were discovered at much lower horizons (around 350-90m vertical versus the 10-70m vertical of historical production). In addition, the Don Lake and Beaver River projects are also in the Beaverlodge district but have never produced uranium despite mineralisation evidence at the surface and through drilling.

When all these key features of uranium past production, favourable geology, and uranium surface showings align, the context is right for a potential major discovery.

This reinforces the adage that the best place to find a mine is right next to a mine, and Xcite has four of them in the district.

The Beaver River Project

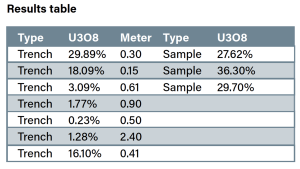

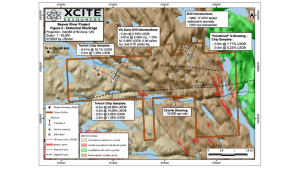

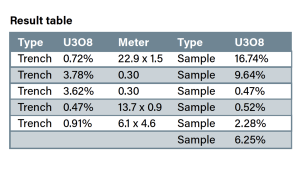

The VIC showing returned some stellar uranium surface results, returning tranche and samples above 30% U3O8 over an area of 200 meters long, which caught the attention of Xcite’s management when they purchased the property. The project generated multiple high-grade uranium results, and previous owners never followed up on the discovery with further work. This creates a unique discovery opportunity in the near future.

The VIC Zone

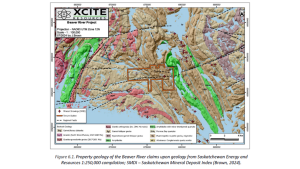

In addition, the geology is uranium prospective, counting multi-pathfinder elements like copper, nickel, and boron in clay, which is associated with the unconformity prospective geology hosting the major uranium deposits.

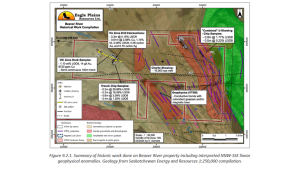

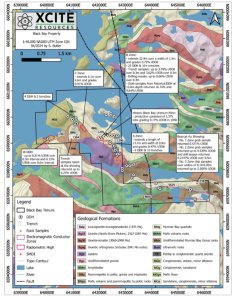

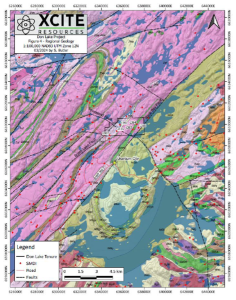

On the map below, the presence of major cross-cutting faults is also a compelling feature of the Beaver River Project. They create weakness in the underground, enabling uranium to precipitate in rich pockets of mineralisation.

The additional ingredient for success is the graphitic conductors because uranium loves graphite. On the above map, the purple spaghetti is the graphitic conductor mapped on the property.

The company is preparing the next round of work to refine the drilling target and maximise discovery success. This will include geophysics, fieldwork, and detailed mapping of the prospective areas.

The Black Bay Uranium Project

The Black Bay project demonstrated economic uranium mining in the 1950s, mining 1,375 tonnes at 0.17% U3O8. The property is uranium-rich at the surface and depth, with significant results.

The fact that historical mining happened on the project is significant, showing that at a near-surface economic concentration from the 1950s mining perspective and available technologies. The fact that limited modern-day exploration methods have been invested in the Black Bay Project leaves the door open for a uranium discovery.

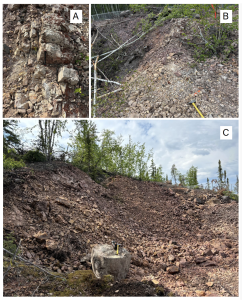

On the ground, the presence of the Martin Group formation is an important geological feature and is the signature of the Athabasca Basin unconformity signature. The A and B Zones are characterised by radioactive quartzose stringer hosted within a well-banded, hematitic, pyritic quartzite that contains diopside interbands. The fracture hosts yellow uranium oxide, and minor tremolite was altered to talc.

Scintillometer readings of up to 10,000 cps are localised in two areas of intense orange hematite-stained badinage amphibole-quartz-biotite schist interlayered within the quartzite.

Again, the exploration programme will include geophysics, mapping, and sampling before drilling.

The Don Lake Project

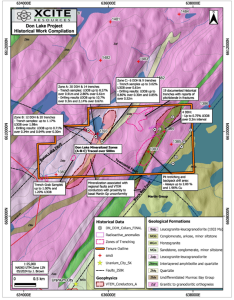

The geology of the Don Lake Project is divided into two separate opportunities. Uranium is hosted in structurally associated vein, shear, and breccia-hosted uranium particular to the Beaverlodge uranium model, with additional consideration for sub-Athabasca-basin, basement-hosted unconformity-style uranium mineralisation.

The structurally controlled nature of the U mineralisation indicates the importance of faulting on the tenure.

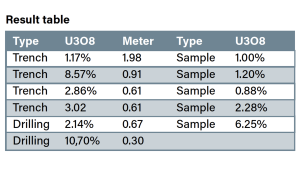

The most significant drilling campaign on the project was for 1,200 metres. This was a shallow drilling campaign that averaged less than 40 metres per hole for a total of 37 holes. Even if the drilling was limited, the project generated excellent results despite the lack of a geophysics survey, mapping and modern targeting.

The most significant drilling campaign on the project was for 1,200 metres. This was a shallow drilling campaign that averaged less than 40 metres per hole for a total of 37 holes. Even if the drilling was limited, the project generated excellent results despite the lack of a geophysics survey, mapping and modern targeting.

The Don Lake Project sits right at the contact point of the Black Bay fault system and the Beaverlodge rock package. The fault separates the Beaverlodge and the Martin Group Sediments rocks, which are targets for Athabasca unconformity uranium-hosted deposits.

The property is also crossed by the Townsend Fault, adding more complexity to the geology but also adding more potential for a world-class uranium discovery.

The geology is favourable, and multiple evidence of uranium-rich mineralisation is demonstrated right at the surface. High-grade uranium samples and trenches reported grades up to 10% U3O8.

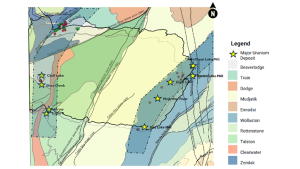

Key location and geology

Xcite’s uranium projects are also aligned on the proven major Clearwater geological trend and the Black Bay fault, which has produced world-class uranium discoveries. The Trend is hosting the Tripple R deposit from Fission Uranium Corp. (around $1bn market cap) and the Arrow deposit from Nexgen Energy Ltd. (around $5bn market cap).

This trend generated the most exciting discoveries since the Cameco Cigar Lake and McArthur River deposits.

All Xcite projects are served by road infrastructure and are located near Uranium City, where contractors, lodging facilities, and an airport are available to support exploration logistics.

Uranium prices are firming up once again

After uranium prices reached over $100 per pound a year ago, prices are firming up again, triggering sector momentum and M&A transaction activity.

Uranium M&A activities

On 24 June, Paladin Energy announced the acquisition of Fission Uranium for $1.14bn in a court-approved plan of arrangement under the Canada Business Corporation Act. Critical uranium supply may block or at least slow down the transaction.

In October, the Minister of Innovation, Science and Industry ordered a national security review of the arrangement. Fission stated in a press release that: ‘‘In light of the national security review of the arrangement, there can be no certainty that Fission will be able to obtain ICA clearance in a timely manner or at all.

“Failure to obtain ICA clearance would prevent the arrangement from being completed.’’

On 2 October, IsoEnergy announced a definitive agreement for the acquisition of Anfield Energy in an all-share deal.

Xcite’s management view on the commodity price is to remain robust for the next 15 years with normal, timely pullbacks. The number of new nuclear plants committed in the next ten years will fuel demand. The other energy consumption driving force is the power requirement for the new AI tech solution being developed.

Why did Microsoft enter a deal with the Three Mile Island Nuclear Plant?

Even if the details of the deal were not disclosed, the agreement is for an electricity purchase for a 20-year period.

Constellation Energy is betting billions on the restart of the Pennsylvania Plant, which is still without permits and approvals. The estimated investment is $1.6bn, and the plant should come online by 2028.

Since all big tech companies are making a move into AI, the following data explains the move.

On average, a ChatGPT query needs nearly ten times as much electricity to process as a Google search. That difference lies in a coming sea change in how the US, Europe, and the world at large will consume power and at what cost.

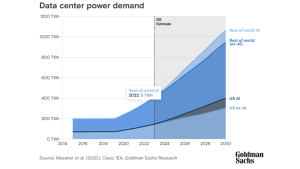

For years, data centres displayed a remarkably stable appetite for power, even as their workloads mounted. Now, as the pace of efficiency gains in electricity use slows and the AI revolution gathers steam, Goldman Sachs Research estimates that data centre power demand will grow 160% by 2030, and consumption is estimated at about 200 terawatt-hours per year.

Data centre overall power demand is set to double in the next decade, and yet infrastructures aren’t capable of supplying that coming demand. Microsoft’s smart move is to secure a 20-year power contract before energy prices inflation, coming ahead of the curve by securing this contract.

https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand